Key Takeaways (Read This First):

Match your name exactly across every certificate and application.

Verify your provider’s DRE sponsor number is valid and active.

Make sure your course titles and Read more...

Key Takeaways (Read This First):

Match your name exactly across every certificate and application.

Verify your provider’s DRE sponsor number is valid and active.

Make sure your course titles and completion dates are correct and align with DRE expectations.

You’ve completed your real estate courses, downloaded your certificates, and submitted your application — but your real estate exam application still hasn’t been approved. For most applicants, the delay begins with one easily overlooked issue: Education Verification.

The DRE’s system is designed to move efficiently when everything aligns, but it slows down immediately when it encounters inconsistencies. Understanding how the DRE evaluates education documents is key to avoiding weeks of unnecessary waiting.

How the DRE Automated Verification Works

The DRE processes thousands of applications every month (crazy right?), and most of that work happens through automated checks. The system verifies whether your certificates match what their database expects: your name, your provider, your course titles, and the timing of your completions.

If anything looks unusual — mismatched names, unexpected dates, incorrect titles, inactive provider numbers — the automated flow stops. Your file leaves the fast lane and drops into manual review, which is where delays begin.

Most applicants assume that as long as the courses are completed, the DRE will read the certificates and approve them. But the DRE’s process is literal and exact. Even small formatting errors or inconsistencies can trigger a complete review.

Top 4 Reasons for Education Verification Failure

1. The Name Match Requirement

The biggest cause of delays comes from name inconsistencies.

Your certificates must reflect your legal name exactly as it appears on your DRE application.

If your application says one thing, your ID says another, and your certificate uses a shortened version or a hyphen that appears nowhere else, the system assumes there’s a potential identity mismatch.

You may see a harmless variation. The DRE sees a documentation discrepancy that must be reviewed manually.

Example of a Name Mismatch That Triggers a DRE Delay

Name on DRE Application: Maria Laura Hernandez

Name on Driver’s License: Maria L. Hernandez-Wilson

Name on Course Certificates: Maria Hernandez

To the applicant, these all feel like harmless variations — a middle initial here, an abbreviated last name there, a maiden name.

But to the DRE’s automated system, these are three different names.

The system cannot confidently verify that the education belongs to the same person who submitted the application, so your file is pulled out of the automated queue and into manual review.

A small inconsistency that seems meaningless to you is treated by the DRE as a potential identity mismatch, and that’s enough to slow the entire licensing process down.

2. Incorrect or “Marketing” Course Titles

Course titles create another major slowdown.

The DRE expects titles to match their official naming conventions. Providers often rename courses for branding, but the DRE doesn’t process branding — they process compliance.

If the DRE expects “Legal Aspects of Real Estate” and your certificate says ““Intro to RealEstate Fundamentals,” the system may not recognize it, pushing your file into manual review.

This is not the DRE being picky. It’s the DRE preventing misclassification.

3. Invalid or Inactive Provider Numbers

Provider issues are more common than people realize.

Not every website selling real estate courses is a DRE-approved school (be careful!). Some operate as resellers.

If the DRE cannot verify the provider number printed on your certificate, the application pauses immediately because the system cannot confirm your education source.

This is one of the quickest ways for an applicant to fall into a long delay without understanding why.

4. Timestamp and Study Period Errors

Completion dates also matter. California requires minimum study periods.

If your coursework appears to be completed too quickly… you fall into manual review.

The DRE checks whether your completion timeline aligns with legally required pacing. If your provider uses a faulty timestamping system, or if your certificates don’t reflect legal timing, your application will be held until an analyst can review it manually.

Even when the student did everything correctly, tech errors on the provider side can stall an otherwise clean application.

Remember, no one course can be finished faster than 18 days and no two courses can be finished faster than 36 days, etc. Also, no course can take longer than one year to complete.

The Danger of Fragmented Submissions

Fragmented submissions are another overlooked cause of delays. Applicants sometimes send things piecemeal into the DRE.

When your education record appears split across multiple submissions, your application leaves the automated lane and waits for an analyst to reorganize the documents.

This is especially critical for broker applicants. The DRE requires all eight college-level courses submitted together. Anything less creates complications.

The DRE Submission Checklist (Use This Before You Hit “Submit”)

My name matches exactly across all certificates, application forms, and ID

Course titles match official DRE titles

Completion dates comply with minimum study periods

My provider’s DRE sponsor number was active and valid at the time of completion

All certificates are submitted together in one complete upload

PDFs are clean, readable, and fully visible

No duplicate or outdated certificate versions are included

@media(max-width:1200px){

.example{

display: inline;

}

}

Checking every box eliminates nearly all common verification delays.

When you submit clean, consistent, DRE-verified certificates, your licensing process runs exactly the way it should. And the easiest way to make that happen is to start with a provider that understands the DRE’s requirements and formats everything correctly from day one. If you want to avoid delays, start your coursework with a DRE-approved school that guarantees compliant certificates — and keeps your licensing timeline on track.

|

As a real estate agent, you might encounter the misconception that the holiday season is a slow time for selling homes. With people busy with festivities and travel, it's easy to assume that listing a Read more...

As a real estate agent, you might encounter the misconception that the holiday season is a slow time for selling homes. With people busy with festivities and travel, it's easy to assume that listing a property during this time could be challenging. But don't let that common belief deter you! The truth is, the holiday season offers unique advantages that you can leverage to benefit your clients. Let's debunk this myth and explore why listing during the holidays can be a winning strategy for you and your sellers.

Less Competition - Your LIsting Shines Even Brighter

As a real estate agent, you can use the reduced competition during the holidays to your advantage. Many sellers mistakenly believe it's a bad time to list, perhaps due to misconceptions or advice from those who haven't had the benefit of a quality real estate license school. This leads to lower inventory, with the National Association of Realtors reporting a 15% drop in listings in December compared to the spring selling season. This presents a golden opportunity for you. With fewer homes on the market, your listings are more likely to grab attention and attract serious buyers.

Serious Buyers - Ready to Make a Move

While there might be fewer buyers overall during the holidays, those actively searching tend to be highly motivated. These buyers often have specific needs or timelines driving their search, such as year-end tax breaks, job relocations, or a desire to settle into a new home before the new year. Their urgency can translate into quicker closings and better offers.

Holiday Spirit - Capture the Magic

As a real estate agent, you can capitalize on the inherent charm of the holiday season. Encourage your clients to enhance their home's appeal with tasteful decorations, festive lights, and even the enticing aroma of freshly baked cookies. This creates a warm and inviting atmosphere that resonates with potential buyers on an emotional level, making the property more memorable and desirable. To maximize this effect, suggest professional staging that incorporates festive touches while maintaining a clean and spacious feel. Also, work with your clients to ensure their listing photos highlight the cozy holiday ambiance without appearing cluttered. This will help your listings stand out and attract more interest.

Favorable Timing for Sellers - Minimize Disruption, Maximize Opportunity

As a real estate agent, remember to highlight the advantages of holiday listings for your clients. With fewer showings, they can enjoy the festivities with minimal disruption to their routines. Plus, if they're planning to buy in the spring market, selling now allows them to secure their next home before the competition heats up. This strategic timing, something you likely learned in your real estate license school, can give them a real advantage and provide a smoother transition.

Considerations Before Listing - Plan for Success

When advising clients about holiday listings, be sure to address potential challenges while emphasizing the overall benefits. Acknowledge that limited showing schedules due to holiday gatherings and travel might require flexibility. Reassure them that with careful planning and open communication, these obstacles can be easily managed.

Ultimately, position holiday listing as a strategic move. Highlight the unique opportunities it presents, from reduced competition and motivated buyers to the captivating allure of a festively decorated home. By guiding your clients through the dynamics of holiday home selling and implementing effective marketing strategies, you can increase their chances of a successful and timely sale, further solidifying your value as their trusted real estate advisor.

So, are you ready to embrace the holiday season as a prime time for real estate success? By understanding the unique dynamics of the market during this period, you can effectively guide your clients and turn the "slow" season into a win-win for everyone. Remember, a well-prepared agent is a successful agent, and a quality real estate license school can equip you with the knowledge and skills to thrive in any market condition.

Want to learn more about maximizing your potential in the real estate industry? Contact us today or visit our website to explore our comprehensive real estate training programs and discover how we can help you achieve your career goals.

Love,

Kartik

|

Disclaimer: This article is for informational purposes only and does not constitute legal advice. The information provided is based on California laws and regulations as of the date of publication, which Read more...

Disclaimer: This article is for informational purposes only and does not constitute legal advice. The information provided is based on California laws and regulations as of the date of publication, which are subject to change. Every situation is unique, and the outcome of any DRE application or appeal depends on its specific facts. Readers are strongly encouraged to consult with a qualified attorney specializing in California real estate or administrative law for guidance on their individual case. Contact the California Department of Real Estate directly at dre.ca.gov or 877-373-4542 for official information and requirements.

If your California Department of Real Estate (DRE) application is denied because of background issues—don’t panic.

A denial doesn’t always mean “permanent disqualification.” It starts a legal process, and if you act strategically, you can often turn that denial into a conditional or full license.

This guide explains what’s happening, why it happened, and—most importantly—what to do right now to fix it.

Things can and do change, however. Please be sure you check with the DRE at dre.ca.gov or call 877-373-4542 with questions.

Understanding the DRE Denial Process

The Department of Real Estate (DRE) may issue one of two types of notices if an issue is discovered during your background review via Live Scan, and each may have different timelines and procedures for requesting a hearing:

Notice of Denial of Application

Document You Receive: "Notice of Denial of Application"

Scenario: This is a Denial without a formal Statement of Issues (SOI).

Governing Law: The procedure is governed by Business and Professions Code Section 485(b).

Deadline to Request Hearing: You may have (check with your counsel) 60 days from the date of the notice to request a hearing.

Denial with Statement of Issues (SOI)

Document You Receive: "Statement of Issues"

Scenario: This is a Denial with a formal Statement of Issues (SOI).

Governing Law: The procedure for responding to the Statement of Issues is governed by Government Code Section 11506.

Deadline to Request Hearing: You may have (check with your counsel) 15 days from the date of service to file a Notice of Defense and request a hearing.

Pro tip: Always assume the shortest (15-day) window applies. Missing that deadline usually means automatic default denial and loss of hearing rights.

If you request a hearing in time, your case goes to the Office of Administrative Hearings (OAH) before an Administrative Law Judge (ALJ).

The ALJ issues a proposed decision, which the Real Estate Commissioner can adopt, modify, or reject.

The “Substantial Relation” Test — What the DRE Really Looks At

The DRE can deny a license under Business & Professions Code § 480(a) and California Code of Regulations § 2910 if the offense is “substantially related to the qualifications, functions, or duties of a real-estate licensee.”

Crimes Typically Considered Substantially Related

These involve dishonesty, fraud, or moral turpitude, directly affecting consumer trust:

Mail fraud or wire fraud

Grand theft, embezzlement, forgery

Check fraud or identity theft

Crimes Sometimes Defensible as Not Related

Offenses unconnected to honesty, fiduciary duty, or financial handling, especially if old:

A DUI from years ago with no repeat offenses

Simple possession or non-property misdemeanors fully resolved

Strategy:

With the advice of your legal counsel and being honest, explain why your incident doesn’t touch honesty or fiduciary responsibility—those are the DRE’s core concerns.

Evidence of Rehabilitation — What the DRE Wants to See

Under Cal. Code Regs § 2911 , the DRE must consider whether you’ve demonstrated rehabilitation.

That means documented change, not just words.

.why-video-now-one-table {

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

tbody, td, tfoot, th, thead, tr{

border: 1px solid black !important;

padding: 10px;

text-align: center;

}

.table-wrapper{

max-width: 100%;

overflow-x: scroll;

}

Evidence Type

What the DRE Needs to See

Example in Practice

References

Letters from respected, non-family members (employers, supervisors, community leaders) that specifically address honesty and professionalism.

“[Applicant's Name] consistently demonstrated unwavering honesty in handling all confidential client data and maintained the highest standards of professionalism throughout their tenure as my direct report at [Company Name].”

Restitution / Fines

Proof of full, timely payment of all court-ordered fines or restitution.

Court receipts or probation completion letter showing zero balance.

Community Involvement

Documented volunteer or leadership roles showing civic engagement.

3 years of weekly Habitat for Humanity work + supervisor statement.

Employment History

Stable, verifiable work with positive performance reviews.

HR verification showing 5 years of continuous employment.

Tip: Package your proof in a clearly labeled binder or PDF with exhibits (Exhibit A – Character Letters, Exhibit B – Restitution Proof, etc.). The easier it is to review, the more credible you appear.

How to Disclose Convictions the Right Way

Incomplete disclosure is one of the top reasons applicants receive a Statement of Issues.

Here’s how to handle it correctly on your DRE application:

Always answer “Yes” if appropriate.

Even if the conviction was expunged —you still must disclose it.

Attach a short, factual statement that includes:

Case number and court name

Date of conviction and completion

What happened, what you learned, and what’s changed

Include proof: court minute orders, dismissals, program completions, and letters of reference.

✅ Sample Disclosure Statement:

“In 2015, I was convicted of a misdemeanor DUI (Case #XYZ123, Orange County Superior Court). I completed all terms of probation and education. Since then, I’ve maintained a clean record and volunteer with MADD as a mentor for first-time offenders.”

Attorney Help and Stipulated Settlements — Smart Middle Ground

Once a Statement of Issues has been filed, your case is handled by DRE’s legal counsel.

You should consider hiring an experienced administrative attorney who can often negotiate what’s called a Stipulated Settlement—a pre-hearing resolution.

What a Stipulated Settlement Is

A mutual agreement between you and the DRE allowing licensure under specific terms:

Restricted or probationary license (e.g., quarterly supervision reports, limits on roles)

Probationary period (typically 1–2 years)

Possible upgrade to full license after successful completion

This avoids the uncertainty and cost of a full hearing and may get you licensed months sooner.

If You’re Denied — How to Reapply the Right Way

If your denial becomes final, you can reapply after the waiting period.

Make sure your new application includes:

Updated letters of recommendation

Documented community involvement since the denial

Any new training, certifications, or awards

Evidence of expungement or dismissal, if applicable

The DRE’s focus shifts heavily to “what have you done since last time?”—so show tangible progress.

Bottom Line

A DRE denial isn’t the end—it’s an opportunity to prove rehabilitation and integrity.

By understanding key codes,, fully disclosing your background, and submitting real evidence of reform, you can often turn a denial into a conditional or unrestricted license.

Key takeaway: Act fast, document everything, and build your case around trustworthiness—the DRE’s number-one concern.

|

California has always been a magnet for real estate professionals. Its market is vast, complex, and full of opportunity — from high-end coastal homes and bustling Los Angeles neighborhoods to the fast-growing Read more...

California has always been a magnet for real estate professionals. Its market is vast, complex, and full of opportunity — from high-end coastal homes and bustling Los Angeles neighborhoods to the fast-growing Inland Empire and tech-driven Silicon Valley. It’s no wonder that licensed agents from across the country often ask how they can bring their expertise to California and start working there.

But there’s one critical fact that every out-of-state agent needs to understand right away: California does not have real estate license reciprocity with any other state. No matter where you’re currently licensed — Nevada, Texas, Florida, or New York — you’ll need to go through the same process as a first-time applicant to become licensed here.

That may sound daunting at first, but the process is straightforward once you understand the California Department of Real Estate’s (DRE) requirements and how to navigate them efficiently.

This article is for informational purposes only. Licensing requirements and forms may change. Always verify details directly with the California Department of Real Estate (dre.ca.gov) before applying.

What “No Reciprocity” Really Means

Many states have reciprocity agreements, which allow agents to move between jurisdictions without having to repeat the entire licensing process. These arrangements recognize that an agent’s existing education and experience often meet the host state’s requirements.

California, however, is different. The DRE maintains its own set of standards for education, testing, and licensing, meaning every applicant — regardless of background — must satisfy them in full. There’s no fast track, no waiver, and no exemption for those who already hold a license elsewhere. In practical terms, this means that even if you’ve been selling homes in Arizona for a decade, you’ll still need to complete the same 135 hours of pre-licensing coursework, pass the California salesperson exam, and apply for your license just like any new entrant.

The Path to Getting Licensed in California

While there’s no shortcut to reciprocity, the steps are logical and accessible. The DRE requires that all applicants be at least eighteen years old, demonstrate honesty and integrity, and submit to a fingerprint-based background check . Residency in California isn’t mandatory — out-of-state applicants complete an extra form called the Consent to Service of Process

Education is the foundation of the process. California mandates 135 hours of approved coursework, divided into three 45-hour classes: Real Estate Principles, Real Estate Practice, and one elective such as Finance, Escrow, or Property Management.

ADHI Schools offers DRE-approved courses that can be taken online from anywhere in the country.

Once your coursework is complete, you’ll move on to the application phase. This is where many out-of-state agents make a small but important mistake. The DRE provides two ways to apply:

Form RE 400A, which is only for the state exam, or

Form RE 435, known as the Combination Exam and License Application, which allows you to apply for both the exam and the license at the same time.

For most applicants — especially those eager to get licensed quickly — the RE 435 “combo” application is the better choice. It saves several weeks of processing time by letting the DRE review your license paperwork while you’re preparing for or taking the exam. You’ll simply pay both the exam and license fees upfront, and once you pass the test, your license can be issued immediately after fingerprint clearance.

The California salesperson exam itself consists of 150 multiple-choice questions covering real estate law, agency, contracts, financing, property ownership, and disclosures. A passing score is 70 percent or higher.

When the DRE has processed your background check and verified your passing score, your California real estate license is activated — allowing you to officially begin working under a licensed broker.

The entire process can be tracked and managed through the DRE’s eLicensing portal , which allows you to submit forms, check exam dates, pay fees, and even schedule or reschedule your test online. Using eLicensing not only speeds up communication but also helps ensure that your application doesn’t get delayed in the mailroom queue, which is a common issue for paper submissions.

Experience Matters — But California Is Its Own Market

For out-of-state agents, experience is both a blessing and a challenge. Your background in real estate transactions, client service, and market analysis will serve you well — but California’s real estate landscape comes with its own set of rules and nuances.

Purchase agreements, disclosures, and agency laws in California are among the most detailed in the nation. The state also has unique consumer protection regulations and local ordinances that vary by county and city. That’s why, even for seasoned professionals, the real estate coursework isn’t just a formality — it’s an essential orientation to how business is done here.

Programs like ours at ADHI Schools help bridge that gap by tailoring instruction to out-of-state agents, emphasizing California-specific contracts and exam preparation. Because all of the coursework can be completed online, you can begin the process before relocating — saving months of waiting time.

A Note for Out-of-State Brokers

Brokers face a slightly higher bar. To qualify for the California Broker Exam, applicants must show at least two years of full-time licensed salesperson experience within the last five years and complete eight college-level real estate courses. Like salesperson applicants, out-of-state brokers are not exempt from these requirements. Each must apply, document their prior experience, and pass the California Broker Exam before conducting brokerage activities in the state.

This process ensures that all brokers operating in California understand local regulations, disclosure obligations, and the DRE’s stringent compliance framework — something that ultimately protects both consumers and licensees.

Clearing Up the Most Common Misunderstandings

There are several misconceptions that persist among agents seeking to transfer their real estate licenses to California. The first is the idea that prior licensing automatically waives the education requirement. It doesn’t — the DRE treats every applicant the same.

The second misconception is that California has some form of reciprocity or “mutual recognition” with nearby states. It does not. Every applicant must complete their California specific education and pass the state exam.

Finally, some assume that they can start practicing immediately upon moving to California. In reality, no real estate activity — marketing, advising, or representing clients — can occur until your California license is officially issued and hung with a broker.

Why California Is Worth It

The effort required to become licensed in California is well worth it. The state’s real estate industry is one of the most dynamic in the world, spanning everything from residential sales and new construction to commercial leasing and investment opportunities. Agents who build a foothold here gain access to a massive client base and some of the most sophisticated markets anywhere.

Out-of-state agents who complete the process often find that their broader perspective gives them a competitive edge. The key is preparation — and selecting a trusted education provider to ensure a smooth transition. Schools like ADHI Schools specialize in helping aspiring agents meet California DRE requirements efficiently, offering flexible schedules, instructor support, and comprehensive exam prep designed for busy professionals.

Final Thoughts

Relocating or expanding your real estate career to California isn’t as simple as transferring your existing license — but with clear guidance, it’s entirely achievable. Understanding that California operates without reciprocity allows you to plan correctly, meet the DRE’s expectations, and start building relationships in one of the most lucrative real estate markets in the country.

Whether you’re an agent from another state looking to get licensed or a seasoned broker ready to grow your business on the West Coast, the path begins with education. Start with your 135-hour pre-licensing courses through ADHI Schools , prepare for the state exam, and take the next step toward your California real estate career.

|

If you’re a California real estate salesperson ready to take the next step and become a broker, you’ll need more than coursework and an exam — you’ll need to prove your experience.

That’s Read more...

If you’re a California real estate salesperson ready to take the next step and become a broker, you’ll need more than coursework and an exam — you’ll need to prove your experience.

That’s where the RE 226 — Licensed Experience Verification — comes in. It’s one of the most important documents in your broker license application, and completing it correctly can mean the difference between a smooth approval and a DRE delay.

Let’s break it down.

What Is Form RE 226?

Form RE 226 is the California Department of Real Estate’s official method for confirming that you’ve been licensed — and actually working — long enough to qualify for the broker’s exam.

In plain English, it answers the question:

“Has this person truly gained enough real estate experience to become a broker?”

The form must be completed and signed by your supervising or responsible broker — not by you alone — and submitted with either your Broker Exam Application (RE 400B) or your Combined Exam/License Application (RE 436).

The Experience Requirement

To qualify for the broker exam, you must demonstrate at least two years of full-time licensed salesperson experience within the five years immediately preceding your application.

Here’s what that means:

Full-time = roughly 40 hours per week (part-time experience is prorated).

Experience must be earned under an active California real estate license.

Out-of-state licensees can use equivalent experience but must still verify it via RE 227.

Older experience (more than five years before applying) won’t be counted.

What Your Broker Must Complete

Your supervising broker certifies your experience by completing several key sections of RE 226, including:

Employment period: The dates you worked under their supervision.

Average weekly hours: Full-time or part-time.

Types of activities handled: Listings, sales, leases, loans, etc.

Approximate earnings or income: Or a signed explanation if income was minimal.

Nature of duties: A brief description of what you did — e.g., residential listings, commercial leasing, property management.

Your broker must sign, date, and include their license number and contact details.

If you’ve worked under multiple brokers, you’ll need a separate RE 226 for each one.

Common Mistakes That Delay Applications

Small errors on RE 226 often cause major delays. Avoid these pitfalls:

Missing broker signatures or dates

Leaving blank fields (use “N/A” or “none” where applicable)

Overlapping or incorrect employment dates

Reporting low transaction volume without a written explanation

Submitting an outdated form version

What If You Don’t Have Enough Experience?

If you don’t meet the full two-year salesperson requirement, you may still qualify through equivalent experience in related fields, such as:

Real estate escrow or title work

Mortgage or loan processing

Property management or development

In that case, you’ll use Form RE 227 (Equivalent Experience Verification) instead — a similar form tailored for non-salesperson roles.

Pro Tip from ADHI Schools

Start thinking about your RE 226 early. Don’t wait until you’re ready to submit your broker application.

Track down past brokers ahead of time and confirm they’re willing to sign.

Provide them with a partially pre-filled version to save time.

Double-check that their license number, business address, and phone are current — the DRE may contact them for verification.

How ADHI Schools Can Help

At ADHI Schools, we’ve helped thousands of California agents move from their first real estate class to earning their broker license. We know exactly how to make the paperwork simple.

If you’re ready to make the jump:

Enroll in our Broker Course Package (Real Estate Appraisal, Finance, Legal Aspects, and more).

Schedule a one-on-one advisor session to review your experience documentation before submission.

Final Thoughts

Form RE 226 isn’t as intimidating as it looks — it’s simply the DRE’s way of confirming that you’ve put in the work and earned your experience in the field.

Fill it out carefully, coordinate with your broker, and you’ll be one step closer to joining California’s broker ranks.

For more tips and step-by-step licensing guidance, visit ADHISchools.com — your trusted partner from first class to broker license.

|

Assembly Bill 1033 has created a new class of real estate in California: the sellable ADU. In jurisdictions that opt in, homeowners can now convert their property into a condominium, allowing the ADU to Read more...

Assembly Bill 1033 has created a new class of real estate in California: the sellable ADU. In jurisdictions that opt in, homeowners can now convert their property into a condominium, allowing the ADU to be sold separately from the main residence. This unlocks a brand-new listing category for agents but also brings the complexities of condo law, lender sign-offs, and extensive disclosures into what would otherwise be a simple residential sale. This guide provides the essential details you'll need to navigate these transactions confidently.

What AB 1033 Actually Does (and Why It's Not a "Lot Split")

AB 1033 allows cities and counties to pass an ordinance that lets a homeowner sell their ADU separately from the primary residence. However, it's critical to understand the legal method: this is not a lot split. Instead, you are creating a common interest development—essentially, a small, two-unit condominium project.

Here’s the practical distinction:

A lot split divides the land itself, creating two or more legally independent parcels. Each new lot is owned outright.

An AB 1033 conversion keeps the original lot intact. The land becomes a "common area" jointly owned by the owners of the main home and the ADU with each owner holding a separate interest in their airspace unit.

This brings up a common question: "Won't the two units have different Assessor's Parcel Numbers (APNs)?"

Yes, they most likely will. Once the condominium is legally created, the county assessor will typically assign a separate APN to each unit (the main home and the ADU). However, this is done for property tax purposes only. Since the units can be owned by different people, the county needs a way to send two separate tax bills. The assignment of an APN is an administrative function for taxation and does not change the legal fact that the property is a condominium on a single, shared lot—not two separate lots.

Ultimately, the state law only provides the framework; this entire process is only possible when a local city or county officially opts in and defines the specific local rules.

Where This Is Live (and why adoption is uneven)

Because AB 1033 is opt-in, the map is patchy. San José moved first —adopting an ordinance in July 2024 and green-lighting the state’s first ADU condo sale in August 2025. That milestone proved the concept and kicked off copycat discussions in other cities. Always verify local status before you market or write offers.

The Path for Sellers: From ADU to “micro-condo”

Think of the conversion as three intertwined tracks—legal mapping, habitability sign-off, and lender consent—followed by a familiar marketing and escrow period.

Confirm opt-in & pull the city checklist. If your city hasn’t adopted, you’re done. If it has, the checklist will mirror state guardrails but add local steps and forms.

Assemble the deal team early. You’ll need a land-use or condo attorney, title, a surveyor, and someone who can draft CC&Rs that divide maintenance and spell out access, parking, utilities, noise, and exclusive-use areas.

Plan the disclosure stack. In addition to the standard residential TDS and NHD and other mandated disclosures, the buyer will need condo docs (CC&Rs, bylaws, operating budget/reserves), the condo map/plan, any shared-elements easements, and recorded lienholder consents (more on that below).

Meet the safety inspection requirement. Before the map records, AB 1033 requires proof of a safety inspection—either a certificate of occupancy issued by the local agency or a HUD Housing Quality Standards (HQS) report by a certified inspector. Build time for this into your timeline.

Secure lender consent (non-negotiable). The condo map cannot record without written consent from each lienholder. Lenders can refuse or require conditions (e.g., refinancing, reserve thresholds, or revised collateral language). The consent must include specific statutory language and be recorded with the county. Start these conversations early—this is where otherwise clean deals can stall.

Sort utilities and notify providers. Separate meters may be required by local policy or utility providers; if not, the CC&Rs must clearly allocate costs, access, and shut-off rights. Upon condo creation, the homeowner must notify utility providers of the separate conveyance.

Record, list, and close. Once the map and consents are recorded, market the ADU as a condo. Expect the county assessor to assign separate APNs post-conveyance (timing varies by county). Underwriting, comps, and buyer expectations look different from a standard condo—see below.

The Buyer’s Reality: Financing, monthlys, and resale

Financing. These are condominium loans, and the smaller the unit, the more attention lenders pay to project questionnaires (reserves, insurance coverage, owner-occupancy mix, litigation). Be ready to provide the new HOA budget and reserve plan. Underwriters will model HOA dues and reserves into DTI.

Monthlies. Coach buyers on the full monthly picture: mortgage + taxes + HOA dues (with reserve contributions), potential special assessments, and shared insurance mechanics (e.g., master policy + HO-6). That clarity prevents cold feet at contingency removal.

Resale. Micro-condos trade more like cottages than flats: private entries, small footprints, and the presence (or absence) of exclusive-use outdoor space, storage, and parking drive value. Your comp set will be tiny condos, cottage courts, and—ideally—local ADU-condo comps as they emerge.

Some Documents That Protect Your Client (and you)

Statutory disclosures: TDS (Civ. Code §1102) and NHD (Civ. Code §1103 et seq.) still apply.

Condo packet: recorded CC&Rs, bylaws, operating budget and (if available) reserve study/plan, condo map/plan, shared-elements easements, utility agreements, lienholder consents, and any city notices or checklist forms.

AVID & over-disclosure: Map shared systems (sewer laterals, water lines, shared roofs/driveways) and note any open permits or variances. It’s hard to over-disclose on a first-generation product category.

HOA landmines (and how to avoid them)

Most post-closing drama comes from maintenance responsibility and use rules. Avoid ambiguity by:

Drawing a maintenance matrix that names each component (roof, siding, foundation, shared driveway/gate, landscape, fences, trash enclosure, shared meters) and assigns responsibility and inspection cadence.

Being explicit about exclusive use (patios, side yards, storage sheds) versus common area.

Setting realistic noise and parking expectations in the rules—especially where units are close.

Checking short-term rental rules at both city and HOA levels; do not imply rental income without verifying.

Utilities, access, and parking: the practical stuff

AB 1033 recognizes that upon separate conveyance, a local agency or utility may require a new or separate utility connection (and proportionate connection fees) where it wasn’t otherwise required for a standard, non-separately-conveyed ADU. If services remain shared, the CC&Rs need crystal-clear language on access, meter reading, maintenance, and billing. Record any access and utility easements so future owners—and lenders—aren’t guessing.

Pricing and positioning a micro-condo

Treat these like livable, detached cottages with condo paperwork. Price on privacy and function: no shared corridors, ground-level entries, outdoor space, light, and acoustic separation. Include a to-scale floor plan and a simple site plan (labeling the unit, parking, trash, and paths of travel). For buyers coming from apartment-style condos, the single-story cottage experience can command a premium per square foot despite smaller size.

Compliance notes your clients will thank you for

Don’t oversell “automatic.” Everything depends on local opt-in and meeting statutory conditions (inspection, mapping, consents).

Be precise about the past. Prior law had a narrow nonprofit exception; AB 1033 adds a broad condo pathway via local ordinance.

A quick case study: San José’s “first”

San José’s early adoption set the pattern: pass a clear ordinance, publish a homeowner-facing conversion guide, and coordinate internal teams (planning, building, and code enforcement). The city then approved the first recorded ADU condo in August 2025—an example that has helped normalize lender and title workflows statewide. Use that precedent when socializing the concept with your local stakeholders, but always cite your own city’s ordinance in contracts and disclosures.

What to do this week (agent checklist)

Build a local “opt-in” tracker. Keep links to city ordinances and checklists in one doc.

Collect a lender short-list. Identify originators who’ve already closed small-unit condos and will engage early on questionnaires and reserves.

Template your condo packet. Create a repeatable binder: TDS/NHD + CC&Rs + budget + map/plan + easements + utility agreements + lienholder consents.

Educate your farm. A one-page explainer for ADU owners can generate listing calls months before they’re ready to convert. Make sure to check with your broker on advertising compliance.

Bottom line: AB 1033 turns some backyards into starter homes—but only in jurisdictions that opt in, and only when you clear the condo law hurdles. The agents who win here will be the ones who master the process (mapping, inspection, lender consent), package the disclosures cleanly, and set expectations early on financing and HOA realities. Check with legal counsel and your broker to make sure you are staying compliant and you’ll be the first call when your market’s homeowners decide their ADU is ready for the big leagues.

|

You’ve decided to pursue a real estate career in California. The dream is clear: earning your real estate license, passing the real estate exam, and stepping into a career with unlimited potential.

But Read more...

You’ve decided to pursue a real estate career in California. The dream is clear: earning your real estate license, passing the real estate exam, and stepping into a career with unlimited potential.

But here’s the truth most students don’t realize: your choice of real estate school can make or break that journey. Pick the wrong school, and you risk being stranded mid-course, with your investment gone and your momentum lost.

This is why stability matters. And in a market where schools come and go with every housing cycle, choosing the right partner is your first big career decision.

The Risk of Fly-By-Night Schools

The real estate education market is volatile, and many schools that launched during the COVID boom have already collapsed. With the housing slowdown and new regulations like SB1495’s Interactive Impact Bias requirement taking effect in 2024, countless websites have vanished overnight.

And when a school disappears, it’s not just their problem — it’s yours.

Students could be stranded mid-course with no way to finish.

Hard-earned credits don’t transfer to another provider.

Tuition money is gone — and so is your time.

Worst of all, your momentum toward a license and career vanishes in an instant.

The Market Context: How Real Estate Schools Rise and Fall

The business of real estate education has always mirrored the housing market itself. When homes are selling quickly and prices are climbing, interest in becoming an agent naturally spikes. That was true in the mid-1990s boom leading up to 2006, when real estate schools were filled with new students eager to ride the wave. But when the 2008 financial crisis hit and the market collapsed, many of those same schools shuttered their doors almost overnight.

We saw a similar pattern during the COVID-19 surge in 2020–2021. With people stuck at home and rethinking their careers, thousands rushed to get a real estate license. It felt like new schools were appearing online almost weekly, many with flashy websites and big promises. The barrier to entry was relatively low, and in a hot market, making quick money seemed easy.

But downturns always test the foundation of a school. When the 2023 market cooled and enrollments slowed, newer operators discovered what ADHI has known for decades: running a compliant, high-quality real estate school requires deep infrastructure, experienced staff, and the strength to withstand lean years.

Without that, thin margins and mounting compliance costs quickly push pop-up schools out of business — leaving students caught in the middle.

The Pillars of Our Resilience

At ADHI Schools, we’ve proven again and again that we’re built to last. Since 2003, we’ve not only survived market turbulence — we’ve helped thousands of students thrive through it.

Here are the pillars of our resilience:

Experience Through Every Cycle: From the Great Recession (2008–2012) to the 2023 slowdown, we’ve guided students through the toughest housing markets.

Regulatory Strength: We adapt promptly to new regulations, such as SB1495. Compliance is never an afterthought — it’s part of our DNA.

Full-Journey Support: From enrollment to exam day, our infrastructure ensures you’re supported at every step.

Proven Longevity: With nearly 25 years in business, we’re not here to make a quick profit. We’re here to launch real careers.

A Trusted Community: Thousands of working agents in California today started right where you are — with ADHI Schools.

This is the stability every aspiring real estate professional deserves.

A Safer Next Step

Your real estate career is too meaningful to gamble on a school that may not be here tomorrow. Choosing ADHI Schools means choosing security, expertise, and a clear path to your license.

|

Is there a “best” age to launch a real estate career? The answer might shock you. While you only need to be 18 years old to get a real estate license, the truth is that every decade of life offers Read more...

Is there a “best” age to launch a real estate career? The answer might shock you. While you only need to be 18 years old to get a real estate license, the truth is that every decade of life offers a unique, decisive advantage. The “perfect” time to start is whenever you decide you’re ready. At ADHI Schools, we’ve helped students in their teens, 20s, 40s, 60s, and beyond pass the real estate exam and build careers that fit their lives.

The Legal Minimum: The Only Real Rule

Across most states, there’s just one hard requirement: you must be at least 18 to hold a real estate license.

Good news: many states allow you to start pre-licensing education earlier and then apply for your license once you turn 18. Rules vary, so check your state’s criteria—or ask ADHI Schools, and we’ll map your exact steps for how to get a real estate license in California.

Ages 18–25: The Hustler’s Edge

Your advantages

Energy & adaptability to outlearn and outwork competitors

Tech fluency with short-form video, social ads, and CRMs

Long runway to compound skills, reviews, and referrals

Winning strategies

Volume of activity: Open houses, strategic outreach, and neighborhood videos build skills fast.

Modern lead gen: Create TikToks/shorts on rent-vs-buy, local highlights, and first-time buyer tips—then funnel viewers to a simple lead form.

Join a team: Trade a higher split for mentorship and reps; you’ll accelerate faster than going solo.

How ADHI helps

At ADHI Schools, our pre-licensing course and study materials include modern digital marketing modules that demonstrate how to convert TikTok and Instagram views into real leads, set up a basic CRM, and follow up effectively.

Common worry for younger folks is “I don’t have a network.”

Reframe it: you’re building one with today’s tools. Weekly “market minute” videos, DM outreach with value (not spam), and consistent open houses grow a pipeline from zero.

This is the moment to pour a foundation for lifelong success. ADHI’s flexible online real estate school fits around classes or a first job and prepares you to pass the real estate exam on your first attempt.

Ages 26–50: The Networker’s Advantage

Your advantages

Established sphere: Friends, colleagues, fellow parents, alumni groups—your first 10–20 clients are likely already in your contacts.

Career skills transfer: Sales, marketing, ops, finance, and customer service map directly to real estate.

Credibility & stability clients trust.

Winning strategies

Activate your sphere: Announce your new path with value—free home-value reviews, “move-up math,” and buyer readiness checklists.

Specialize by life stage: “Young families near [School District],” “condo-to-house,” or “first-time investors.”

Systematize: Use a CRM, nurture emails, and a repeatable open-house cadence to stay top-of-mind without burnout.

How ADHI helps

A great real estate school like ADHI doesn’t just teach you to pass the test; our business-building webinars help you craft the perfect announcement strategy for your existing network, choose a niche, and structure your first 90-day action plan.

Common worry: “How do I juggle work and family?”

Real estate can offer you flexibility—once the necessary systems are in place. Time-block showings, batch content on weekends, and plan childcare for offer nights. Your schedule, your rules.

You already have the network—now get the license. ADHI’s proven curriculum and support help you pass the real estate exam and launch your “second act” confidently.

Ages 50+: The Advisor’s Advantage

Your advantages

Wisdom & calm: You’ve seen markets cycle; clients value steady, consultative guidance.

Deep relationships: Community ties fuel referral-driven business.

Financial flexibility: Choose part-time niches or higher-touch service models.

Winning strategies

Lead with advice, not pressure: Emphasize planning, risk reduction, and life-stage moves.

Niche where experience shines: Senior relocation, downsizing, probate/trust sales, or vacation and second-home markets.

Referral engine: Quarterly client check-ins, vendor partnerships (CPAs, attorneys, contractors), and educational workshops.

How ADHI helps

ADHI Schools offers self-paced, easy to understand education that respects your time and experience—giving you the confidence to launch a rewarding second act.

Your Age Advantage: At-a-Glance

.why-video-now-one-table {

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-one-table th, .why-video-now-one-table td {

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

tbody, td, tfoot, th, thead, tr {

border-color: inherit;

border-style: solid;

border-width: 0;

border: 1px solid black !important;

padding: 5px;

text-align: center;

}

.table-wrapper{

max-width: 100%;

overflow-x: scroll;

}

th{

width: 20%;

padding: 10px;

}

Life Stage

Biggest Strength

Top Strategy

Common Hurdle

Mindset Shift

18–25

Energy & tech skills

Volume + team mentorship

Small sphere

You’re building a modern network from zero

26–50

Established sphere

Activate relationships + niche

Time constraints

Systems create flexibility and scale

50+

Credibility & patience

Advisory positioning + referrals

Aversion to “sales”

Serve and educate; let trust do the selling

Your Time Is Now

The market doesn’t ask your age; it asks for your value. Ultimately, your success is determined by passion, consistency, and preparation—not your birth year. Where you are right now isn’t a hurdle; it’s your unique advantage. The first step to leveraging it is to earn your real estate license.

The second is to choose the right partner for your education like ADHI Schools!

Quick FAQ

.accordion-button:not(.collapsed)::after {

background-image: url(/images/web_new_reskin/dash.svg) !important;

}

.accordion-button:not(.collapsed)::after {

background-image: url(/images/web_new_reskin/blogminus.svg) !important;

}

.accordion p,

.accordion br{

display: none;

}

.accordion-button::after{

left: 0% !important;

}

.accordion-body{

font-size: 15px;

color: gray;

}

button.accordion-button {

background-color: aliceblue !important;

}

.accordion-button:not(.collapsed) {

background-color: black !important;

color: white !important;

}

What’s the minimum age to get a real estate license?

In most states, you must be 18 years old to hold a license. Some states let you start pre-licensing courses earlier and apply once you turn 18 - California is one such state.

Am I too old to start a career in real estate?

No. Many top producers begin their careers in their 40s, 50s, or later. Your network and credibility are powerful advantages.

How long does it take to obtain a license?

It depends on your state’s pre-licensing course hours and exam schedule. With a focused plan, many students finish coursework in weeks, not months. ADHI Schools’ coursework can be finished in under 8 weeks!

How do I choose the best real estate school?

Look for state-approved courses, comprehensive real estate exam prep, flexible formats, and responsive support. (That’s our wheelhouse at ADHI Schools.)

I’m nervous about the real estate exam. What if I fail?

It’s a common concern! The key is choosing a real estate school with a proven track record. At ADHI Schools, our curriculum includes practice exams, comprehensive materials, and instructor support designed to help you pass the real estate exam on your first attempt. We build your confidence along with your knowledge.

Regardless of your age, a successful career in real estate begins with quality education. ADHI Schools provides the industry-leading curriculum, expert instruction, and flexible scheduling you need to pass your state’s real estate exam on the first try.

Contact us today to learn more about our real estate school programs and how we help you every step of the way to become a Realtor!

|

Thinking about a career in real estate? You're not alone. The freedom, the income potential, the ability to help people make one of the most significant decisions of their lives—there's a lot to love.

Read more...

Thinking about a career in real estate? You're not alone. The freedom, the income potential, the ability to help people make one of the most significant decisions of their lives—there's a lot to love.

But here's the truth: success in real estate isn't luck, and it isn't automatic after you pass the real estate exam.

It's a professional discipline that rewards preparation, resilience, and consistent action.

A good real estate license school won't just teach you the state laws to pass your exam. It will equip you with the scripts, systems, and mindset to build a profitable business from your first day as an agent. That's the philosophy we built ADHI Schools on: rigorous pre-licensing courses, supportive learning, real-world practice, and a clear path from "student" to "producing agent."

This article is a positive, empowering guide to self-assessment. We'll explore the realities of a real estate career through a crucial question: who is truly a good fit for a license? If you see yourself in any of the archetypes below, it doesn't mean you should quit. It means you've identified a hurdle.

And hurdles are what training, coaching, and thoughtful planning are for.

The Self-Assessment: Four Archetypes (and How to Beat Them)

Each of these profiles comes with a harsh reality, followed by an encouraging reframe, and explains how a strong real estate license school—like ADHI Schools—can help you overcome it.

1) The Day-Job Dreamer

Harsh reality:

If you imagine real estate as a "no-sweat" side hustle with quick, easy money and zero impact on your evenings or weekends, the first months will be a shock. Real estate is flexible, but "flexible" isn't the same as "low-time." Showings happen when clients are available (often nights/weekends in residential real estate).

New agents win by establishing consistent lead-generation habits—such as prospecting, attending open houses, following up, writing offers, conducting inspections, obtaining price feedback, and nurturing their sphere. Those hours have to come from somewhere.

Typical signs:

You plan to "try it" with leftover time rather than schedule it.

You avoid open houses or weekend showings because they cut into leisure time.

You want commissions without committing to daily prospecting.

The reframe (and how ADHI helps):

Treat real estate as a professional sport: a flexible schedule with disciplined blocks of time. That means time-blocking and holding yourself accountable. At ADHI Schools, we teach time-blocking frameworks, how to prioritize money-making activities (such as conversations, appointments, and offers), and how to use simple daily scorecards to ensure you're on track.

What this looks like in practice:

A weekly cadence with 5–10 hours of prospecting, 2–4 open houses per month, and scheduled follow-ups.

A simple KPI mindset (e.g., "8 genuine real estate conversations per day").

Scripts and objection handlers to help your time produce appointments, not just activity.

2) The Lone Wolf

Harsh reality:

Real estate is a relationship business. You don't have to be ultra-extroverted, but you do need to build trust, follow up, and consistently show up. If you dislike networking, avoid asking for referrals, and resist collaborating with lenders, inspectors, escrow agents, and other professionals, your growth will likely stall. Even top solo producers operate inside a web of human relationships.

Typical signs:

You'd rather tinker with your website than call your past clients or open-house leads.

You skip brokerage events, team meetings, and community functions.

The idea of asking for referrals makes you uncomfortable.

The reframe (and how ADHI helps):

Treat networking as service, not self-promotion. Your role is to solve problems and reduce stress. At ADHI Schools, we use low-pressure conversation frameworks and referral-ask scripts that feel natural. We also simulate real-life situations—such as introductions, lender handoffs, and post-closing check-ins—so it's second nature when it counts.

What this looks like in practice:

A two-minute referral ask that sounds like you (not a robot).

A 30-day post-closing care plan so clients feel cared for (and refer you).

A simple "weekly relationships" checklist: 5 outreach texts, three coffee chats, one community event.

3) The Financially Fragile

Harsh reality:

Real estate income is irregular at the start. You'll have upfront costs (your licensing course , exam, and application fees, association/MLS dues, lockboxes, signs, and basic marketing), and it can take months to close your first transaction. If you need a steady paycheck immediately or you have no savings to cover several months of living expenses, the pressure can be overwhelming.

Typical signs:

No emergency fund; credit cards are already maxed out.

Dependents relying on your income with no runway.

Expectation of fast, guaranteed deals to pay the bills.

The encouraging reframe (and how ADHI helps):

Plan the launch like a business. Build a runway (ideally six months), or layer in a bright transition plan (e.g., a part-time bridge job with predictable hours) while you build your pipeline. This is precisely where your real estate license school can help beyond the test.

"This is why choosing a real estate license school that offers career guidance and business planning modules is critical. At ADHI Schools, our courses include units on financial planning for new agents so that you can create a realistic budget and runway." — Kartik Subramaniam, Founder

What this looks like in practice:

A detailed launch budget spreadsheet distinguishing essential costs (MLS, lockbox, signs, basic marketing) from optional ones (premium website, paid ads) so you don't overspend early.

A 90-Day Sprint Plan focused on high-probability, low-cost lead generation: host open houses every weekend, daily sphere-of-influence outreach, and consistent follow-up.

A short guide for finding a compatible bridge job (showing assistant, transaction coordinator, leasing consultant, or property management assistant) that provides income without conflicting with prospecting and client care.

"ADHI had us map out expenses and a realistic 90-day plan. I stopped guessing, stopped stressing, and started executing."— ADHI Schools Student.

4) The Rejection-Phobic

Harsh reality:

Even with great marketing, you will hear "no"—often. People will ghost you, choose their cousin, or decide to rent for another year. If you take rejection personally, avoid follow-up, or get derailed by the first objection, you'll struggle to keep consistent activity. Real estate rewards those who normalize rejection and stay pleasantly persistent.

Typical signs:

You dread calling back because the last person said no.

You avoid door knocking, open houses, or cold outreach.

You overthink every message, then send nothing at all.

The reframe (and how ADHI helps):

Rejection is data, not a verdict on your worth. The cure is reps with feedback. In strong real estate school programs, you'll do role-playing with scripts, objection handling, voicemail frameworks, and post-open-house follow-ups until it's muscle memory.

What this looks like in practice:

A simple follow-up cadence (Day 0, 2, 5, 10, then weekly).

Objection handlers for when the client says: "We already have an agent," "We're waiting," or "We're just looking."

Bonus Archetypes We See (And Fix)

5) The Shortcut Seeker

Harsh reality:

If you believe the real estate license itself equals clients, you'll be disappointed. The license is permission to practice—not a guarantee of success. Without daily lead measures (conversations, open houses, content that builds trust), the phone stays quiet.

Reframe with ADHI:

We emphasize execution. Yes, you'll be ready for the real estate exam and pass the test —but your training must extend into marketing, lead generation, and client experience. We provide you with starter scripts, an outline for planning your business, and a referral-first playbook, so the license becomes a revenue engine.

6) The Unstructured Self-Manager

Harsh reality:

If you need a manager to set your daily to-do list, real estate can feel disorienting.

Your results correlate with your calendar. Empty calendar = empty pipeline.

Reframe with ADHI:

We teach a weekly operating system:

Plan (Sunday 30-minute pipeline review)

Block (Prospecting first; admin later)

Execute (Daily scorecard: conversations, appointments, showings)

Reflect (Friday 15 minutes: wins, gaps, next moves)

7) The Ethics-Flexible

Harsh reality:

You're handling people's most significant assets and private data. Cutting corners, misrepresenting facts, or ignoring agency duties will end your career. Quickly.

Reframe with ADHI:

Long-term success is trust. Our courses emphasize compliance, disclosure, fiduciary duties, and how to protect clients (and your license). Ethical agents earn repeat and referral business because they tell the truth—even when it's inconvenient.

Are You Ready? Score Your Real Estate Readiness

Use this quick self-assessment to identify your strengths and areas for improvement. Answer Yes / No / I'm not sure:

Do you have at least six months of living expenses saved (or a clear, realistic transition plan)?

Will you time-block 10–15 hours per week for lead generation, open houses, and follow-up—even on some evenings/weekends?

Are you comfortable introducing yourself to new people and asking for referrals in a way that feels authentic?

Can you handle hearing "no" repeatedly without losing momentum—and keep following up politely?

Do you have a simple budget for your first year (including dues, MLS, signs, and basic marketing) and a plan to keep costs lean?

Are you willing to practice scripts and role-play until objection handling feels natural and comfortable?

Will you run your calendar like a business owner—with weekly planning, daily scorecards, and honest self-review?

Interpret your score:

If you answered **"No" or "I'm not sure" to 3 or more questions, you may need a real estate school that specializes in comprehensive career coaching and support to bridge those gaps. That's precisely the foundation ADHI Schools is built on. Our career‑focused curriculum is explicitly designed to turn those "not sures" into confident "yeses" before you even hit the field.

What Makes ADHI Schools Different (and Why It Matters)

A real estate school should prepare you for both the exam and for the work. Here's what our students value most:

Career Preparation, Not Just Test Prep: Our pre-licensing course is paired with practical training, including time-blocking, lead generation plans, open-house systems, and post-closing care.

Supportive Learning Environment: Live instruction, office hours, and study communities where you get feedback, not just lectures—authentic, supportive learning.

Role-Play and Real-World Scenarios: We practice the conversations that close the gap between "licensed" and "producing."

Business Planning Modules: Budget templates, runway planning, and "first 90 days" roadmaps so you can launch with confidence.

State Exam Prep That Works: Focused state exam prep resources and strategy so passing the real estate exam is a milestone, not a mystery.

Ethics and Compliance Emphasis: Protect clients and protect your real estate license—because long-term success is built on trust.

"I picked ADHI Schools for the exam, but I stayed for the business plan. The launch playbook and weekly rhythm made the difference." — ADHI Schools Graduate.

Bringing It All Together

So, who should not get a real estate license?

Not the person who refuses to plan their time, build relationships, save a runway, or practice resilience.

But if you recognize those risks and you're willing to do the work, none of them are deal-breakers.

Self-awareness is your edge. The right real estate license school won't ignore these hurdles—it will prepare you to clear them. That's what we do at ADHI Schools: we combine the knowledge you need to pass the test with the habits and systems you need to build a real estate business that lasts.

Ready to Move Forward—With Eyes Open and a Plan?

If this reality check has you excited about the challenge, the next step is to find a school that supports your entire journey. At ADHI Schools, we prepare you not just to pass your real estate exam, but to build a successful and sustainable career.

→ Explore our career‑focused pre‑licensing courses today. See the whole curriculum, upcoming class schedules, and discover how our supportive learning environment sets you up for real‑world success from day one.

TL;DR (for the skimmers)

Real estate is flexible, not effortless.

Your calendar, not your intentions, predicts your income.

Relationships win. Rejection is normal. Resilience is trained.

A runway + a plan beats "I'll wing it."

A great real estate school (like ADHI Schools) teaches the exam AND the business.

When you're ready to treat real estate like the professional path it is, we're prepared to train with you.

Love,

Kartik

|

Real‑estate transactions live and die by what is written—and signed—in the contract. Yet nearly every deal, from a starter‑home purchase to a multimillion‑dollar commercial lease, must be tweaked Read more...

Real‑estate transactions live and die by what is written—and signed—in the contract. Yet nearly every deal, from a starter‑home purchase to a multimillion‑dollar commercial lease, must be tweaked after that first signature. That’s where two deceptively similar tools come in: the addendum and the amendment. Because the terms sound alike, many buyers, sellers, and even new agents mix them up—sometimes with expensive consequences.

This guide cuts through the confusion. You’ll learn the fundamental difference, see practical language examples, spot common pitfalls, and walk away knowing exactly which document to use, when, and why.

The Core Distinction: Adding vs. Altering

.table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

font-size: 16px !important;

}

th, td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

font-size: 16px !important;

}

th{

text-align: center !important;

}

@media(max-width:428px){

.table-responsive{

max-width: 100%;

overflow-x: scroll;

}

}

Tool

What It Does

One‑Sentence Analogy

Addendum

Supplements the contract by adding entirely new terms, conditions, or disclosures without touching existing text.

Like attaching a new appendix to a report.

Amendment

Modifies the contract by changing, deleting, or replacing language that is already there.

Like editing a paragraph in the report’s body.

Addendum Defined

An addendum (sometimes called a “rider” or “attachment”) is a separate, signed document that becomes part of the original agreement, but nothing in the original contract is struck, deleted, or replaced.

Analogy: You finished your book and later decide to add a bonus chapter—the original chapters stay exactly as written; you just hand readers an extra section.

Amendment Defined

An amendment rewrites part of the original agreement. You are altering the existing language—price, dates, contingencies, or even simple typos.

Analogy: You catch a typo in Chapter 3 of your book. Instead of adding a new chapter, you open the manuscript and correct that specific sentence.

When to Use Which: Practical Applications

Below are the most common scenarios you’ll encounter in both residential and commercial deals. For each, notice whether new material is added (addendum) or existing material is changed (amendment).

A. Addendum Scenarios & Examples

.table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

font-size: 16px;

}

th, td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

th{

text-align: center;

}

Scenario

Example Property Type

“Before” (excerpt)

Addendum Language (conceptual)

New contingency

Rural residence

Contract silent on septic system.

“This agreement is contingent on Buyer’s receipt and approval of a satisfactory septic inspection report on or before August 5.”

Personal property inclusion

Suburban home

Contract lists fixtures only.

“Seller shall include the following personal property at no additional cost: LG washer, LG dryer, and GE refrigerator (Model XYZ).”

Disclosure attachment

Pre‑1978 home

Contract mentions lead‑based paint but no form attached.

“Lead‑Based Paint Disclosure (EPA‑approved form) is attached hereto as Addendum A and incorporated herein.”

Lease pet clause

Apartment lease

Lease prohibits pets.

“Notwithstanding Paragraph 10, Tenant may keep one spayed cat under 15 lbs; Tenant assumes all liability for pet damage.”

Typical timing: Often drafted with the initial offer or immediately post‑acceptance (e.g., delivery of mandatory disclosures).

B. Amendment Scenarios & Examples

Scenario

Example Property Type

“Original Clause”

Amendment Language (conceptual)

Price change

Residential purchase

“Purchase Price: $500,000.”

“Paragraph 2 is hereby amended to state: ‘Purchase Price: $490,000.’”

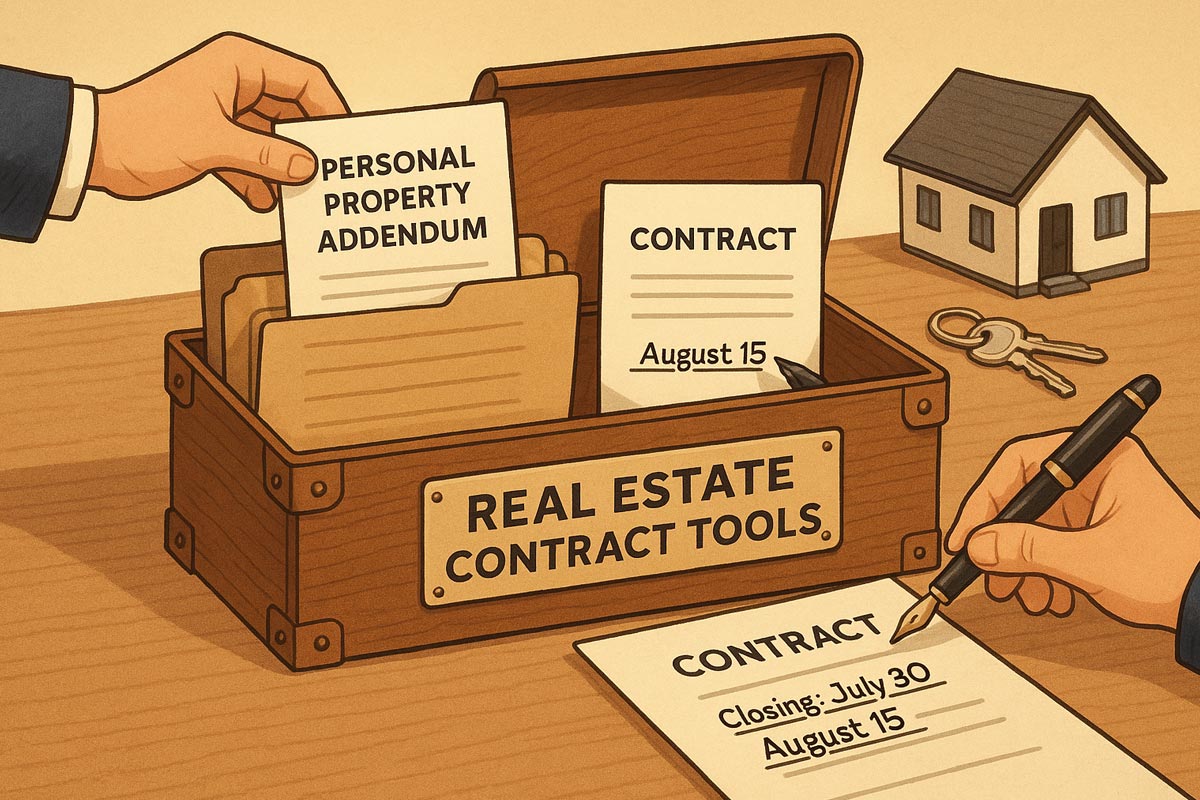

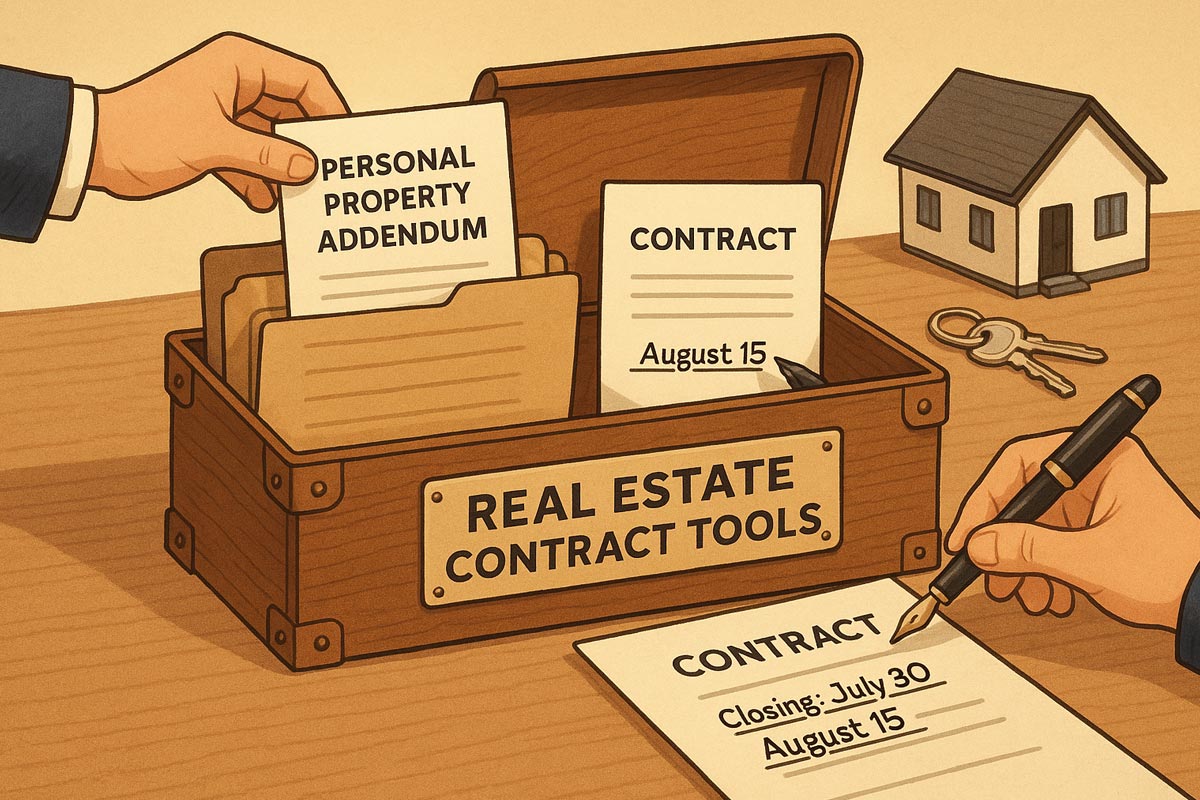

Closing‑date extension

Vacant land

“Closing Date: July 30 2025.”

“Closing Date is amended to August 15 2025.”

Repair credit

Condo

“Seller to repair roof leaks.”

“Seller shall instead credit Buyer $7,500 at closing in lieu of repairs; Paragraph 12 is amended accordingly.”

Loan‑type switch

Single‑family home

“Buyer financing: FHA loan.”

“Paragraph 5 is amended to read ‘Conventional 30‑year fixed loan.’”

Scrivener’s error

Commercial lease

Suite number misstated as 320.

“Suite number corrected from 320 to 302; all other terms remain unchanged.”

Typical timing: After the contract is executed when inspections, financing, or negotiations reveal the need to alter agreed‑upon terms.

Quick‑Decision Flowchart – Addendum or Amendment?

Is the information completely new and not addressed anywhere in the contract?

Yes → Addendum

Are you changing, deleting, or replacing wording that already appears in the contract?

Yes → Amendment

Need to do both?

Use both documents (e.g., add a new contingency and extend closing).

Proper Formatting & Language Tips

Best Practice

Why It Matters

Reference the underlying contract by date, parties, and property address at the top of the addendum or amendment.

Prevents arguments over which agreement the change attaches to.

Number each addendum/amendment (e.g., “Addendum #1”).

Aids tracking when deal requires multiple modifications.

Use clear headings such as “Purchase‑Price Adjustment” or “Inspection Contingency Addendum.”

Improves readability for all parties and attorneys.

State the effective date (often the last dated signature).

Clarifies when obligations begin.

For amendments, quote the original clause before showing the revised language (or cite the paragraph number).

Reduces ambiguity over what is being altered.

Obtain signatures from every party to the contract (and their spouses if required by local law).

An unsigned modification is unenforceable.

Common Mistakes & How to Avoid Them

Using the wrong document: Adding a new contingency with an amendment may accidentally overwrite existing clauses.

Leaving blanks or ambiguous wording: Courts interpret vagueness against the drafter.

Missing deadlines: An addendum or amendment delivered after a contingency expires may be ineffective.

Relying on verbal agreements: In most states, real‑estate contracts must be in writing (Statute of Frauds).

Failing to attach required disclosures: Violations can trigger rescission rights or fines.

Pro Tip: Keep a running “contract log” noting each modification, date sent, date signed, and current key dates (closing, inspection, loan approval).

State‑Specific Variations

While the concepts of addendums and amendments are universal, forms and statutory disclosures vary:

California: The Residential Purchase Agreement (RPA) uses a “Contract Addendum” (CAR Form) for new terms and a separate “Amendment of Existing Terms” for changes; specific addenda are mandatory for HOA docs, Mello‑Roos, etc.

Texas: The Texas Real Estate Commission (TREC) publishes promulgated addenda (e.g., Third‑Party Financing Addendum) and employs a universal “Amendment to Contract” form.

New York: Attorneys often custom‑draft riders (addenda) at contract formation; later changes are typically handled via attorney letters that serve as amendments.

Always consult local forms and professionals to ensure compliance.

Key Takeaways

Addendum = Add. Amendment = Alter.

Use addendums to introduce brand‑new terms without disturbing the original text.

Use amendments to change terms that are already written.

Clear drafting, proper referencing, and obtaining all signatures are non‑negotiable.

Laws and standard forms differ by state—check locally.

Beyond your time in real estate school, understanding the difference between an addendum and an amendment gives you powerful leverage in negotiations and protects you from costly missteps. If you are a buyer, remember that before signing—or sending—either document, consult your real‑estate agent and, for complex or high‑value transactions, a qualified real‑estate attorney. With the right tool and sound advice, you’ll keep your deal on track and your interests safeguarded.

Love,

Kartik

|