Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, Read more...

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, and stained glass windows are just a few examples of the architectural details that contribute to this character. However, the reality of owning an older home can present unexpected challenges. While those creaky floorboards might add to the charm, they could also signal underlying structural issues.

While there is no substitute for a physical inspection by a competent professional, I wanted to write an article on how to navigate some of the complexities of buying an older home to ensure your dream home becomes something other than a money pit. Because lots of our real estate school students dream of selling unique and historic homes it's important to keep in mind that it’s not just about the charm, it's also about being cautious and prepared.

Structural Integrity

Foundations: A solid foundation is crucial. Look for telltale signs like cracks, shifting, or evidence of water damage. Uneven floors, doors that stick, and cracks in the walls, particularly above windows and doors, can all point to foundation problems.

Cracks: Imagine the foundation as the base of a LEGO structure. If that base cracks or shifts, the LEGO bricks above will no longer fit together neatly. Cracks in walls, especially diagonal ones spreading from corners of windows or doors, show that the house's frame is being pulled out of shape by movement in the foundation below.

Uneven Floors: A sinking or uneven foundation can cause the floor joists above to sag or become misaligned. This leads to sloping or bouncy floors. Think of it like a table with uneven legs – it wobbles.

Sticking Doors: When a foundation shifts, it can distort the door frames. This makes doors difficult to open or close because they no longer fit squarely within the frame. It's like trying to fit a puzzle piece into the wrong spot.

Checklist:

Are the floors level?

Do doors and windows open and close smoothly?

Are there any visible cracks in the foundation walls?

Is there any evidence of water damage in the basement or crawlspace?

Roof: The roof is your first defense against the elements.

Checklist:

What is the age of the roof? (And what is the typical lifespan for that roofing material? - e.g., asphalt shingles typically last 20-30 years)

Are there any missing, damaged, or curled shingles?

Are there any signs of sagging or unevenness in the roofline?

Are there any signs of moss or algae growth? (This can indicate moisture problems.)

Are the gutters and downspouts in good condition? (Proper drainage is essential.)

Is there any evidence of water damage in the attic? (Look for stains, mold, or rot.)

Walls and Ceilings: Inspect walls and ceilings for cracks, water stains, or bowing. These imperfections could indicate structural issues, water damage, or poor maintenance.

Plumbing and Electrical Systems

Common Plumbing Problems in Older Homes

Plumbing: Older homes may have outdated plumbing systems, such as galvanized pipes, and be prone to corrosion and leaks. Inquire about the age of the plumbing and look for signs of leaks, low water pressure, or discolored water.

Checklist:

What type of plumbing pipes are used in the home?

What is the age of the plumbing system?

Are there any visible leaks or signs of water damage?

Is the water pressure adequate in all fixtures?

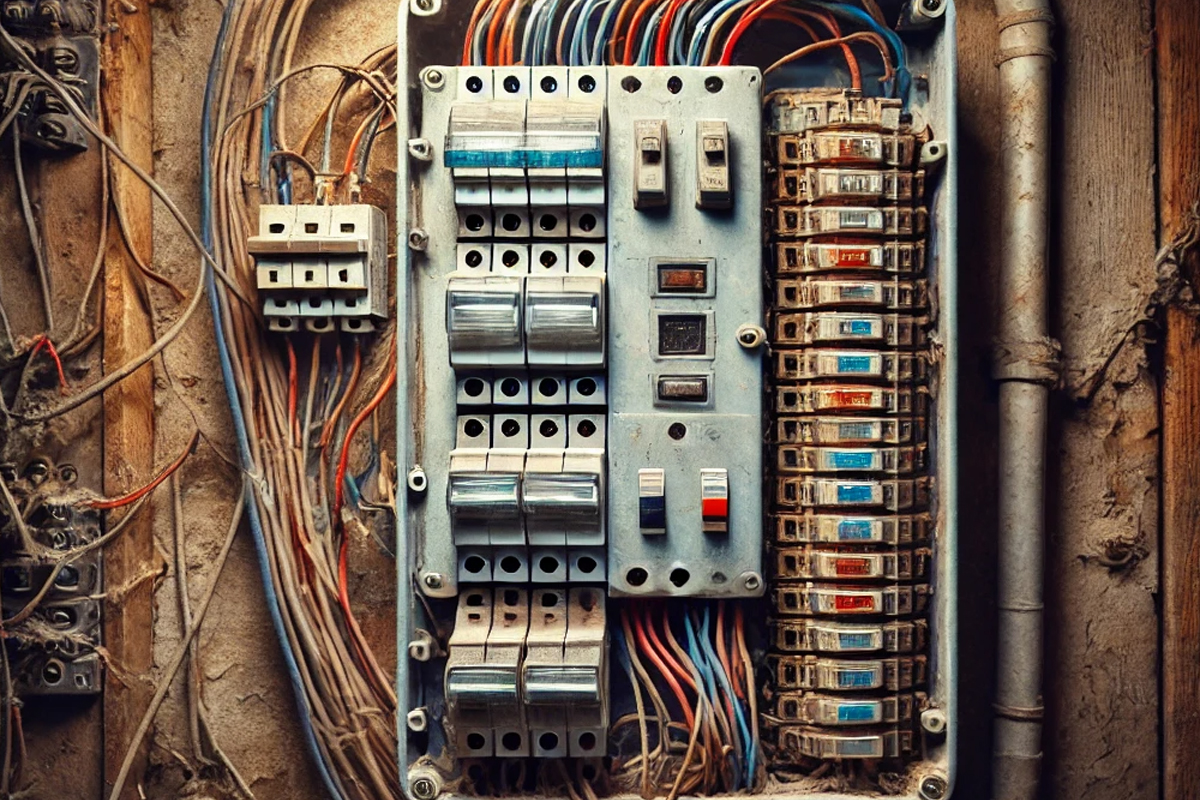

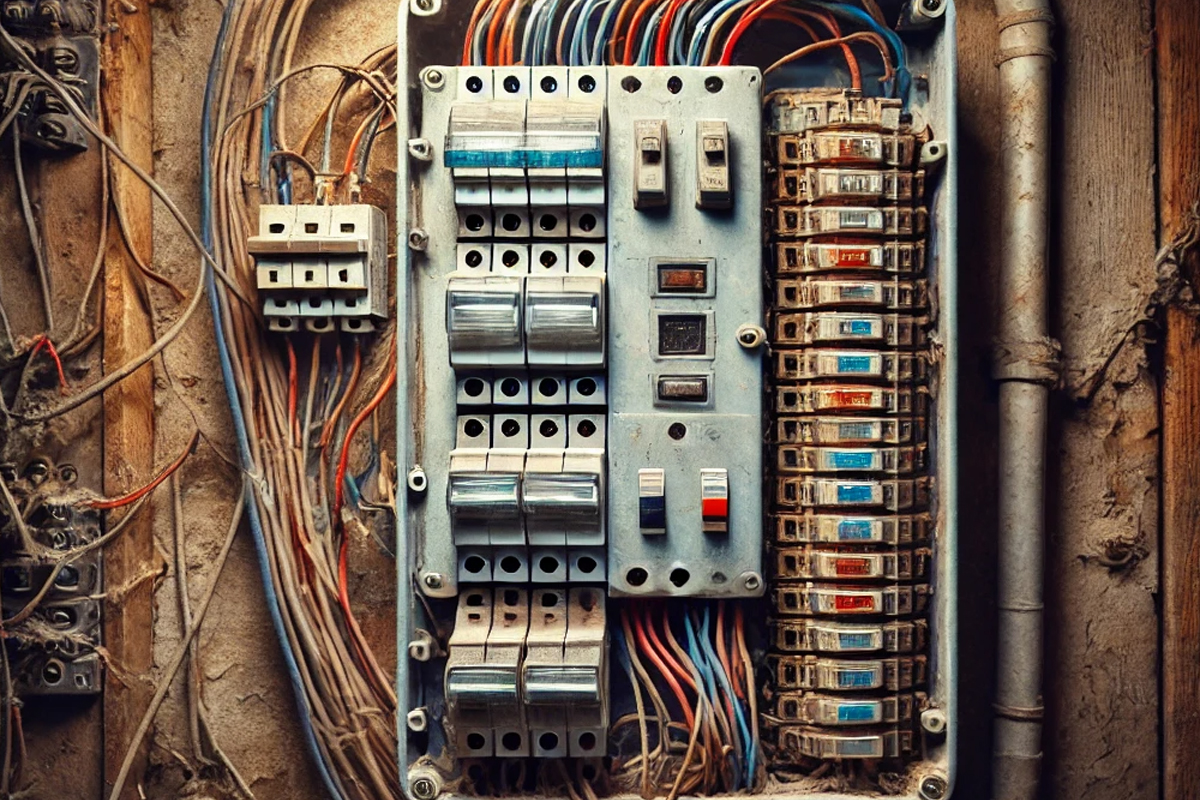

Electrical Safety Concerns

Electrical: An outdated electrical panel can be a safety hazard. Evaluate the panel for its capacity and age. Look for obsolete wiring (like knob-and-tube wiring), insufficient outlets, and any signs of electrical problems, such as flickering lights or frequent circuit breaker trips.

Knob and tube wiring is an old type of electrical wiring that was commonly used in homes from the late 1800s to the early 1900s. You can recognize it by its white ceramic knobs and tubes, which help hold and protect the wires.

The knobs are used to keep the wires attached to the wooden beams in the house, while the tubes are used when the wires need to pass through those beams. The system doesn't have a ground wire, which is used in modern wiring to help protect against electrical shocks and fires.

Because it's so old, knob and tube wiring doesn't meet today's safety standards and can't handle the amount of electricity we use now with all of our gadgets and appliances. That's why it's usually replaced if found in homes today, to make sure everything is safe and works well with modern electricity needs.

Checklist:

What is the age of the electrical panel?

What is the amperage of the electrical service?

Are there any signs of outdated wiring?

Are there enough outlets and circuits to meet your needs?

Hazardous Materials

Asbestos: Asbestos was commonly used in insulation, flooring, and siding in older homes. If you suspect asbestos-containing materials, hire a qualified professional for testing and abatement. Recent regulations have focused on safer removal methods to minimize health risks.

Lead Paint: Homes built before 1978 may contain lead-based Paint, which can be hazardous, especially for children. Lead paint testing and proper reduction are crucial. Modern encapsulation methods offer compelling alternatives to complete removal in some cases.

Heating, Ventilation, and Air Conditioning (HVAC)

System Age: HVAC systems have a limited lifespan, typically 15-20 years. Determine the age of the system and consider its remaining years of service. Older systems are less efficient and more prone to breakdowns.

Efficiency: Pay attention to signs of inefficient operation, such as uneven heating or cooling, drafts, and high energy bills. Consider upgrading to a modern, high-efficiency system to save money and reduce environmental impact. Look for systems with high SEER (Seasonal Energy Efficiency Ratio) and AFUE (Annual Fuel Utilization Efficiency) ratings.

Insulation and Energy Efficiency

Insulation Quality:

Inspect the attic, walls, and basement for adequate insulation.

Look for sufficient insulation depth (e.g., at least 12 inches in the attic) and check for any signs of moisture or pests.

Consider the type of insulation (e.g., fiberglass batts, blown-in cellulose) and its R-value, which indicates its thermal resistance. The higher the R-value, the more effective the insulation.

Poor insulation leads to higher energy bills and uncomfortable living conditions.

Windows and Doors: Check for drafts around windows and doors. Single-pane windows are notorious for heat loss. Consider upgrading to energy-efficient windows and doors to improve comfort and reduce energy consumption.

Potential for Renovations and Upgrades

Local Regulations: Research local zoning laws and building codes, especially if the home has historical status, as renovations might be restricted or require special permits.

Costs vs. Value: Get estimates for any necessary renovations and upgrades. Consider the potential return on investment and whether the improvements will significantly increase the home's value.

Financing Renovations: Explore financing options for renovations, such as home equity loans, personal loans, or government programs that offer incentives for energy-efficient upgrades.

Checking for Pest Infestations

Common Pests: Be vigilant for signs of termites (mud tubes, wood damage), rodents (droppings, gnaw marks), and other pests like carpenter ants (sawdust-like frass).

Signs of Infestation: Check for evidence of past pest control treatments. A history of infestations could indicate ongoing problems.

Water Damage and Mold

Signs of Damage: Look for water stains on ceilings, walls, and floors. Mold growth and musty odors are also red flags.

Sources of Water Damage: Inspect the roof, gutters, and drainage systems. Inquire about any history of flooding or leaks.

Legal and Insurance Issues

Property History: Research the property's history for past insurance claims, disclosures by the seller, and any known issues.

Insurance: Ensure that you can obtain homeowners insurance for the property. Older homes may present challenges or higher premiums due to age and potential risks.

Hiring a Professional Inspector

When hiring a home inspector, it's important to ask the right questions to ensure a thorough inspection. Here are some key questions to consider:

What is your experience with older homes?

What specific areas will you be inspecting?

Can you provide references from previous clients?

How long will the inspection take?

When will I receive the inspection report?

Choosing an Inspector: Select a qualified and experienced home inspector. Ask about their credentials, what they look for, and whether they have experience with older homes.

Understanding the Inspection Report: Carefully review the inspection report. Pay close attention to any significant issues and ask the inspector to explain any findings you need help understanding.

California specific pro-tip: In California, there is no state licensing requirement for home inspectors. This means that home inspectors in California are not regulated by any state agency, unlike in other states where inspectors must be licensed. As a result, the burden often falls on the consumer to ensure they are hiring a qualified and experienced inspector. It’s recommended to look for inspectors who are certified by reputable organizations, such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI), as these certifications typically require passing an exam, completing a certain number of inspections, and adhering to a strict code of ethics and standards of practice.

Common Problems by Era

Victorian Homes (pre-1900) are often characterized by knob-and-tube wiring, asbestos insulation, and foundation issues due to their age.

Mid-Century Homes (1950s-1960s): These homes may feature outdated plumbing, such as galvanized pipes, and are known for using aluminum wiring, which can pose a safety hazard.

Buying an older home can be a rewarding experience, but it's essential to approach the process with realistic expectations and a keen eye for potential problems. By conducting thorough inspections, consulting professionals, and addressing any issues proactively, you can minimize risks and enjoy the unique charm and character of your older home for years to come.

Love,

Kartik

|

The real estate industry is built on trust. Buying or selling a property is often the most significant financial decision in a person's life, and clients depend on their agents for expert guidance and Read more...

The real estate industry is built on trust. Buying or selling a property is often the most significant financial decision in a person's life, and clients depend on their agents for expert guidance and support. This reliance makes ethical conduct vital for every real estate professional. Ethical agents don't just follow the rules; they prioritize honesty, transparency, and their client's best interests in every interaction. This commitment to integrity builds strong client relationships and forms the bedrock of a successful and fulfilling career.

Understanding Your Role as a Fiduciary

Real estate agents hold a unique position of trust. They act as fiduciaries for their clients, meaning they have a legal and ethical obligation always to put their clients' needs first. This fiduciary duty encompasses several vital principles: loyalty, always prioritizing the client's interests; confidentiality, safeguarding sensitive information; disclosure, providing all relevant information, even if it's not favorable; obedience, following lawful client instructions; reasonable care and diligence, providing competent and skilled service; and accounting, handling funds and property responsibly.

Transparency: The Key to Building Trust

Open and honest communication is essential for building strong client relationships. Be upfront about potential challenges, market conditions, and any factors influencing their decisions.

Transparency goes beyond simply answering questions; it means proactively sharing information and setting realistic expectations. Communicate timelines, potential obstacles, and the intricacies of the real estate process. Keep your clients informed and engaged through regular updates and feedback, ensuring they feel heard and understood throughout their journey.

Example: The Power of Transparency in Real Estate

A seasoned real estate agent, Emma met with Alex and Mia, a young couple eager to purchase their first home. They were captivated by a charming, older house with a history of foundation issues. Understanding the importance of honesty, Emma openly shared her findings with the couple, explaining the potential for future complications and the competitive market conditions.

Determined to ensure their first investment was sound, Emma discussed the benefits and drawbacks of older versus newer homes, highlighting possible challenges and setting realistic expectations for the buying process. She maintained frequent communication, providing updates and addressing their concerns, which made them feel supported and valued.

Appreciating her candidness, Alex and Mia explored other listings and eventually purchased a newer home that offered stability without unforeseen costs. Grateful for Emma's guidance, they later expressed their happiness and confidence in their decision, thanking her for her transparency.

Emma's commitment to transparent, honest communication helped them find the right home and solidified a trusting client relationship, showcasing the critical role of transparency in real estate transactions.

Navigating Ethical Dilemmas

Even with the best intentions, real estate professionals often encounter ethical dilemmas. These situations require careful consideration and a commitment to upholding your fiduciary duties.

Dual Agency: Representing the buyer and seller in the same transaction presents unique challenges. Disclose this relationship clearly and obtain informed consent from both parties. Strive to maintain neutrality and ensure that both clients receive fair and equal representation.

Misrepresentation and Fraud Avoid any temptation to exaggerate or misrepresent facts. Providing false or misleading information can have severe legal and ethical consequences. Always prioritize honesty and accuracy in your dealings.

Confidentiality: Protecting client privacy is paramount. Handle sensitive information with discretion and use it only for the intended purpose. Avoid discussing client matters with unauthorized individuals.

Multiple Offers: When managing multiple offers, present all offers pretty and transparently to the seller. Avoid any actions that could give one buyer an unfair advantage and guide your client to make informed decisions based on their best interests.

The Importance of Ongoing Learning

Real estate is a dynamic field with ever-changing laws and regulations. Commit to continuing education to stay informed about the latest legal requirements, market trends, and best practices. This ongoing learning demonstrates your dedication to professionalism and enhances your ability to serve your clients effectively.

Ethics as a Competitive Advantage

Ethics can be a powerful differentiator in today's competitive real estate market. Clients are increasingly seeking agents they can trust, professionals who prioritize integrity over quick deals. By showcasing your commitment to ethical conduct, you attract clients who value these principles and build a loyal client base that fuels long-term success.

Building a Legacy of Integrity

Ethical conduct is not just a set of rules to follow; it's a way of doing business that reflects your values and commitment to your clients. By consistently acting with integrity, you build a reputation that attracts clients, earns referrals, and fosters lasting relationships. Embrace ethical practices in every aspect of your real estate business, and you'll achieve professional success and contribute to a more trustworthy and respected real estate industry.

Love,

Kartik

|

Is the Real Estate Market Going to Crash in 2025?

In recent years, the real estate market has been a true rollercoaster, experiencing sky-high prices, wildly fluctuating mortgage rates, and a persistent Read more...

Is the Real Estate Market Going to Crash in 2025?

In recent years, the real estate market has been a true rollercoaster, experiencing sky-high prices, wildly fluctuating mortgage rates, and a persistent imbalance between supply and demand. As the chatter about a potential 2025 real estate market crash intensifies, many are curious if we are approaching the bursting point of what some call a housing market bubble.

I wanted to write an article to dive into the key factors contributing to this uncertainty and offer insights into potential market directions

Understanding Market Dynamics

Homeowners Staying Put: With the historically low interest rates of 2021-2022, many homeowners seized the opportunity to lock in low rates. Despite the recent decline in interest rates, many homeowners are still reluctant to sell, fearing they won't secure similarly favorable rates today. This reluctance has led to a reduced number of homes on the market, exacerbating the current supply shortage.

Fewer New Listings and Increased Buyer Competition: Many potential sellers are holding off on entering the market, cautious of higher mortgage costs despite lower interest rates. Meanwhile, the affordability brought on by the lower rates has widened the buyer pool, intensifying competition and driving prices up. This situation presents challenges particularly for first-time buyers and those with limited budgets, adding pressure to an already heated market.

A Market on Shaky Ground

As we saw through 2024, home prices reached unprecedented heights, while the 2023 spike in mortgage rates stretched affordability thin for many. Although there has been a slight easing in mortgage rates, the fundamental mismatch between supply and demand persists, further fueling price growth and competition. This dynamic raises concerns about whether the market is on the verge of a significant correction or if it will stabilize under current conditions.

Expert Opinions: A Range of Predictions

The opinions among economists and real estate analysts about what will happen in the housing market are quite different. Some experts think a big downturn could happen soon because the market has been too hot, with house prices going way up too fast. They believe that things might cool down sharply because homes are becoming too expensive for many people to buy.

However, another group of experts thinks the market will cool down slowly, not suddenly crash. They say that even though houses are expensive, many people still want to buy homes, and there aren't enough homes available, which could keep the market stable. These experts think any changes will happen gradually.

With all these different opinions and factors, people who are interested in buying or selling homes, or those who work in real estate and are getting their real estate license, need to stay alert and keep learning about the market.

The Looming Question: Crash or Correction?

Predicting the exact trajectory of the real estate market is complex, with 2025 poised as a critical year for determining whether the market will crash, correct, or continue its upward trend. For those looking to navigate this uncertain landscape—whether buyers, sellers, or real estate license school students —the key is preparation and informed decision-making.

Preparing for Market Fluctuations

In this unpredictable environment, readiness is crucial. Buyers should consider current market conditions against their personal financial situations. Sellers need to set realistic pricing to avoid prolonged market listings. Investors are advised to perform thorough market analyses to understand potential risks and opportunities.

Navigating the complexities of the real estate market requires up-to-date knowledge and strategic thinking—skills taught at leading real estate schools. By staying informed and applying practical, evidence-based strategies, buyers and sellers can protect their interests and capitalize on opportunities in the real estate market, no matter the economic climate.

Love,

Kartik

|

Homeownership Benefits and Financial Stability through Real Estate

Back in 2002, right after I got my real estate license, I was in a class at Prudential California Realty, a prominent real estate Read more...

Homeownership Benefits and Financial Stability through Real Estate

Back in 2002, right after I got my real estate license, I was in a class at Prudential California Realty, a prominent real estate company at that time. The broker who was teaching us held up a newspaper and shared a story that really stuck with me. It was about Jo Bessell, a tenant who had lived in the same apartment in Newport Beach for over 30 years. She loved her community and felt at home there. However, her rent increase suddenly made the place unaffordable, as she was already on a tight budget with her fixed income. This story highlighted the rental market volatility and showed me how unstable renting can be, especially when you can't keep up with rising costs. It made me realize just how vital homeownership benefits are, as owning a home provides stable and predictable costs each month.

With the cost of rent soaring in 2024, I want to discuss why selling real estate involves more than just completing “a deal”—it's a crucial service that empowers individuals to secure financial stability through real estate and reduce living-related stress.

The Growing Financial Burden of Housing

The affordability of housing in the United States has increasingly become a pressing issue, not just for renters but even for homeowners. A recent report from Harvard University's Joint Center for Housing Studies illuminates this growing housing affordability crisis, revealing troubling trends that have escalated, particularly in the wake of the pandemic.

The Harvard study points out a concerning truth: almost one in four homeowners now spend an alarmingly large part of their income on housing. This means a significant number of people are struggling with housing costs that stretch their budgets to the breaking point. For renters, the situation is even worse. The report shows that for many years, rents have been increasing faster than incomes. This issue became even more severe during the pandemic, leading to what the study calls an “unprecedented affordability crisis.”

Specifically, the number of renters dedicating more than half of their household income to housing and utilities spiked dramatically. In 2022, this figure reached a record high of 12.1 million people, an increase of 1.5 million from pre-pandemic levels. This excessive financial burden places these households in a precarious position, highly vulnerable to becoming unhoused in the face of any unforeseen financial turmoil, such as an unexpected medical bill, a sudden loss of employment, or even something as small as a new set of tires on the family car.

The Benefits of Homeownership

Owning a home is more than just having a roof over your head; it's a long-term investment with numerous financial and personal advantages. One of the most significant benefits is the stability offered by fixed-rate mortgages. Unlike renting, where monthly payments fluctuate with market conditions, a fixed-rate mortgage provides predictable payments for the entire loan term. This predictability allows homeowners to budget effectively, knowing their housing costs won't suddenly increase.

Furthermore, owning a home can protect against inflation and increasing rents. As inflation decreases the value of the dollar, rent costs usually go up. However, homeowners, particularly those with fixed-rate mortgages, are shielded from these hikes. Their monthly payments and even property taxes basically stay fixed, while the value of their property generally goes up over time. This growth builds equity and increases wealth.

In addition to these financial benefits, homeownership offers other intangible advantages such as pride of ownership, a sense of community, and the freedom to personalize your living space. While the path to affordable homeownership may require careful planning and financial discipline, the long-term benefits make it a worthwhile goal for many.

Challenges Faced by Renters

Renters across the United States, especially in high-cost states like California, face many challenges that stem primarily from a volatile housing market. These challenges are particularly pronounced in urban areas like San Francisco and Los Angeles, where the California housing crisis makes the cost of living far exceed national averages.

One interesting twist in California’s housing crisis is the unexpected role of high-income renters. Normally, you'd expect people with higher incomes to buy homes. However, due to a shortage of affordable homes and a highly competitive market, many well-off individuals continue to rent. Back in 1980, the average income of California renters was 13% higher than renters in other parts of the country. By 2022, this difference had grown to 40%. Now, one third of California’s renters make over $100,000 a year—twice as many as in the rest of the U.S. This surge of wealthy renters in the market pushes up rental prices, which ironically makes it tougher for lower-income renters to find affordable places to live.

The statistical data paints a stark picture of the affordability crisis. According to the latest U.S. Census Bureau's Pulse survey, an alarming number of households are financially overstretched by rent. Nearly a million California households are currently behind on their rent payments, and about 150,000 expect eviction could be imminent. This situation highlights the grim reality that, despite their best efforts, many lower-income renters find themselves perpetually one paycheck away from losing their homes.

Personal Reflections and Real Estate's Role

The story of Jo Bessell, which I encountered early in my career, has profoundly shaped my perspective on real estate. Jo's experience of being forced out of her long-term home due to an unaffordable rent increase highlighted the stark realities many renters face. This realization has instilled in me a deep sense of purpose and responsibility. As a real estate professional, we are not merely facilitating transactions but guiding individuals toward achieving stability and security through homeownership.

Real estate professionals play an indispensable role in helping clients negotiate the best real estate deal possible and navigate the complexities of the market. Our expertise and insight can demystify the often intimidating process of buying a home, providing clients with the knowledge they need to make informed decisions. More importantly, we can help them understand the long-term benefits of securing a fixed-rate mortgage, which offers predictable monthly expenses and protection against the volatility of rental markets. This stability is crucial for financial planning and peace of mind, enabling homeowners to invest in their futures without the looming threat of unexpected rent increases.

Beyond its financial asset role, owning a home can be a powerful tool for social good. Homeownership can anchor families within communities, fostering a sense of belonging and civic engagement. Evidence suggests it contributes to better educational outcome for children and provides a foundation for building generational wealth, particularly in underserved communities. We can help close the housing gap and address systemic inequalities by promoting policies that increase access to affordable homeownership.

The narrative of Jo Bessell remains a poignant reminder of why our work matters. It drives home the importance of advocating for policies that protect and empower renters and homeowners alike. As real estate professionals, we have the opportunity—and the obligation—to ensure that real estate's benefits extend beyond the individual, supporting broader social and economic stability. Through our efforts, we can help transform real estate into a cornerstone of a more equitable society.

As I’ve tried to communicate, the benefits of homeownership extend far beyond having a place to call your own. It's an investment in your future, a hedge against inflation, and a source of pride and belonging. Homeownership can be a life-changing decision for renters facing rising costs and uncertainty, providing a secure and stable foundation for their families.

Remember, real estate is more than just a transaction. It can be a cornerstone to a stable and prosperous life, a catalyst for personal growth, and a powerful tool for building stronger communities. By embracing the power of real estate, you can unlock a brighter future for yourself, your family, and your community—and your career as a real estate professional.

Love,

Kartik

|

Understanding Mello-Roos in California: What Homebuyers Need to Know

At ADHI Schools, we recognize the role of comprehensive knowledge in shaping your real estate investment decisions in Read more...

Understanding Mello-Roos in California: What Homebuyers Need to Know

At ADHI Schools, we recognize the role of comprehensive knowledge in shaping your real estate investment decisions in California. One significant factor, particularly in newer developments, is the Mello-Roos tax. This unique assessment can have a profound impact on property owners. Potential homebuyers and investors need to understand these taxes' purpose, assessment, coverage, and impact. I'd like to provide a detailed overview of Mello-Roos taxes, equipping you with the necessary information to make informed real estate decisions.

What is Mello-Roos?

Mello-Roos is a special tax imposed on property owners in specific districts. Its primary purpose is to finance major infrastructure and public services not covered by regular property taxes. This tax was established in 1982 through the Community Facilities District Act, passed by the California legislature to provide local governments with a means to raise funds after Proposition 13 significantly limited their ability to levy real estate taxes.

Proposition 13, passed by California voters in 1978, significantly changed how local governments could assess property taxes, fundamentally altering the state's public funding landscape. This measure was designed to address the rapidly escalating property taxes of the time, which caused significant financial distress to homeowners.

Key Provisions of Proposition 13

Tax Rate Limitation: Proposition 13 capped property tax rates at 1% of the property's assessed value at the time of acquisition. This rate could only be adjusted upon a change in ownership or completion of new construction.

Assessment Increase Limitation: Increases in assessed value were limited to no more than 2% per year as long as the property was not sold or newly constructed.

Impact of Proposition 13

The implementation of Proposition 13 had a profound impact on the revenue generation capacity of local governments from property taxes. Before Proposition 13, local governments could assess property taxes based on current market values and community funding needs. This allowed them to adjust tax rates and reassess property values to meet public services and infrastructure project budget requirements.

However, with the limitations imposed by Proposition 13, local governments found themselves with insufficient funds to cover the costs of new projects and the maintenance of public services, particularly in rapidly growing communities. The tax base became inadequate due to the capped rate and limited growth of property tax assessments, which did not necessarily correlate with the actual increase in property values or economic conditions.

Introduction of Mello-Roos Taxes

In response to these challenges, the California legislature enacted the Community Facilities District Act in 1982, allowing local governments to form Community Facilities Districts (CFDs) and levy what is known as Mello-Roos taxes. These taxes, charged on top of regular property taxes, are crucial in funding infrastructure projects and public services, specifically within those districts. Mello-Roos taxes are not just additional financial burdens, but they are essential mechanisms for local governments to generate the necessary funds to support new development and ensure the provision of essential public services, such as schools, roads, and police and fire protection, especially in areas experiencing rapid growth and development.

The establishment of Mello-Roos was a direct consequence of the fiscal constraints imposed by Proposition 13. It serves as a vital tool for municipalities to adapt to ongoing financial needs without overstepping the tax restrictions placed by Proposition 13. This tax has enabled communities to develop and maintain critical infrastructure, supporting California's growth and addressing the public funding deficits from Proposition 13's limitations.

Why Do Mello-Roos Taxes Exist?

Mello-Roos taxes primarily aim to finance significant community infrastructure projects, such as schools, roads, fire and police services, parks, and libraries. These taxes are usually levied in newer developments where additional funding is needed to support the construction and maintenance of essential infrastructure and services that the existing tax base cannot sufficiently support.

How are Mello-Roos Taxes Assessed?

Mello-Roos taxes are assessed to property owners within a Community Facilities District (CFD) created by a local government, city, or county. These taxes are based on the bonded indebtedness required to fund specific projects within the district. The amount may vary between properties in the district depending on the property's size, the home's square footage, and the area's specific needs.

What Do Mello-Roos Taxes Cover?

The revenues collected from Mello-Roos taxes can be used for various services and facilities. Typically, these taxes fund infrastructure improvements, school facilities, police and fire protection, ambulance services, roads, and libraries. Notably, the funds generated by Mello-Roos taxes must be used for the specific purposes outlined when the tax was approved and cannot be used for unrelated projects.

Impact on Property Values

The impact of Mello-Roos taxes on property values can be mixed. On one hand, these taxes can increase the overall tax burden on a property, which might deter some buyers. However, the enhancements and new facilities funded by Mello-Roos can make a neighborhood more attractive, potentially boosting property values. For many buyers, the improved infrastructure and amenities justify the additional tax, and they see it as an investment in the future value of their property.

Technical Detail and Precision: Understanding the Financial Impact of Mello-Roos Taxes

It is beneficial to consider specific examples and comparative scenarios to grasp the financial implications of Mello-Roos taxes truly. Let’s explore how these taxes influence property values and owner expenses in two scenarios.

Scenario 1: New Development with Mello-Roos Taxes

In a new housing development in Irvine, California, the local government has established a Community Facilities District (CFD) to fund necessary infrastructure such as roads, schools, and parks. A typical single-family home in this development is assessed at $800,000. The Mello-Roos tax for the property is set at 0.8% of the assessed value annually, which amounts to an additional $6,400 per year in property taxes.

Financial Comparison:

Total Annual Property Taxes with Mello-Roos: Assuming the standard property tax rate (including the Mello-Roos tax) totals 1.8%, the annual tax payment would be $14,400.

Total Annual Property Taxes without Mello-Roos: Without the Mello-Roos tax, at a rate of 1%, the annual tax payment would be $8,000.

This scenario illustrates that while Mello-Roos increases the tax burden by $6,400 annually, it also supports infrastructure developments that can enhance property value over time.

Scenario 2: Established Area without Mello-Roos Taxes

Consider a similar property in an older neighborhood of Irvine, where there is no Mello-Roos tax. The home, valued at $800,000, incurs standard property taxes without additional Mello-Roos assessments.

Financial Comparison:

Total Annual Property Taxes: The homeowner pays the standard rate of 1%, totaling $8,000 annually.

Infrastructure and Amenities: Unlike the new development, this area might see a different level of new infrastructure investment, which could affect long-term property values differently.

Long-term Financial Impact:

Owners of new developments may see a higher initial tax rate. Still, the funded amenities could significantly increase property value due to improved infrastructure and community services. In contrast, the older neighborhood may have lower initial taxes but could lack the same potential for increased property values due to older amenities and infrastructure.

By analyzing these scenarios, potential buyers can better understand the balance between upfront costs and the long-term benefits of Mello-Roos taxes. This decision-making process is crucial, especially for those considering properties in districts with these special assessments. Through careful evaluation of the projects funded by Mello-Roos taxes, investors and homeowners can gauge the potential for property value appreciation and make informed decisions tailored to their financial and living situation.

Important Considerations for Homebuyers

If you are considering purchasing a home in a district with Mello-Roos taxes, it's essential to:

Inquire about the tax's expiration date: Mello-Roos taxes are not permanent and generally expire within 25 to 40 years from the CFD's formation date.

Understand what is being funded: Knowing what projects your Mello-Roos taxes are funding can provide insight into potential community enhancements that could increase property values.

Consider the overall tax impact: Evaluate how Mello-Roos taxes fit into the area's overall tax scenario to understand the full financial responsibility.

Understanding Mello-Roos taxes is essential for any potential real estate license school student, California homebuyer or real estate investor. While they can increase the cost of owning a home, they also fund critical infrastructure and services that can significantly enhance the quality of life and potentially increase property values. As with any real estate investment, thorough due diligence is essential to making an informed decision.

By understanding Mello-Roos, homebuyers can better assess the long-term value and costs of purchasing a new home in California's developing areas.

Love,

Kartik

|

Finding Your Dream Home: The Joy and the Jolt

You've done it. After countless open houses, endless online listings, and what felt like an eternal waiting game, you finally found your dream home. The Read more...

Finding Your Dream Home: The Joy and the Jolt

You've done it. After countless open houses, endless online listings, and what felt like an eternal waiting game, you finally found your dream home. The excitement was palpable as your offer was accepted, the contract signed, and the future seemed to paint itself in bright, hopeful colors.

But then, a twist in the tale: the appraisal comes in, and it's lower than your purchase price. This news jolts you, shaking your excitement. It's a scenario many homebuyers fear, yet few are prepared for. It's not just about numbers; it's about your dreams, hopes, and vision for your future.

The Safety Net: Understanding the Appraisal Contingency

In these moments of uncertainty, your appraisal contingency becomes more than just a clause in a contract; it's a lifeline. This contingency is a crucial aspect of the home-buying process, designed to protect you, as the buyer, from overpaying.

But what exactly is an appraisal contingency? In simple terms, it's a condition in your home buying contract stating the purchase is contingent on the property being appraised at or above the agreed-upon sale price. If the appraisal falls short, this clause gives you the power to renegotiate or even walk away from the deal without penalty - more on that later.

More Than Just Money: The Psychological Impact

Beyond its financial safety, an appraisal contingency is also about peace of mind. It's a buffer against the unforeseen, a guard against the unpredictable nature of real estate valuations. When the appraisal comes in low, it's easy to feel overwhelmed and unsure. This clause serves as a reminder that you have options and are not locked into a potentially unfavorable situation.

Navigating the complexities of a low appraisal can be challenging, but understanding the role and power of your appraisal contingency is the first step.

As we delve deeper into this guide, we'll explore how to handle the gap between appraised value and offer price, examine your options under the appraisal contingency, and equip you with the knowledge to make the best decision for your future.

Dealing with the Gap: Understanding and Managing the Discrepancy

The Dilemma of Differing Values

When faced with a lower-than-expected appraisal, you encounter a fundamental dilemma: the gap between the appraised value and your offer price. This discrepancy isn't just a set of numbers but a potential challenge to your home-buying journey.

Appraised Value vs. Offer Price

The appraised value of a property is an expert's opinion of its worth, whereas the offer price is what you're willing to pay for it. These two figures ideally should align closely, but when they don't, it's crucial to understand what each represents. The appraised value is grounded in thoroughly analyzing the property and market conditions. At the same time, the offer price can sometimes reflect more subjective factors like personal desire or market competition.

Common Reasons for a Low Appraisal

Understanding why appraisals come in low can help you navigate this situation more clearly. Here are some common reasons:

Market Fluctuations: Real estate markets are dynamic, and rapid changes can lead to disparities between current market conditions and recent sales data used by appraisers.

Property Condition: If the appraiser notes issues with the property that you, the home inspector, or the seller might have missed, it can affect the appraisal value.

Comparable Sales (Comps): Appraisers generally use recent sales of similar properties in the area (comps) to determine value. If there are few comps or if they sold at lower prices, it can impact your appraised value.

Inaccurate Listing Information: Sometimes, discrepancies in square footage, room count, or amenities between the listing information and the actual property can lead to a lower appraisal.

Navigating the Appraisal Report with Your Agent

There needs to be more than just knowing the appraised value; understanding why it is key. This is where reviewing the appraisal report with your real estate agent becomes invaluable. Your agent can help interpret the report, point out areas that might be disputed, and provide insight into the appraiser's reasoning. This knowledge is crucial for your next steps, whether challenging the appraisal, renegotiating the deal, or even deciding to walk away.

Your Options with an Appraisal Contingency

When faced with a low appraisal, your appraisal contingency clause becomes a critical tool, offering you several paths to consider. Each option carries its own set of considerations and potential outcomes.

Option 1:

Walking Away: This option offers a clean break. Assuming you still have your appraisal contingency intact, you reclaim your earnest money deposit and walk away from the deal, free to explore other opportunities. Consider this path if the gap between the offer and the appraised value is significant, exceeding your budget, or if the appraisal highlights major concerns. While finding another suitable home in a competitive market might take time, the financial and emotional security gained can be invaluable.

The Benefits of Opting Out

Financial Protection: Assuming that your appraisal contingency is still in play, walking away allows you to reclaim your earnest money deposit, safeguarding your finances.

Avoiding Overpayment: You avoid overpaying for a property, which could have long-term financial implications.

Opportunity to Reassess: This situation allows you to reassess your options and find a better fit.

Considering the Drawbacks

Market Challenges: In a competitive market, finding another suitable property might take time and effort.

Emotional Impact: Letting go of a home you've become attached to can be emotionally challenging.

Option 2:

Paying the Difference: This option demands serious financial consideration. If the gap is manageable and aligns with your long-term budget, it can still lead to securing your dream home. However, be meticulous in your calculations. Factor in additional costs like closing fees, potential repairs identified in the appraisal, and the impact on your future financial stability. Consulting your financial advisor is crucial to ensure this decision is manageable for your resources later.

Financial Implications

Immediate Costs: Paying the difference (the amount between the contract price and the appraised amount) means more upfront cash, which can strain your budget.

Long-Term Considerations: This decision could impact your property equity.

Making a Responsible Decision

Financial Planning: Carefully consider your financial situation and future implications.

Seeking Advice: Consulting with trusted advisors can provide clarity.

Option 3:

Renegotiating: This option leverages your appraisal contingency as a negotiation tool. Armed with the appraiser's report, you can present a compelling case to the seller highlighting the discrepancy between the offer and the property's actual market value. Be prepared to compromise – offering alternative solutions like a lower price, closing date adjustments, or repair credits in exchange for a price concession. Remember, a win-win outcome benefits both parties and increases the chances of reaching an agreement.

The Power of Negotiation

Leveraging the Report: Use the appraisal report findings to negotiate a fairer price with the seller.

Finding Compromise: Aim for a win-win situation where both parties feel satisfied with the outcome.

Strategy and Compromise

Presenting Your Case: Be clear and factual when presenting your case based on the appraisal report.

Flexibility and Creativity: Consider other aspects of the deal where you can compromise, such as closing dates or repair credits.

Ultimately, the best decision is the one that aligns with your unique circumstances and risk tolerance. Consider these factors:

Financial Situation: Can you comfortably absorb the difference in price or additional costs?

Market Conditions: Is the market hot or cooling? Is finding another suitable property feasible?

Emotional Attachment: How attached are you to this specific property? Is it worth compromising for?

Alternative Options: Have you explored other properties that suit your budget and needs?

Timeframe: Your appraisal contingency period sets a deadline for making a decision. Utilize it effectively to gather information and weigh your options.

Remember, your real estate agent and advisors are valuable allies in this process. Feel free to use their expertise and experience to analyze your options and make the most informed decision. With a clear head, careful consideration, and the power of your appraisal contingency, you can navigate this unexpected turn and confidently choose the path that leads to your ideal home.

Negotiation Tactics with Your Appraisal Contingency in Play

With a low appraisal comes the opportunity to flex your negotiation muscles, and your appraisal contingency is your secret weapon. Here are some tips to wield it effectively:

1. Know Your Numbers: Thoroughly understand the appraised value, its reasons, and how much you're willing to budge. Present factual evidence from the appraisal report to support your arguments.

2. Be Assertive, Not Aggressive: Approach the seller confidently but maintain a respectful tone. Remember, your goal is to reach a mutually beneficial agreement, not to burn bridges.

3. Focus on Solutions, Not Demands: Instead of simply demanding a lower price, offer alternative solutions like extending the closing date, taking on some repairs identified in the appraisal, or contributing a closing cost credit.

4. Be Prepared to Walk Away: While compromise is key, know your bottom line and walk away if the seller isn't willing to meet your needs. Your appraisal contingency empowers you to do so without penalty.

5. Leverage Your Agent's Expertise: Your real estate agent can act as a mediator, facilitating communication and helping you reach a fair deal. Feel free to rely on their experience and negotiation skills.

6. Consider Professional Appraisers: If you have doubts about the original appraisal, you can hire a second appraiser for a different perspective. However, weigh the cost of a second appraisal against the potential benefits of its findings.

7. Keep Emotions in Check: While feeling attached to the property is natural, don't let emotions cloud your judgment. Stick to your budget and financial goals, and decide based on logic and data.

8. Use Time to Your Advantage: Your appraisal contingency gives you a timeframe to gather information, negotiate, and make a well-informed decision. Don't feel pressured to rush into anything.

9. Document Everything: Keep clear records of all communication with the seller and your agent, including any proposed settlements or agreements. This protects you in case any disputes arise later.

Remember, successful negotiation is a balancing act. By presenting a solid case, remaining flexible, and strategically leveraging your appraisal contingency, you can turn a low appraisal into an opportunity to negotiate the right deal.

Embracing the Crossroads

A low appraisal can feel like a roadblock, throwing a wrench into your dream home journey. But remember, it's not a dead end; it's a crossroads. With your trusty appraisal contingency by your side, you have the power to navigate this unexpected turn and choose the path that leads to your ideal future.

Whether you walk away with your deposit intact, bridge the gap and secure your dream home, or negotiate a win-win with the seller, remember that this decision is about more than just bricks and mortar. It's about your finances, emotional well-being, and long-term goals.

This unexpected curve in the road might lead you to a better destination than you imagined. Another property awaits, perfectly aligning with your needs and budget, with an appraisal that sings your praises. Or, after careful consideration, you decide that this house, with its quirks and charms, is worth the extra effort.

So take a deep breath, trust your instincts, and embrace the crossroads. While filled with twists and turns, the journey to your dream home can be enriching when you chart your course.

Love,

Kartik

|

What is a real estate appraisal?

In real estate, an appraisal is a cornerstone. A real estate appraisal is a professional assessment of a property's market value conducted by a licensed real estate Read more...

What is a real estate appraisal?

In real estate, an appraisal is a cornerstone. A real estate appraisal is a professional assessment of a property's market value conducted by a licensed real estate appraiser This report is important to a variety of stakeholders in various situations, whether you're buying, selling, refinancing, or managing real estate investments.

For buyers, an appraisal offers a clear picture of whether the property is worth the investment. While the listing agent typically recommends a list price, sellers also can gain insights into setting a competitive and realistic price based on location, size, and condition. Most commonly, lenders use these appraisals to determine the viability and value of a property as collateral for loans.

Real estate appraisals provide a snapshot of a property's worth in the current market, offering a critical data point that influences decision-making in the dynamic real estate landscape.

Whether you are preparing for the real estate license exam a first-time homebuyer, a seasoned investor, or a curious reader, understanding the nuances of real estate appraisals is an invaluable part of navigating the property market successfully.

What is a Real Estate Appraisal?

Real estate appraisals, a fundamental subject taught in real estate school, play a pivotal role in the dynamics of property transactions. They influence the decisions of buyers, sellers, and lenders in distinct ways by providing an objective basis for decision-making. This ensures that all parties are well-informed about the actual value of the property in question.

Key components of a real estate appraisal include several critical elements:

Property Inspection: The appraiser conducts a thorough examination of the property, assessing its condition, size, location, and unique features. This physical inspection is a significant part of the appraisal process.

Market Analysis: The appraiser analyzes current market trends, including comparable sales data of similar properties in the area. This comparison helps evaluate how the subject property stacks up against others in the same market.

Documentation and Reporting: The appraiser compiles the data collected during the inspection and analysis into a detailed appraisal report. This report outlines the appraiser's findings and provides a final estimation of the property's value.

Professional Expertise and Standards: Appraisals are conducted by licensed professionals who adhere to standardized methods and ethical practices. Their expertise in property valuation ensures that the appraisal is reliable and compliant with industry standards.

A real estate appraisal is a comprehensive, pivotal real estate market evaluation. It provides a clear, professional assessment of a property's value, taking into account various factors like location, property size and market conditions.

For anyone involved in a real estate transaction, understanding the intricacies of the appraisal process is key to ensuring fair and informed decisions.

Who Typically Hires the Appraiser?

Lenders are who commonly engage appraisers in real estate transactions, particularly for mortgages, to assess the risk associated with the loan. This process ensures that the amount of money lent aligns with the property's actual market value. The appraisal, conducted by an independent professional, objectively evaluates the property's worth. This is crucial for the lender to determine the loan-to-value ratio, a critical factor in loan approval and risk management. Essentially, the appraisal safeguards the lender, ensuring they do not extend more credit than the property is worth, thus protecting their financial interests.

Imagine you want to buy a house that's listed for sale at $300,000. To purchase this house, you approach a bank for a mortgage. The bank, before lending you the money, wants to make sure that the house is really worth $300,000. So, the bank hires an independent appraiser to evaluate the house's value.

The appraiser looks at the house, considering factors like location, size, condition, and compares it to similar houses that have recently sold in the area. Suppose the appraiser determines that the house is indeed worth $300,000. The bank then feels confident to proceed with the loan, knowing that if you fail to pay the mortgage, they can sell the house and recover their money, as the house's value matches the loan amount.

However, if the appraiser finds that the house is only worth $250,000, the bank faces a higher risk. If they lend you $300,000 but you later default on the mortgage, the bank might not be able to recoup the full loan amount by selling the house. In such cases, the bank might offer a smaller loan or ask for a higher down payment to reduce their risk. This shows how appraisals protect lenders from loaning more money than a property is worth.

The Appraisal Process Explained

Understanding the step-by-step process and some basic real estate terms can significantly demystify what goes into determining a property's value. This insight is crucial whether you're a buyer assessing a potential investment, a seller setting a price, or a lender evaluating loan risk. Central to this process is the role of a licensed real estate appraiser whose expertise and impartial assessment are vital for an accurate and fair appraisal.

Engagement of a Licensed Appraiser: The process begins when a licensed appraiser is hired, typically by the lender or sometimes by the buyer or seller. The appraiser must be a professional with the credentials and knowledge of local market trends to ensure a reliable appraisal.

Collection of Preliminary Data: The appraiser starts by gathering basic information about the property, such as its location, size, and unique features. This initial data forms the foundation of the appraisal process.

Physical Inspection of the Property: The appraiser conducts an on-site visit to inspect the property thoroughly. This includes examining the interior and exterior, noting the property's condition, size, layout, and any improvements or unique features. This step is crucial in assessing the property's current state and its impact on value.

Market Research and Analysis: The appraiser then delves into market research, analyzing current real estate market trends and comparable sales data. This involves studying recent sales of similar properties in the area to help determine a fair market value for the subject property.

Preparation of the Appraisal Report: After the inspection and research, the appraiser compiles their findings into a detailed appraisal report. This report includes an analysis of the property and the market and the appraiser's final estimate of the property's value.

Review and Finalization: The completed report is then reviewed for accuracy and compliance with industry standards. Once finalized, it is submitted to the client thereby providing a professional, unbiased property valuation.

The appraisal process is a blend of professional evaluation, market analysis, and reporting. It is a critical component in the real estate industry, providing assurance and clarity to all parties involved in a property transaction.

Factors Affecting Property Value in an Appraisal

In real estate appraisal, understanding the factors influencing property valuation is critical. A real estate appraiser considers numerous aspects during the home appraisal process, each significant in determining the outcome. Let's delve into some of these crucial factors:

Location: Often touted as the most critical factor in property valuation, the location of a property significantly impacts its appraised value. This includes the neighborhood's desirability, proximity to amenities like schools, parks, and shopping centers, as well as the overall safety and accessibility of the area.

Property Size and Layout: The size of the property, including the square footage of the living space and the size of the land, is a primary consideration. Additionally, the layout and functional utility of the space can also affect its value. A well-designed layout that maximizes usability can enhance a property's appeal and value.

Condition and Age of the Property: The current state of the property is a vital component in the appraisal. This includes the home's age, its structure's condition, and any wear and tear. Properties that are well-maintained or recently renovated typically fetch higher appraisals.

Market Trends: Real estate market trends significantly influence property valuation. The appraiser considers the housing market's current state, including supply and demand dynamics, interest rates, and economic factors that could influence property values.

Market Analysis: A real estate appraiser conducts a Market Analysis, comparing the subject property with similar properties recently sold in the area. This comparison helps in gauging the competitive market value of the property.

Additional Features and Improvements: Unique features such as a swimming pool, a large garden, high-quality finishes, or energy-efficient appliances can add to a property's value. The appraiser assesses these additional features and considers how they contribute to the property's overall appeal and functionality.

Zoning and Future Development: The zoning regulations and potential for future development in the area can also impact a property's appraisal. For instance, a property in a zone with potential for commercial development may be valued differently than one in a strictly residential area.

A professional real estate appraiser meticulously evaluates each of these factors during the home appraisal process. Their assessment provides an objective estimate of the property's fair market value, reflecting its true worth in the current real estate market context. This comprehensive analysis ensures that all stakeholders in a real estate transaction have a clear and accurate understanding of the property's value, guiding informed decision-making and fair negotiations.

The Role of Appraisals in Real Estate Transactions

Real estate appraisals play a pivotal role in the dynamics of property transactions, influencing the decisions of buyers, sellers, and lenders in distinct ways. These appraisals provide an objective basis for decision-making, ensuring that all parties are informed about the actual value of the property in question.

For Buyers: Making Informed Purchase Decisions

Risk Mitigation: A professional property valuation helps buyers understand the actual worth of a property, reducing the risk of overpaying.

Negotiation Leverage: An appraisal can be a powerful negotiation tool, particularly if it reveals that the property's market value is lower than the asking price.

Investment Validation: For those purchasing property as an investment, an appraisal confirms whether the investment is sound based on current market trends and property potential.

For Sellers: Setting Realistic Selling Prices

Market-Driven Pricing: Sellers can benefit from appraisals by gaining insights into how to price their property competitively.

Justification for Price: A higher-than-expected appraisal gives sellers the evidence to justify their asking price or even adjust it upwards in a strong market.

Quick Sale Facilitation: Reasonably priced properties, backed by appraisals can attract serious buyers, potentially speeding up the sale process.

For Lenders: Determining Loan Values

Loan-to-Value Ratio: Lenders use the appraised value to determine the loan-to-value ratio, a critical factor in loan approval decisions.

Risk Management: By ensuring the property is worth the loan amount, lenders mitigate the risk of loaning more than the property's actual value.

Regulatory Compliance: Appraisals are often required for lenders to remain compliant with regulatory standards, ensuring that they are not issuing loans that exceed the value of the collateral.

As the real estate market continues to evolve, the role of a well prepared appraisal remains steadfast, offering clarity and confidence to all parties in a real estate transaction. Whether you are stepping into the market as a buyer, seller, or lender, understanding the value and implications of a professional real estate appraisal is crucial. It is not just a formality but a critical step in ensuring that the investment in real estate is sound, well-informed, and aligned with market realities. In essence, real estate appraisals are not just about assigning value to a property but about building trust and transparency in one of life's most significant financial decisions.

Love,

Kartik

|

A foreclosed home is a property repossessed by a lender, typically a bank, due to the homeowner's inability to meet their mortgage obligations. When a borrower fails to make timely mortgage payments, Read more...

A foreclosed home is a property repossessed by a lender, typically a bank, due to the homeowner's inability to meet their mortgage obligations. When a borrower fails to make timely mortgage payments, the le

|

Imagine a young couple finally stumbled upon a charming old Victorian house nestled at the end of a quiet cul-de-sac. Smitten by its ornate design and quaint charm, they quickly decided this was the home Read more...

Imagine a young couple finally stumbled upon a charming old Victorian house nestled at the end of a quiet cul-de-sac. Smitten by its ornate design and quaint charm, they quickly decided this was the home they wanted to start their new chapter in. As they navigated the escrow process, Sarah and Tom

|

In the wake of escalating wildfire risks and a rapidly

changing environmental landscape, major property

insurers are taking steps that could drastically alter the

state of homeowner insurance in California. Read more...

In the wake of escalating wildfire risks and a rapidly

changing environmental landscape, major property

insurers are taking steps that could drastically alter the

state of homeowner insurance in California. Farmers

Insurance, a significant player in the state's insurance

market, has recentl

|