If you’re a California real estate salesperson ready to take the next step and become a broker, you’ll need more than coursework and an exam — you’ll need to prove your experience.

That’s Read more...

If you’re a California real estate salesperson ready to take the next step and become a broker, you’ll need more than coursework and an exam — you’ll need to prove your experience.

That’s where the RE 226 — Licensed Experience Verification — comes in. It’s one of the most important documents in your broker license application, and completing it correctly can mean the difference between a smooth approval and a DRE delay.

Let’s break it down.

What Is Form RE 226?

Form RE 226 is the California Department of Real Estate’s official method for confirming that you’ve been licensed — and actually working — long enough to qualify for the broker’s exam.

In plain English, it answers the question:

“Has this person truly gained enough real estate experience to become a broker?”

The form must be completed and signed by your supervising or responsible broker — not by you alone — and submitted with either your Broker Exam Application (RE 400B) or your Combined Exam/License Application (RE 436).

The Experience Requirement

To qualify for the broker exam, you must demonstrate at least two years of full-time licensed salesperson experience within the five years immediately preceding your application.

Here’s what that means:

Full-time = roughly 40 hours per week (part-time experience is prorated).

Experience must be earned under an active California real estate license.

Out-of-state licensees can use equivalent experience but must still verify it via RE 227.

Older experience (more than five years before applying) won’t be counted.

What Your Broker Must Complete

Your supervising broker certifies your experience by completing several key sections of RE 226, including:

Employment period: The dates you worked under their supervision.

Average weekly hours: Full-time or part-time.

Types of activities handled: Listings, sales, leases, loans, etc.

Approximate earnings or income: Or a signed explanation if income was minimal.

Nature of duties: A brief description of what you did — e.g., residential listings, commercial leasing, property management.

Your broker must sign, date, and include their license number and contact details.

If you’ve worked under multiple brokers, you’ll need a separate RE 226 for each one.

Common Mistakes That Delay Applications

Small errors on RE 226 often cause major delays. Avoid these pitfalls:

Missing broker signatures or dates

Leaving blank fields (use “N/A” or “none” where applicable)

Overlapping or incorrect employment dates

Reporting low transaction volume without a written explanation

Submitting an outdated form version

What If You Don’t Have Enough Experience?

If you don’t meet the full two-year salesperson requirement, you may still qualify through equivalent experience in related fields, such as:

Real estate escrow or title work

Mortgage or loan processing

Property management or development

In that case, you’ll use Form RE 227 (Equivalent Experience Verification) instead — a similar form tailored for non-salesperson roles.

Pro Tip from ADHI Schools

Start thinking about your RE 226 early. Don’t wait until you’re ready to submit your broker application.

Track down past brokers ahead of time and confirm they’re willing to sign.

Provide them with a partially pre-filled version to save time.

Double-check that their license number, business address, and phone are current — the DRE may contact them for verification.

How ADHI Schools Can Help

At ADHI Schools, we’ve helped thousands of California agents move from their first real estate class to earning their broker license. We know exactly how to make the paperwork simple.

If you’re ready to make the jump:

Enroll in our Broker Course Package (Real Estate Appraisal, Finance, Legal Aspects, and more).

Schedule a one-on-one advisor session to review your experience documentation before submission.

Final Thoughts

Form RE 226 isn’t as intimidating as it looks — it’s simply the DRE’s way of confirming that you’ve put in the work and earned your experience in the field.

Fill it out carefully, coordinate with your broker, and you’ll be one step closer to joining California’s broker ranks.

For more tips and step-by-step licensing guidance, visit ADHISchools.com — your trusted partner from first class to broker license.

|

Assembly Bill 1033 has created a new class of real estate in California: the sellable ADU. In jurisdictions that opt in, homeowners can now convert their property into a condominium, allowing the ADU to Read more...

Assembly Bill 1033 has created a new class of real estate in California: the sellable ADU. In jurisdictions that opt in, homeowners can now convert their property into a condominium, allowing the ADU to be sold separately from the main residence. This unlocks a brand-new listing category for agents but also brings the complexities of condo law, lender sign-offs, and extensive disclosures into what would otherwise be a simple residential sale. This guide provides the essential details you'll need to navigate these transactions confidently.

What AB 1033 Actually Does (and Why It's Not a "Lot Split")

AB 1033 allows cities and counties to pass an ordinance that lets a homeowner sell their ADU separately from the primary residence. However, it's critical to understand the legal method: this is not a lot split. Instead, you are creating a common interest development—essentially, a small, two-unit condominium project.

Here’s the practical distinction:

A lot split divides the land itself, creating two or more legally independent parcels. Each new lot is owned outright.

An AB 1033 conversion keeps the original lot intact. The land becomes a "common area" jointly owned by the owners of the main home and the ADU with each owner holding a separate interest in their airspace unit.

This brings up a common question: "Won't the two units have different Assessor's Parcel Numbers (APNs)?"

Yes, they most likely will. Once the condominium is legally created, the county assessor will typically assign a separate APN to each unit (the main home and the ADU). However, this is done for property tax purposes only. Since the units can be owned by different people, the county needs a way to send two separate tax bills. The assignment of an APN is an administrative function for taxation and does not change the legal fact that the property is a condominium on a single, shared lot—not two separate lots.

Ultimately, the state law only provides the framework; this entire process is only possible when a local city or county officially opts in and defines the specific local rules.

Where This Is Live (and why adoption is uneven)

Because AB 1033 is opt-in, the map is patchy. San José moved first —adopting an ordinance in July 2024 and green-lighting the state’s first ADU condo sale in August 2025. That milestone proved the concept and kicked off copycat discussions in other cities. Always verify local status before you market or write offers.

The Path for Sellers: From ADU to “micro-condo”

Think of the conversion as three intertwined tracks—legal mapping, habitability sign-off, and lender consent—followed by a familiar marketing and escrow period.

Confirm opt-in & pull the city checklist. If your city hasn’t adopted, you’re done. If it has, the checklist will mirror state guardrails but add local steps and forms.

Assemble the deal team early. You’ll need a land-use or condo attorney, title, a surveyor, and someone who can draft CC&Rs that divide maintenance and spell out access, parking, utilities, noise, and exclusive-use areas.

Plan the disclosure stack. In addition to the standard residential TDS and NHD and other mandated disclosures, the buyer will need condo docs (CC&Rs, bylaws, operating budget/reserves), the condo map/plan, any shared-elements easements, and recorded lienholder consents (more on that below).

Meet the safety inspection requirement. Before the map records, AB 1033 requires proof of a safety inspection—either a certificate of occupancy issued by the local agency or a HUD Housing Quality Standards (HQS) report by a certified inspector. Build time for this into your timeline.

Secure lender consent (non-negotiable). The condo map cannot record without written consent from each lienholder. Lenders can refuse or require conditions (e.g., refinancing, reserve thresholds, or revised collateral language). The consent must include specific statutory language and be recorded with the county. Start these conversations early—this is where otherwise clean deals can stall.

Sort utilities and notify providers. Separate meters may be required by local policy or utility providers; if not, the CC&Rs must clearly allocate costs, access, and shut-off rights. Upon condo creation, the homeowner must notify utility providers of the separate conveyance.

Record, list, and close. Once the map and consents are recorded, market the ADU as a condo. Expect the county assessor to assign separate APNs post-conveyance (timing varies by county). Underwriting, comps, and buyer expectations look different from a standard condo—see below.

The Buyer’s Reality: Financing, monthlys, and resale

Financing. These are condominium loans, and the smaller the unit, the more attention lenders pay to project questionnaires (reserves, insurance coverage, owner-occupancy mix, litigation). Be ready to provide the new HOA budget and reserve plan. Underwriters will model HOA dues and reserves into DTI.

Monthlies. Coach buyers on the full monthly picture: mortgage + taxes + HOA dues (with reserve contributions), potential special assessments, and shared insurance mechanics (e.g., master policy + HO-6). That clarity prevents cold feet at contingency removal.

Resale. Micro-condos trade more like cottages than flats: private entries, small footprints, and the presence (or absence) of exclusive-use outdoor space, storage, and parking drive value. Your comp set will be tiny condos, cottage courts, and—ideally—local ADU-condo comps as they emerge.

Some Documents That Protect Your Client (and you)

Statutory disclosures: TDS (Civ. Code §1102) and NHD (Civ. Code §1103 et seq.) still apply.

Condo packet: recorded CC&Rs, bylaws, operating budget and (if available) reserve study/plan, condo map/plan, shared-elements easements, utility agreements, lienholder consents, and any city notices or checklist forms.

AVID & over-disclosure: Map shared systems (sewer laterals, water lines, shared roofs/driveways) and note any open permits or variances. It’s hard to over-disclose on a first-generation product category.

HOA landmines (and how to avoid them)

Most post-closing drama comes from maintenance responsibility and use rules. Avoid ambiguity by:

Drawing a maintenance matrix that names each component (roof, siding, foundation, shared driveway/gate, landscape, fences, trash enclosure, shared meters) and assigns responsibility and inspection cadence.

Being explicit about exclusive use (patios, side yards, storage sheds) versus common area.

Setting realistic noise and parking expectations in the rules—especially where units are close.

Checking short-term rental rules at both city and HOA levels; do not imply rental income without verifying.

Utilities, access, and parking: the practical stuff

AB 1033 recognizes that upon separate conveyance, a local agency or utility may require a new or separate utility connection (and proportionate connection fees) where it wasn’t otherwise required for a standard, non-separately-conveyed ADU. If services remain shared, the CC&Rs need crystal-clear language on access, meter reading, maintenance, and billing. Record any access and utility easements so future owners—and lenders—aren’t guessing.

Pricing and positioning a micro-condo

Treat these like livable, detached cottages with condo paperwork. Price on privacy and function: no shared corridors, ground-level entries, outdoor space, light, and acoustic separation. Include a to-scale floor plan and a simple site plan (labeling the unit, parking, trash, and paths of travel). For buyers coming from apartment-style condos, the single-story cottage experience can command a premium per square foot despite smaller size.

Compliance notes your clients will thank you for

Don’t oversell “automatic.” Everything depends on local opt-in and meeting statutory conditions (inspection, mapping, consents).

Be precise about the past. Prior law had a narrow nonprofit exception; AB 1033 adds a broad condo pathway via local ordinance.

A quick case study: San José’s “first”

San José’s early adoption set the pattern: pass a clear ordinance, publish a homeowner-facing conversion guide, and coordinate internal teams (planning, building, and code enforcement). The city then approved the first recorded ADU condo in August 2025—an example that has helped normalize lender and title workflows statewide. Use that precedent when socializing the concept with your local stakeholders, but always cite your own city’s ordinance in contracts and disclosures.

What to do this week (agent checklist)

Build a local “opt-in” tracker. Keep links to city ordinances and checklists in one doc.

Collect a lender short-list. Identify originators who’ve already closed small-unit condos and will engage early on questionnaires and reserves.

Template your condo packet. Create a repeatable binder: TDS/NHD + CC&Rs + budget + map/plan + easements + utility agreements + lienholder consents.

Educate your farm. A one-page explainer for ADU owners can generate listing calls months before they’re ready to convert. Make sure to check with your broker on advertising compliance.

Bottom line: AB 1033 turns some backyards into starter homes—but only in jurisdictions that opt in, and only when you clear the condo law hurdles. The agents who win here will be the ones who master the process (mapping, inspection, lender consent), package the disclosures cleanly, and set expectations early on financing and HOA realities. Check with legal counsel and your broker to make sure you are staying compliant and you’ll be the first call when your market’s homeowners decide their ADU is ready for the big leagues.

|

Real‑estate transactions live and die by what is written—and signed—in the contract. Yet nearly every deal, from a starter‑home purchase to a multimillion‑dollar commercial lease, must be tweaked Read more...

Real‑estate transactions live and die by what is written—and signed—in the contract. Yet nearly every deal, from a starter‑home purchase to a multimillion‑dollar commercial lease, must be tweaked after that first signature. That’s where two deceptively similar tools come in: the addendum and the amendment. Because the terms sound alike, many buyers, sellers, and even new agents mix them up—sometimes with expensive consequences.

This guide cuts through the confusion. You’ll learn the fundamental difference, see practical language examples, spot common pitfalls, and walk away knowing exactly which document to use, when, and why.

The Core Distinction: Adding vs. Altering

.table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

font-size: 16px !important;

}

th, td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

font-size: 16px !important;

}

th{

text-align: center !important;

}

@media(max-width:428px){

.table-responsive{

max-width: 100%;

overflow-x: scroll;

}

}

Tool

What It Does

One‑Sentence Analogy

Addendum

Supplements the contract by adding entirely new terms, conditions, or disclosures without touching existing text.

Like attaching a new appendix to a report.

Amendment

Modifies the contract by changing, deleting, or replacing language that is already there.

Like editing a paragraph in the report’s body.

Addendum Defined

An addendum (sometimes called a “rider” or “attachment”) is a separate, signed document that becomes part of the original agreement, but nothing in the original contract is struck, deleted, or replaced.

Analogy: You finished your book and later decide to add a bonus chapter—the original chapters stay exactly as written; you just hand readers an extra section.

Amendment Defined

An amendment rewrites part of the original agreement. You are altering the existing language—price, dates, contingencies, or even simple typos.

Analogy: You catch a typo in Chapter 3 of your book. Instead of adding a new chapter, you open the manuscript and correct that specific sentence.

When to Use Which: Practical Applications

Below are the most common scenarios you’ll encounter in both residential and commercial deals. For each, notice whether new material is added (addendum) or existing material is changed (amendment).

A. Addendum Scenarios & Examples

.table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

font-size: 16px;

}

th, td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

th{

text-align: center;

}

Scenario

Example Property Type

“Before” (excerpt)

Addendum Language (conceptual)

New contingency

Rural residence

Contract silent on septic system.

“This agreement is contingent on Buyer’s receipt and approval of a satisfactory septic inspection report on or before August 5.”

Personal property inclusion

Suburban home

Contract lists fixtures only.

“Seller shall include the following personal property at no additional cost: LG washer, LG dryer, and GE refrigerator (Model XYZ).”

Disclosure attachment

Pre‑1978 home

Contract mentions lead‑based paint but no form attached.

“Lead‑Based Paint Disclosure (EPA‑approved form) is attached hereto as Addendum A and incorporated herein.”

Lease pet clause

Apartment lease

Lease prohibits pets.

“Notwithstanding Paragraph 10, Tenant may keep one spayed cat under 15 lbs; Tenant assumes all liability for pet damage.”

Typical timing: Often drafted with the initial offer or immediately post‑acceptance (e.g., delivery of mandatory disclosures).

B. Amendment Scenarios & Examples

Scenario

Example Property Type

“Original Clause”

Amendment Language (conceptual)

Price change

Residential purchase

“Purchase Price: $500,000.”

“Paragraph 2 is hereby amended to state: ‘Purchase Price: $490,000.’”

Closing‑date extension

Vacant land

“Closing Date: July 30 2025.”

“Closing Date is amended to August 15 2025.”

Repair credit

Condo

“Seller to repair roof leaks.”

“Seller shall instead credit Buyer $7,500 at closing in lieu of repairs; Paragraph 12 is amended accordingly.”

Loan‑type switch

Single‑family home

“Buyer financing: FHA loan.”

“Paragraph 5 is amended to read ‘Conventional 30‑year fixed loan.’”

Scrivener’s error

Commercial lease

Suite number misstated as 320.

“Suite number corrected from 320 to 302; all other terms remain unchanged.”

Typical timing: After the contract is executed when inspections, financing, or negotiations reveal the need to alter agreed‑upon terms.

Quick‑Decision Flowchart – Addendum or Amendment?

Is the information completely new and not addressed anywhere in the contract?

Yes → Addendum

Are you changing, deleting, or replacing wording that already appears in the contract?

Yes → Amendment

Need to do both?

Use both documents (e.g., add a new contingency and extend closing).

Proper Formatting & Language Tips

Best Practice

Why It Matters

Reference the underlying contract by date, parties, and property address at the top of the addendum or amendment.

Prevents arguments over which agreement the change attaches to.

Number each addendum/amendment (e.g., “Addendum #1”).

Aids tracking when deal requires multiple modifications.

Use clear headings such as “Purchase‑Price Adjustment” or “Inspection Contingency Addendum.”

Improves readability for all parties and attorneys.

State the effective date (often the last dated signature).

Clarifies when obligations begin.

For amendments, quote the original clause before showing the revised language (or cite the paragraph number).

Reduces ambiguity over what is being altered.

Obtain signatures from every party to the contract (and their spouses if required by local law).

An unsigned modification is unenforceable.

Common Mistakes & How to Avoid Them

Using the wrong document: Adding a new contingency with an amendment may accidentally overwrite existing clauses.

Leaving blanks or ambiguous wording: Courts interpret vagueness against the drafter.

Missing deadlines: An addendum or amendment delivered after a contingency expires may be ineffective.

Relying on verbal agreements: In most states, real‑estate contracts must be in writing (Statute of Frauds).

Failing to attach required disclosures: Violations can trigger rescission rights or fines.

Pro Tip: Keep a running “contract log” noting each modification, date sent, date signed, and current key dates (closing, inspection, loan approval).

State‑Specific Variations

While the concepts of addendums and amendments are universal, forms and statutory disclosures vary:

California: The Residential Purchase Agreement (RPA) uses a “Contract Addendum” (CAR Form) for new terms and a separate “Amendment of Existing Terms” for changes; specific addenda are mandatory for HOA docs, Mello‑Roos, etc.

Texas: The Texas Real Estate Commission (TREC) publishes promulgated addenda (e.g., Third‑Party Financing Addendum) and employs a universal “Amendment to Contract” form.

New York: Attorneys often custom‑draft riders (addenda) at contract formation; later changes are typically handled via attorney letters that serve as amendments.

Always consult local forms and professionals to ensure compliance.

Key Takeaways

Addendum = Add. Amendment = Alter.

Use addendums to introduce brand‑new terms without disturbing the original text.

Use amendments to change terms that are already written.

Clear drafting, proper referencing, and obtaining all signatures are non‑negotiable.

Laws and standard forms differ by state—check locally.

Beyond your time in real estate school, understanding the difference between an addendum and an amendment gives you powerful leverage in negotiations and protects you from costly missteps. If you are a buyer, remember that before signing—or sending—either document, consult your real‑estate agent and, for complex or high‑value transactions, a qualified real‑estate attorney. With the right tool and sound advice, you’ll keep your deal on track and your interests safeguarded.

Love,

Kartik

|

Your Blueprint for Referrals and Repeat Business

The moment you receive your real estate license marks the beginning, not the end, of your professional journey. While our real estate school teaches Read more...

Your Blueprint for Referrals and Repeat Business

The moment you receive your real estate license marks the beginning, not the end, of your professional journey. While our real estate school teaches you the fundamentals of property law and transaction mechanics, the true art of building a career centered on client retention lies in what happens after the closing.

In today's competitive market, the most successful agents understand a fundamental truth: relationships are a form of currency. The cost of acquiring a new client can be five to seven times higher than nurturing an existing one. Yet many agents, caught in the endless cycle of chasing new leads, overlook the goldmine sitting in their past client database. This shift from transactional thinking to cultivating luxury client relationships isn't just good karma—it's innovative business that generates consistent real estate referrals, repeat transactions, and a personal brand that stands the test of time.

For newer agents fresh out of real estate school, developing this client-centric mindset early establishes the foundation for long-term success. Seasoned brokers will find advanced strategies here to deepen existing relationships, particularly within luxury markets where discretion and personalization are paramount.

Mastering Client Engagement: Tech-Powered, Human-Centric

Forget the old days of just holiday cards. Today's top agents blend cutting-edge tech with authentic human connection to create systematic, personalized client touchpoints that scale.

Develop a tiered communication rhythm. In the first 30 days post-closing, check in weekly. These aren't sales calls; they're genuine inquiries about their move, new home, or local recommendations. As time goes on, these touchpoints become less frequent but more valuable, shifting from problem-solving to relationship-building.

Modern CRM systems like Follow Up Boss, Chime, or HubSpot, supercharge this process. They use AI to analyze client behavior, predict needs, and suggest optimal contact times. These platforms segment your database by transaction type, property value, communication preferences, and even life events. Imagine your CRM alerting you that a past client's child is nearing college age—perfect for discussing downsizing or investment properties. Tech handles the remembering and organizing, freeing you to focus on the human connection.

The real magic is when high-tech efficiency meets high-touch authenticity. Your CRM prompts the outreach, but the message should feel like it's from a friend.

Send a handwritten note within 48 hours of closing—it speaks volumes in our digital world. Mark home purchase anniversaries not with a generic email, but with a personalized video message showing their home's appreciation.

Creating Value Beyond the Transaction

Your digital presence should position you as a trusted advisor and community connector, not just another agent flooding social media with listing photos. Think about what your past clients need and want to know. They're not shopping for homes anymore—they're living in them. They're wondering when to refinance, how to maximize their home's value, which local contractor won't overcharge them, and where to find the best pizza in their new neighborhood.

This is where your content strategy becomes crucial:

Social Media Excellence: Share seasonal home maintenance tips that save them from costly repairs. Spotlight the local coffee shop owner who remembers everyone's order, or the family-run hardware store that still offers personalized service. Celebrate community events and milestones. When you position yourself as a curator of local knowledge and lifestyle enhancement, you remain valuable long after the sold sign comes down.

Newsletter Mastery: Your monthly newsletter shouldn't read like a market report designed for economists. Instead, translate those statistics into stories your clients care about. Rather than simply stating that home values increased 8%, explain what this means for their family's wealth-building journey. Include practical guides like "Five Weekend Projects That Add $10,000 to Your Home Value" or "The Hidden Gems of [Neighborhood Name] Only Locals Know About."

Website as Resource Hub: Transform your website from a listing showcase into a comprehensive resource center. Create downloadable seasonal maintenance guides, maintain a vetted vendor directory, and publish neighborhood insights that keep past clients returning for valuable information.

The Art of Memorable Client Appreciation

Moving beyond generic closing gifts requires understanding what creates lasting impressions. That standard gift basket gets regifted or forgotten, but the client who loves cooking will remember the private chef who prepared a gourmet meal in their new kitchen. The wine enthusiast will talk for years about the sommelier-led tasting you arranged at their housewarming. The family with young children will be touched by the custom treehouse plans you commissioned for their backyard oak.

These thoughtful gestures extend beyond closing day. When you learn through your ongoing conversations that a client received a promotion, send congratulations. When their child graduates, take a moment to acknowledge the milestone. When they mention training for their first marathon, surprise them with a gift certificate to the local running store. These moments of recognition build emotional equity that no competitor can match.

Creating exclusive experiences amplifies this effect exponentially. Your annual client appreciation event shouldn't feel like a networking mixer—it should feel like a reunion of friends. Some agents host summer barbecues in local parks where clients' kids play together while adults swap renovation stories. Others organize holiday cookie decorating parties that become cherished traditions.

For luxury clientele, discretion is paramount. Ensure your outreach respects their privacy, providing value without intrusion. The bar for experiences rises accordingly: private art gallery tours with the curator, sunset yacht cruises, or exclusive wine harvest experiences at boutique vineyards. The key to these events isn't their extravagance—it's their authenticity combined with impeccable attention to privacy preferences.

Building Your Referral Engine

The most successful agents never have to ask for referrals—they create experiences so remarkable that clients naturally want to share them. However, there's an art to facilitating this process without appearing pushy or transactional.

The best moments for referral conversations arise organically during your regular touchpoints. When a client expresses gratitude for your help resolving a post-sale issue, that's your cue. When they mention at your summer barbecue that their coworker is house-hunting, that's your opportunity.

Here's a simple script that works: "Thank you so much for your trust in working with me. If anyone you care about mentions real estate—whether buying, selling, or just curious about the market—I'd be honored if you'd pass along my contact information. I'm never too busy for your referrals."

Make referring effortless by providing these tools:

Digital business cards they can text instantly

Pre-written introduction emails like: "I wanted to connect you with [Your Name], who helped us find our dream home. They made the entire process smooth and stress-free, and I think you'd appreciate their approach."

Social media templates for sharing experiences

QR codes linking to your testimonial page

When legal and ethical, some agents enhance referral relationships through thoughtful incentives that strengthen bonds rather than create obligations. Consider donating to a client's favorite charity in their name as a reward for successful referrals or as a way to provide exclusive experiences, such as tickets to local cultural events. The key is to ensure that any incentive feels like a natural extension of your relationship, not a transaction.

Becoming the Indispensable Advisor

The transformation from a transaction-focused agent to a trusted advisor occurs when you expand your value proposition beyond buying and selling. Offer annual home equity reviews that help clients understand their growing wealth. Provide market updates contextualized to their investment strategies. Connect them with resources for renovations, refinancing, or navigating real estate implications of significant life changes.

Sarah, a luxury agent specializing in equestrian properties, exemplifies this approach perfectly. When clients close on horse properties, she doesn't just hand over keys—she delivers custom stable signs featuring their property name and includes a year's membership to the local riding club. Her monthly "Saddle Up" newsletter has become a must-read in the equestrian community, featuring regional event calendars, seasonal property maintenance tips tailored to horse facilities, and spotlights on trusted veterinarians and trainers.

But Sarah's genius lies in her "Equestrian Services Directory"—a carefully vetted list of providers from farriers to fence contractors, all offering preferred rates to her clients. She introduces each client to relevant providers, hosts quarterly "Boots & Bourbon" networking events at a local ranch, and has positioned herself as the hub of the luxury equestrian real estate community.

The result?

Sixty percent of her business comes from referrals and repeat clients; she commands premium commissions, and she has built a list of potential clients who seek her out specifically.

Measuring What Matters

Success in relationship-based real estate isn't measured solely in transaction volume. Here's how to track what truly matters:

Referral Rate: Aim for 20-30% of new business from past client referrals. Track this through your CRM by tagging lead sources and running quarterly reports to monitor progress.

Client Lifetime Value (CLV): Calculate total revenue per client relationship using this formula: Initial transaction commission + repeat transaction commissions + referral-generated commissions. Most CRMs can automatically generate these reports.

Repeat Business Rate: Monitor the percentage of clients who complete multiple transactions with you. Set up annual reviews in your CRM to track this metric over time.

Engagement Metrics: Use email marketing platforms to track open rates (target 25%+), click-through rates, and event RSVPs. Tools like Mailchimp or Constant Contact can provide detailed analytics.

Net Promoter Score (NPS): Send quarterly surveys using tools like SurveyMonkey or Google Forms, asking: "On a scale of 1-10, how likely are you to recommend me to a friend?" Scores of 9-10 indicate strong advocates.

These metrics tell a story far more valuable than monthly sales figures. They indicate whether you're building a sustainable practice or just churning through transactions.

Your Path Forward

Your real estate license opens doors, but your relationships determine how far you'll walk through them. In an industry where lots of agents fail within five years, those who thrive understand that each closed transaction isn't an ending—it's the beginning of a potentially lifelong professional relationship.

The lessons from our real estate school lay the foundation, but applying these relationship strategies truly builds the skyscraper of your career. This approach requires a fundamental mindset shift. Instead of viewing your database as a list of past clients, see them as your professional community. Instead of measuring success by the number of new leads generated, measure it by the relationships deepened. Instead of chasing the next transaction, invest in creating such remarkable experiences that transactions naturally follow.

The choice is yours: continue the exhausting chase for cold leads, or invest in the warm relationships already in your sphere. Your future success in real estate isn't determined by how many people you meet—it's defined by how many relationships you nurture.

Take a moment today to revisit your past client list. Identify five clients to reconnect with this week—perhaps send a handwritten note, share a relevant market update, or check in on how they're enjoying their home. Your future business depends on these small but significant actions.

Love,

Kartik

|

1 | Why Video Now?

Video: A Game-Changer for New Real Estate Agents

In today's attention-driven market, video is crucial for new real estate agents. Social media algorithms favor video Read more...

1 | Why Video Now?

Video: A Game-Changer for New Real Estate Agents

In today's attention-driven market, video is crucial for new real estate agents. Social media algorithms favor video content, with short real estate clips often getting more than twice the engagement of simple still images.

More importantly, video helps build trust. When prospective clients can see your face and hear your voice, it significantly shortens the sales cycle. This is especially beneficial for newer agents looking to establish credibility quickly. Instead of just relying on written advice or static images, showcasing properties, explaining market trends, or sharing client testimonials through video can rapidly build rapport and confidence with potential buyers and sellers.

2 | Before You Hit Record

The best lens in the world can’t fix a fuzzy objective. Before you even open the camera app, answer three questions and tape the answers to your tripod:

Defining Your Video Strategy as a New Real Estate Agent

Before you even hit record, taking a few minutes to plan your video will save you hours in editing and wasted ad spend. Here's a quick framework tailored for new real estate agents:

.why-video-now-one-table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-one-table th,.why-video-now-one-table td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-one-table th{

text-align: center;

}

Question

Example Answer for New Agents

Who is the target viewer?

First-time homebuyers in your local area (e.g., Rancho Cucamonga)

What action should they take?

Schedule a free consultation or attend your next open house

How will you measure success?

New client inquiries or sign-ups for your open house

3 | Pre-Production Toolkit for New Real Estate Agents

Planning is where your creative ideas meet practical research. For new real estate agents, a solid pre-production workflow is essential to create effective video content without breaking the bank. Here are some tools to help you get started:

AnswerThePublic (freemium): Use this tool to uncover common questions your target audience is searching for, such as "What do I need to know about buying my first home in Rancho Cucamonga?" Incorporating these questions directly into your video scripts will ensure you're addressing your viewers' needs.

ChatGPT or Google Gemini (free to paid tiers): These AI tools can help you draft compelling video hooks, YouTube titles, and calls-to-action that align with your brand's voice. They can save you significant time in crafting engaging copy.

Teleprompter apps (free to $29): Apps like PromptSmart or Teleprompter Pro scroll your script automatically and even pause when you do, making it easy to deliver your lines naturally and avoid that "reading off a cue card" look. This is especially helpful when you're just starting out and want to appear confident and polished on camera.

Simple Storyboard Template: Before you shoot, sketch out your video plan. A basic template with columns for "Scene #," "Location," "Shot Size," "Audio Notes," and "B-roll ideas" can keep you organized. While offering a PDF opt-in is great for brokerages, for a new agent, simply using this as an internal planning tool will ensure a smoother shooting and editing process.

By using these tools, you'll be well on your way to creating professional and impactful videos that help you connect with clients and grow your real estate business. What kind of video are you thinking of creating first?

4 | Filming Toolkit

Picking Gear by Growth Stage

.why-video-now-two-table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-two-table th,.why-video-now-two-table td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-two-table th{

text-align: center;

}

Category

Starter (≤ $50)

Growth (≤ $300)

Pro (> $300)

Camera

Latest smartphone

Sony ZV‑1

Full‑frame mirrorless (Canon R8)

Stabilization

Mini tripod

DJI Osmo Mobile SE

Zhiyun Crane M4

Lighting

12″ ring light

Two‑light LED kit

Aputure Amaran 60x

Audio

BOYA BY‑M1 lav

Rode Wireless GO II

Sennheiser AVX

Drone¹

—

DJI Mini 3 Pro

DJI Air 3

¹Always verify Part 107 licensing requirements; see Section 6 for compliance.

Why tiers? Because the last thing a new agent—or a real estate‑license student moonlighting as a creator—needs is a $4,000 rig before the first transaction closes. Start where you are and upgrade only when video revenue or referral traffic—not gear envy—warrants it.

5 | Post‑Production Toolkit

Editing is where raw footage becomes a trust‑building asset for your brokerage or real estate school:

iMovie (Mac) or Clipchamp (Windows): Drag‑and‑drop simplicity for “just sold” reels.

CapCut Desktop: Auto‑generates captions; exports ratio presets for every social network.

Descript: Edit video by editing text—delete filler words with a keystroke.

Canva Pro: Batch‑create on‑brand thumbnails (1280 × 720) that match the color palette of your real estate school or brokerage.

Caption everything. Captions boost watch‑time by ~12 % and help satisfy ADA accessibility guidelines.

6 | Compliance & Legal Must‑Knows

.why-video-now-three-table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-three-table th,.why-video-now-three-table td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-three-table th{

text-align: center;

}

@media(max-width: 428px){

.table-wrapper{

max-width: 100%;

overflow: scroll;

}

}

Topic

Common Mistake

Quick Fix

Drone footage

Flying over people without an FAA Part 107 license

Pass the $175 Remote Pilot test or hire a licensed pilot

Music

Using Top‑40 tracks

Subscribe to royalty‑cleared libraries such as Artlist or Epidemic Sound

Occupied properties

No written release from sellers

Use a standard location‑release form

Fair‑housing language

Saying “family neighborhood”

Stick to facts: “three‑bed, two‑bath near Lincoln Park”

A robust compliance framework not only protects your brokerage but also models best practices to your real‑estate‑license students.

7 | Distribution, SEO, & Accessibility

Where to Host?

.why-video-now-four-table{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-four-table th,.why-video-now-four-table td{

border: 1px solid gray !important;

border-collapse: collapse !important;

margin: 10px !important;

padding: 10px !important;

}

.why-video-now-four-table th{

text-align: center;

}

Platform

Pros

Cons

YouTube

Unmatched reach and Google SEO benefits

Competing ads and suggested videos

Vimeo

Clean, brandable player; swap files without changing URLs

Monthly subscription

Wistia

Heat‑maps and built‑in lead‑capture forms

Higher cost

Five‑Point SEO Checklist

Front‑load your keyword: e.g., “Video marketing tips — Adhi Schools’ real estate license school.”

500‑character description peppered with local terms—“Los Angeles real estate license,” “Orange County broker.”

Chapters: 00 : 00 Intro, 00 : 45 Pre‑production, etc.

Tags: “real‑estate video,” “real estate license,” “real estate school.”

SRT captions: Improve accessibility and Google indexing.

8 | Measuring Success: Analytics in 10 Minutes

Metric

Where to Find

Improvement Tip

Audience Retention

YouTube Studio → Content tab

Insert B‑roll at the 30‑second drop‑off

Click‑Through Rate

YouTube Studio → Overview

A/B‑test thumbnail copy

Leads Generated

Google Analytics 4 + UTM links

Give each video its own landing page so ROI is unmistakable

Allocate ten minutes every Friday to review these metrics. Then create one small experiment—new title, fresh hook, different thumbnail—and implement it before Monday.

9 | Advanced Gear Roadmap

Once your video channel starts generating predictable business—or when your real estate school wants to film premium coursework—consider:

A motorized slider (~$499) for buttery parallax kitchen shots.

A Godox SL60W key light with soft‑box for cinematic interviews under $300.

A Blackmagic Pocket 6K body when annual marketing revenue exceeds $250 k; shoot in BRAW to unlock professional color‑grading latitude.

10 | Emerging Formats to Watch

Vertical shorts (Reels, TikTok): Fifteen‑second teasers that funnel viewers to your full YouTube tour.

Live‑streamed open houses: Field buyer questions in real time; archive the replay to compound reach.

Interactive 3D tours: Pair a Matterport scan with voice‑over for an “always‑open” showing.

AI‑assisted clipping: Premiere Pro’s Text‑Based Editing feature finds quotable moments and auto‑exports them as micro‑content.

These formats are already part of curriculum refreshes at ADHI Schools.

11 | Key Takeaways for New Real Estate Agents

To truly leverage video in your burgeoning real estate career, keep these core principles in mind:

Lead with strategy, not gear. Don't get caught up in buying the most expensive camera. A clear plan for what you want to achieve and who you're speaking to is far more important than 8K resolution. Your smartphone is likely more than capable of producing excellent content.

Audio and lighting beat high resolution every time. Even if your video isn't shot in cinematic quality, clear audio and good lighting make your message understandable and professional. Invest in a simple lavalier microphone and understand how to use natural light or basic ring lights to your advantage.

Stay compliant. This is crucial for new agents. Be mindful of regulations around drone usage (especially in areas like Rancho Cucamonga), copyright for music, and ensure all your language adheres to fair housing guidelines. Ignorance is not an excuse for non-compliance.

Optimize every upload around your target audience's search terms. For instance, if you're showcasing homes in Rancho Cucamonga, use keywords like "Rancho Cucamonga real estate," "homes for sale Rancho Cucamonga," or "first-time homebuyer guide Rancho Cucamonga" in your video titles, descriptions, and tags. Think about what your ideal client is typing into search engines.

Measure and iterate. Don't just post and forget. Pay attention to your video analytics. Which videos get the most views? Which ones lead to inquiries? Learn from what works and what doesn't, and continuously refine your approach. This iterative process is key to long-term success in real estate video marketing.

Ready to Level Up?

This guide provides a practical roadmap for new real estate agents, taking you from initial concept to analyzing your video's performance. Whether you're focused on securing your first listing, building your personal brand, or simply looking to connect with potential clients, understanding video strategy is essential in today's market.

For more in-depth coaching, editable templates, and strategies to help you start filming faster and closing sooner, consider exploring specialized marketing resources tailored for new agents. These resources can accelerate your growth and establish your presence in the competitive real estate landscape.

Love,

Kartik

|

Embarking on a career in real estate is an exciting venture, but the path to success can sometimes feel overwhelming for new agents. As you navigate the complexities of lead generation, marketing, transactions, Read more...

Embarking on a career in real estate is an exciting venture, but the path to success can sometimes feel overwhelming for new agents. As you navigate the complexities of lead generation, marketing, transactions, and client management, you'll undoubtedly encounter two common terms: real estate coaching and real estate training. While often used interchangeably, they offer distinct benefits and cater to different needs. Understanding the nuances between the two is crucial for new agents looking to invest in their professional development wisely.

Real Estate Training: The Foundation of Knowledge

Think of real estate training as the classroom education for your real estate career. It's about acquiring fundamental knowledge, learning industry best practices, and understanding the "how-to" of the business.

Key characteristics of real estate training:

Structured Curriculum: Training programs typically follow a predefined curriculum, covering topics like contracts, agency relationships, ethics, marketing strategies, negotiation tactics, CRM software usage, and local market trends.

Broad Applicability: The information provided in training is generally applicable to a wide range of agents, regardless of their individual strengths or weaknesses.

Focus on Information Transfer: The primary goal is to impart knowledge and skills. This often involves lectures, webinars, workshops, manuals, and online modules.

Group Setting: Training can occur in a group setting, allowing for peer learning and questions.

Often Transaction-Focused: Many training programs focus on the mechanics of a real estate transaction, from listing to closing.

Examples: Pre-licensing real estate courses, broker-provided onboarding programs, real estate software tutorials, continuing education classes, and workshops on specific topics like social media marketing or and workshops on specific topics like open house strategies.

Who benefits most from real estate training?

New agents who are still learning the ropes, need to understand the legal and ethical frameworks of the industry, or require instruction on specific tools and processes will find training invaluable. It provides the essential building blocks for a successful career. Even experienced agents can benefit from training if it is timely and relevant to current events in the real estate industry.

Real Estate Coaching: Personalized Guidance for Growth

Real estate coaching, on the other hand, is meant to be a more personalized and iterative process focused on helping agents apply their knowledge, overcome specific challenges, and achieve their individual goals. It's less about what to do and more about how to do it effectively in the unique situation of an individual agent.

Key characteristics of proper real estate coaching:

Individualized Approach: Coaching is tailored to the agent's specific needs, strengths, weaknesses, and aspirations.

Action-Oriented: Coaches work with agents to develop actionable plans, set measurable goals, and hold them accountable for their progress - This personal accountability piece is an important distinction.

Focus on Application and Mindset: Coaching helps agents translate theoretical knowledge into practical application, address limiting beliefs, improve time management, and develop a winning mindset.

Problem-Solving and Strategy: Coaches help agents troubleshoot challenges, refine their strategies, and identify opportunities for growth.

Ongoing Support and Accountability: Coaching relationships are typically viewed as ongoing, with regular check-ins and performance reviews.

Examples: One-on-one sessions with a real estate coach, accountability partnerships, and personalized business planning sessions.

Who benefits most from real estate coaching?

New agents who have a grasp of the basics but are struggling with implementation, feeling stuck, or looking to accelerate their growth will benefit immensely from coaching. It's for those who want to refine their approach, develop stronger habits, and achieve higher levels of success.

A Word of Caution

Real estate coaching can turbocharge your career—but only if your coach has actually fought in the trenches. Beware of self-proclaimed 'gurus' who’ve never closed a deal themselves. These charlatans often dazzle with slick marketing and empty promises of overnight success, peddling textbook strategies they’ve never tested.

Real estate isn’t a theoretical playground—it’s a fast-paced, cutthroat industry defined by shifting markets, high-stakes negotiations, and emotionally charged clients. A coach without skin in the game can’t grasp these realities, leaving you with generic advice that crumbles under real-world pressure.

Steer clear of upselling imposters. If they haven’t survived a market crash, outmaneuvered a bidding war, or rebuilt their pipeline from scratch, their guidance is worthless. Demand proof of their sales track record: closed transactions, client testimonials, and battle scars.

Your career isn’t a lab experiment. Invest in coaches who’ve done it, not just taught it.

The Interplay: Why Both Are Important

It's not a matter of choosing one over the other; rather, real estate training and real estate coaching are complementary forces that contribute to a well-rounded and successful real estate career.

Training provides the knowledge base. You can't effectively implement strategies if you don't understand the fundamentals.

Coaching helps you apply that knowledge effectively. It bridges the gap between theory and practice, helping you navigate real-world scenarios.

For new agents, a common progression might look like this:

Initial Training: Complete pre-licensing courses and broker-provided onboarding to gain foundational knowledge and skills.

Early Coaching: Once you've entered the field, consider engaging a coach to help you set up your business, generate your first leads, and overcome initial hurdles.

Ongoing Training: Continue to attend workshops and continuing education to stay updated on market trends, legal changes, and new technologies.

Ongoing Coaching: As your business evolves, a coach can help you scale, refine your niche, improve your sales process, and navigate market shifts.

Making the Right Choice

When deciding between training and coaching (or how to incorporate both), consider the following:

Your current knowledge level: Are you completely new, or do you have a basic understanding?

Your specific challenges: Are you lacking fundamental knowledge, or are you struggling with implementation or mindset?

Your learning style: Do you thrive in structured learning environments, or do you prefer personalized guidance?

Your budget: Training programs often have a fixed cost, while coaching can be an ongoing investment.

By understanding the distinct roles of real estate coaching and real estate training, new agents can strategically invest in their professional development, build a strong foundation, and accelerate their journey towards a thriving career in real estate.

Love,

Kartik

|

Congratulations—you completed the real estate license courses, passed the real estate exam and landed your license! Now the real work begins: prospecting, showings, more than a little paperwork, and Read more...

Congratulations—you completed the real estate license courses, passed the real estate exam and landed your license! Now the real work begins: prospecting, showings, more than a little paperwork, and a CRM that won't fill itself. Trying to do it all solo is the fastest route to 14-hour days.

The fix?

Delegate smart, even if your business is getting off the ground.

You might think, "I just got my license, and now I need to think about delegation?" The answer is a resounding "yes!" While our real estate license school focused on the essential knowledge to get you started, mastering the art of delegation early on is crucial for scaling and long-term growth as a businessperson.

Delegation doesn’t necessarily mean that you have a huge team - it's really about establishing efficiency right away.

Key Takeaways

Delegate Early, Not Later: Freeing up hours lets you close your first few deals faster—without the late-night inbox grind.

Start Simple: Begin by offloading administrative tasks or transaction coordination.

Leverage Cloud Tools: Simple online platforms can streamline communication and task management from the start.

Why Delegation is Your New Best Friend (Even as a Rookie Agent)

Your plate is likely full of learning the ropes: familiarizing yourself with the MLS, practicing your sales pitch, and getting comfortable with whatever CRM you have chosen. If every single administrative detail bogs you down, you'll burn out before closing your first few deals. Delegation, even in its simplest forms, means strategically offloading tasks so you can focus on revenue generating activities.

Focus on Client Connections: While our real estate license school taught you the legalities, remember that genuine client relationships are built on time and attention.

Hone Your Sales Acumen: The more you focus on lead generation, showing properties, and negotiating, the faster you'll build expertise and finalize transactions.

Build a Sustainable Business: Instead of just surviving, you build your foundation for consistent growth.

Delegation isn't just about handing things off; it's about innovative task management to ensure everything gets done accurately and efficiently, allowing your business to flourish.

Starting Smart: What to Delegate First

Even as a new agent, you can start identifying tasks that, while necessary, might be consuming valuable time you could be using to connect with potential clients or learn more about the market. Think about the areas that might be slowing you down:

Top Time-Drains to Delegate First

Early Transaction Prep: Even before a deal is fully underway, paperwork and coordination can be time-consuming.

Basic Marketing: Setting up social media posts, sending introductory emails, and creating simple flyers.

Consider tasks that are repetitive or don't require your direct, licensed expertise.

Your First Support System: Who to Consider

You're not ready for a whole team yet, but considering where your biggest time drains are will help you decide if and when to bring in support.

Rule of thumb: Once you're juggling ≥5 active buyers or your first two listings, you're ready for at least five virtual assistant hours/week.

Considering an Administrative Assistant (Part-Time/Virtual)

If your calendar is a mess, your inbox is overflowing, or you're spending too much time on data entry, even a few hours a week from a virtual administrative assistant could be a game-changer. Typical hourly rates for a virtual assistant are reasonable depending on where they are located.

They can handle:

Managing emails and phone inquiries.

Scheduling appointments and organizing your calendar.

Basic data entry and CRM maintenance.

Exploring a Real Estate Transaction Coordinator (Part-Time/Per Transaction)

Once you start getting escrows going, you'll quickly realize the sheer volume of paperwork and deadlines. A transaction coordinator (TC) specializes in this, even on a per-transaction basis. A TC typically charges around $350−$450 per deal. They can be invaluable for: Managing contracts, disclosures, and legal documents.

Ensuring all deadlines are met.

Communicating with lenders, title companies, and other parties.

If you go back 20 years the concept of a transaction coordinator wasn’t as wide spread as it is today. The thought was that agents should instead handle their first few deals themselves. Working every step—contract, disclosures, deadlines, contingencies, and escrow—gives them real-world insight no classroom can match. That hands-on immersion sharpens problem-solving, reveals common pitfalls, and builds confidence. After running a couple of transactions solo, they’ll have the practical know-how to supervise a TC effectively and deliver truly informed service to clients.

Work with your broker or manager to determine the right path for your first few deals.

Clear Expectations: Even for a simple task, be clear about what to do.

Finding Help: Look for local college students seeking internships or explore online platforms for virtual assistants. Networking with other agents might also reveal good recommendations.

Basic Onboarding: When you hire someone, even for a limited role, clearly explain your business, your processes, and what you expect. A simple checklist of their responsibilities can go a long way.

Tools to Make Delegation Easier

You don't need fancy software to start. Simple tools can help you manage tasks and communicate effectively:

Your CRM: Use your CRM to track client interactions and set follow-up reminders. Many CRMs have basic task management features.

Shared Documents/Cloud Storage: Tools like Google Drive or Dropbox can help you share documents and keep everything organized for anyone assisting you.

Simple Automation: Even setting up automated email responses for basic inquiries can save you time.

As you grow, you might look into more specialized task management tools, but for now, focus on what helps you keep things organized. Having clear, written steps for everyday tasks (Standard Operating Procedures or SOPs) is also constructive, even if they're just notes for yourself.

Mini SOP Example:

New Lead Intake Process (5 steps, 10 min total):

Receive Lead: Check email/CRM for new lead notifications.

Initial CRM Entry: Input name, contact info, lead source, and initial notes.

Automated Welcome Email: Trigger pre-written welcome email from CRM.

Calendar Invite: Schedule the initial call/meeting on the agent's calendar.

Task Assignment: Create a follow-up task for an agent in CRM.

Developing Your Support (and Yourself!)

Even with a small amount of delegated work, consider it a partnership.

Learn and Grow Together: Encourage whoever is helping you to learn more about the real estate industry. Your success is their success.

Feedback is Key: Provide clear and constructive feedback. This helps them improve and ensures tasks are completed to your standards.

Daily Focus: Even for a new agent, creating a "Daily Action Checklist" helps you stay focused on revenue-generating activities, knowing that other tasks are being handled.

A daily action checklist is crucial for new real estate agents because it maintains focus on revenue-generating activities, preventing distraction by administrative tasks. By knowing other responsibilities are delegated, agents can prioritize client interactions, lead generation, and showings. This structured approach builds discipline and efficiency, ensuring consistent progress toward closing deals. Ultimately, it maximizes productivity during a critical learning phase, establishing habits essential for long-term success.

The "Admin" Side of Having Help

Even for small engagements, think about:

Compensation Models: How will you compensate them? Hourly? Per task?

Legal Considerations: For very small, casual engagements, it might be simple, but as you grow, you'll want to understand the difference between independent contractors and employees. This is something you'll learn more about as your business expands.

Trusting the Process

As a new agent, wanting to control every detail is tempting. However, the essence of delegation is to train someone on a task and then trust them to do it. This frees you up to focus on what you're truly licensed to do: connect with clients, show properties, and negotiate deals.Your real estate license was the first step. Mastering delegation, even in its earliest stages, is how you truly begin to build a successful and sustainable real estate career. Don't wait until you're overwhelmed; start thinking about how to work smarter from day one.

Love,

Kartik

|

California dreaming? Suppose your dreams involve navigating the exciting world of real estate and helping people find their perfect rental haven. In that case, a career as a property manager in Read more...

California dreaming? Suppose your dreams involve navigating the exciting world of real estate and helping people find their perfect rental haven. In that case, a career as a property manager in California might be your calling! With a booming rental market, diverse properties (from beachfront bungalows to chic city apartments), and a dynamic landscape of laws and regulations, California offers a unique and rewarding experience for property management professionals.

But hold on! Before you jump headfirst into showing properties and collecting rent, let's break down what it really takes to thrive as a property manager in the Golden State. This guide will be your roadmap, covering everything from licensing and essential skills to the quirks of the California market and the tech tools that'll make your life easier.

Licensed vs. Unlicensed: Finding Your Path

To begin, it's important to understand California property management licensing. Your role will determine whether you need a real estate license or not.

Licensed property managers hold a real estate license, which opens doors to a broader range of responsibilities and higher earning potential. Consider negotiating leases, collecting rent, and even representing clients in property sales. It's like having a VIP pass to the California real estate scene!

On the other hand, unlicensed managers might be working as a resident property manager, for example. Alternatively, they may be working as a w2 employee at a large apartment complex. Maybe they are an assistant to a licensed property manager and handling administrative tasks like coordinating maintenance. They're essential team members, but they must work under the supervision of a licensed broker. Think of it as being the Robin to a licensed Batman!

The Journey to Becoming a Licensed Pro

Ready to take the plunge and get your real estate license? Here's the lowdown:

Check the Basics: Make sure you're at least 18, have a high school diploma or equivalent, and are legally allowed to work in the U.S. (No surprises here!)

Hit the Books: It's time to dive into the world of real estate! Enroll in an accredited real estate school like ADHI Schools and complete the required coursework. You'll cover topics like real estate principles and practices and even choose an elective (hint: Property Management is excellent!).

Conquer the Exam: Once you've mastered the fundamentals, it's time to prove your knowledge. The California real estate license exam will test your understanding of national and state-specific laws, so study hard and utilize practice tests to boost your confidence.

Find Your Brokerage: Freshly licensed and ready to roll? Not so fast! In California, licensees must partner with a licensed broker who should be providing valuable mentorship, legal oversight, and a chance to learn the ropes from seasoned professionals.

Level Up with Certification (Optional but Recommended): Want to stand out? Consider earning a Property Management Certification from the California Association of Realtors (CAR) or the Certified Property Manager (CPM) designation from the Institute of Real Estate Management. It's not mandatory, but it adds serious credibility to your name and demonstrates your commitment to excellence.

Mastering the Property Management Game in California

Now that you've sorted out the licensing let's discuss the skills you'll need to succeed in the California market.

Marketing Maestro: California's rental market is competitive! You'll need to be a marketing whiz to attract tenants. Leverage online platforms like Zillow, social media, and even good old-fashioned networking to showcase your properties beyond basic listings.

Tenant Whisperer: Building strong relationships with tenants is key. Be responsive, approachable, and proactive in addressing their concerns. Remember, happy tenants = happy landlords!

Financial Guru: You must be comfortable with numbers, from collecting rent to managing budgets. Utilize property management software to streamline accounting tasks and provide transparent financial reports to owners.

Legal Eagle: California has a unique set of laws and regulations, including rent control (AB 1482), eviction rules, and security deposit limits. Stay informed and ensure your practices comply with all applicable laws.

Tech-Savvy: Embrace technology to boost efficiency. Property management software like AppFolio or Buildium can automate tasks, improve communication, and keep you organized.

Navigating the California Rental Landscape

California's rental market is as diverse as its landscape. Each region has quirks, from bustling city centers with sky-high rents to laid-back beach towns with seasonal demand.

Market Trends: Stay updated on rental trends in your area. For example, you might encounter fierce competition for units and strict rent control policies in San Francisco. In contrast, a beach town might experience seasonal fluctuations in demand.

Key Laws: Familiarize yourself with California-specific laws like AB 1482 (rent caps), eviction rules, and security deposit limits. These regulations can significantly impact your day-to-day operations.

Building Your Property Management Empire

Are you dreaming of running your own property management company? Here's how to get started:

Legal Foundation: In California, you'll typically need to form a corporation to operate a property management company. Make sure you obtain all necessary licenses and permits.

Operational Excellence: Set up efficient systems for rent collection, maintenance requests, and tenant communication. Invest in reliable property management software to streamline your workflow.

Client Acquisition: To attract clients, build a professional website, leverage social media, and network with real estate agents. Offer competitive rates and exceptional service to build a strong reputation.

FAQs: Your Burning Questions Answered

Q: Do I need a real estate license to manage properties in California?

A: It depends! If you're involved in activities like negotiating leases or handling rent, then yes, a license is mandatory. However, unlicensed individuals can perform limited tasks that do not require a real estate license.

Q: What's the average salary for a property manager in California?

A: Salaries can vary based on experience, location, and the types of properties you manage. However, you can expect to earn a comfortable living, with the average salary ranging from $68,000 to $85,000 per year. Major cities like San Francisco and Los Angeles often offer higher earning potential.

Q: Is the Property Management Certification (PMC) or Certified Property Management (CPM) designation essential?

A: While not required, the PMC from CAR can give you a competitive edge. It demonstrates your expertise and commitment to professional development, which can attract clients and employers.

Q: Can I manage short-term rentals like Airbnb in California?

A: Absolutely! However, local regulations regarding short-term rentals can vary significantly. Ensure you research and comply with your area's applicable permits and restrictions.

The Bottom Line: A Rewarding Career Awaits

Becoming a successful property manager in California requires dedication, knowledge, and a passion for real estate. Following the steps outlined in this guide, mastering essential skills, and staying informed about the ever-evolving California market, you can build a thriving career and help people find their perfect homes. So, are you ready to take on the challenge? The Golden State awaits!

Love,

Kartik

|

Why Understanding Market Indicators Matters

Want to excel as a real estate agent? Mastering market analysis is essential, and it's a skill you can start developing now, even while you're still Read more...

Why Understanding Market Indicators Matters

Want to excel as a real estate agent? Mastering market analysis is essential, and it's a skill you can start developing now, even while you're still in real estate school. Understanding market trends empowers you to advise clients effectively, price properties accurately, and anticipate market shifts. This guide breaks down the key indicators—median and average home prices, days on market (DOM), inventory levels, interest rates, foreclosure rates, and the absorption rate—providing clear explanations and practical examples. I’ll show you why a holistic approach to market analysis is crucial and how local conditions and seasonality influence these metrics. By the end, you'll have the knowledge and confidence to navigate any market.

Median vs. Average Home Price

Median Home Price:

The median home price is the middle price of all homes sold in a particular area during a given time.

For example, if five homes sold for:

$200,000

$220,000

$250,000

$600,000

$700,000

The median is $250,000 (the one in the middle).

The median, being less affected by outliers, is a reliable measure when there are a few very expensive or very cheap homes that could make the average less accurate.

Average Home Price:

To find the average home price, you simply add up all the sold home prices and divide by the number of homes. Using the same prices above, the total is $1,970,000. Divide that by five, and you get an average of $394,000.The average, while useful for spotting general trends, can be heavily skewed by extremely high or low prices, making it less reliable in such cases.

What These Prices Tell Us:

If median and average prices are rising, it often means home values are going up. If they’re falling, it might mean the market is slowing down.

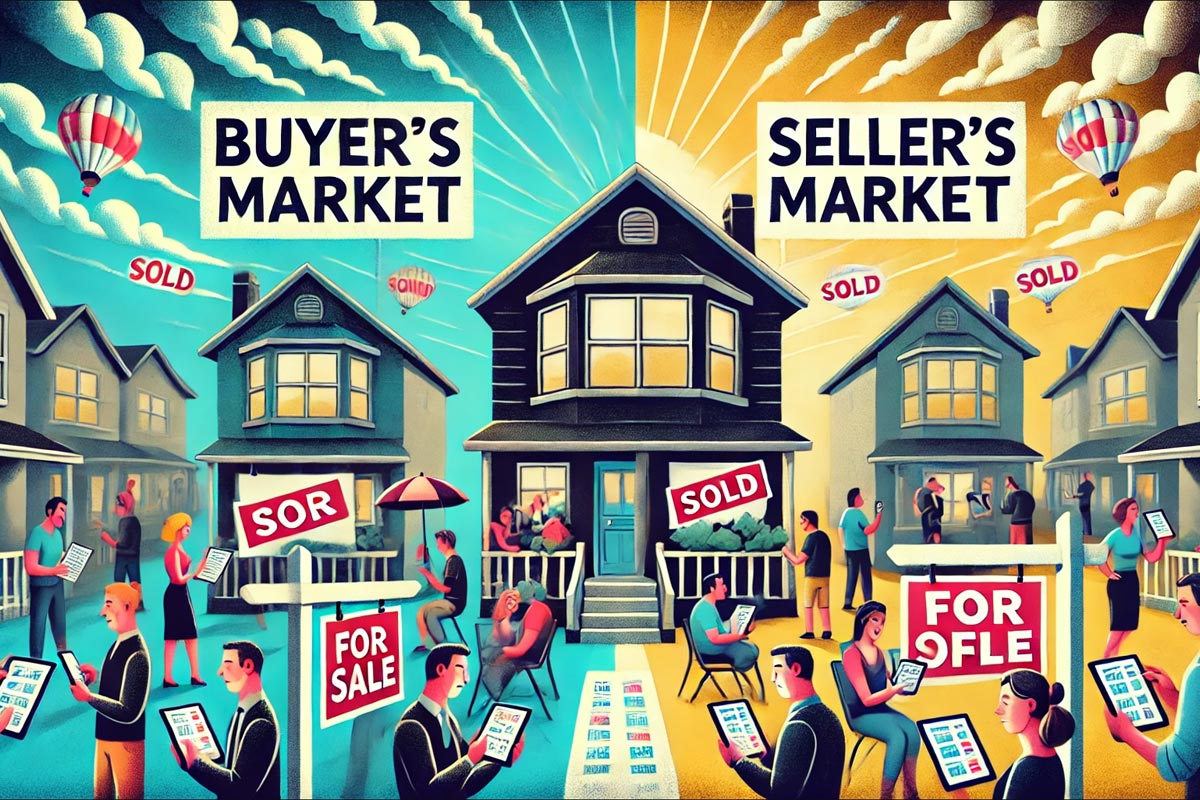

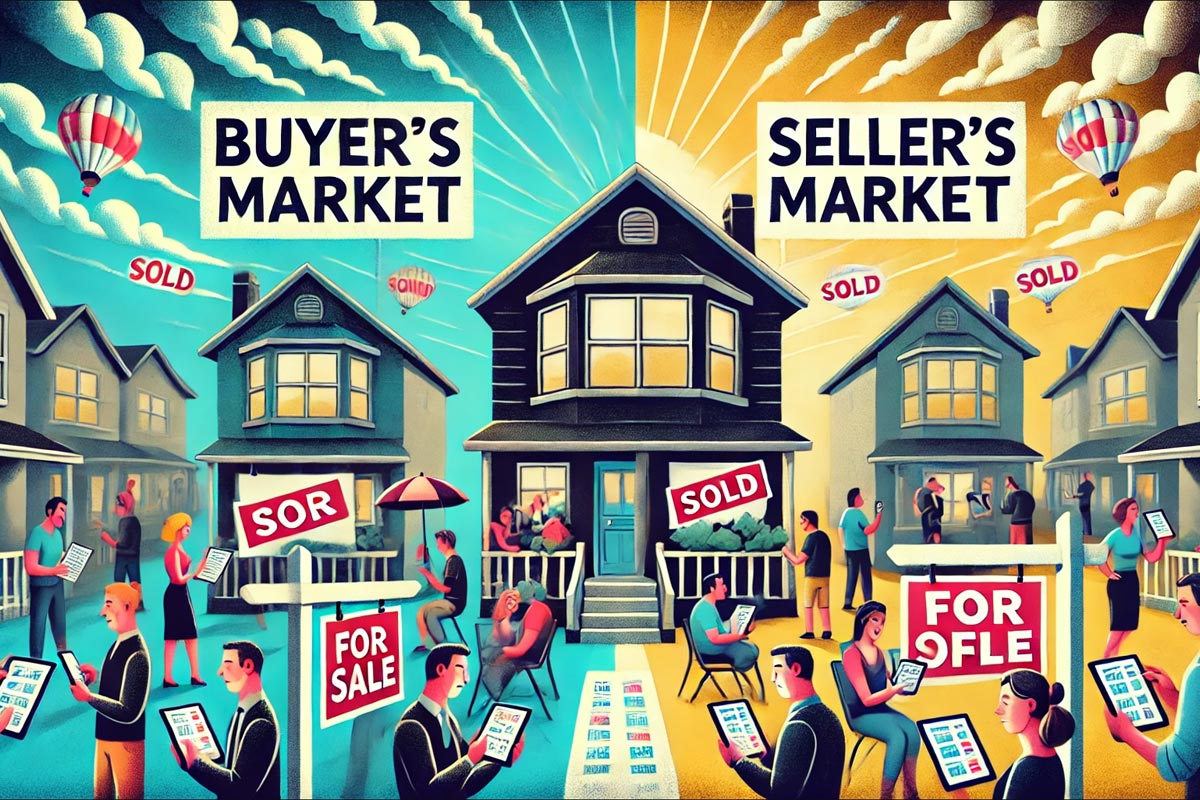

Days on Market (DOM)

Days on Market (DOM) measures how long a home takes to sell.

Short DOM (under 30 days): Suggests a hot market with many interested buyers. This is often called a seller’s market because sellers have the upper hand.

Medium DOM (30-60 days): A balanced market where buyers and sellers have similar power.

Long DOM (60+ days): Suggests a more extraordinary market with fewer buyers. This is often called a buyer’s market because buyers have more choices and bargaining power.

Inventory Levels (Months’ Supply of Inventory)

Ever wondered how long it would take to sell all the homes on the market if no new ones were listed? That's what a month's supply of inventory tells us.

How to Calculate:

Months’ Supply = (Number of Homes for Sale) ÷ (Number of Homes Sold per Month)For instance, if there are 600 homes for sale and 200 sell each month, you can easily calculate the months’ supply as 600 ÷ 200 = 3 months, giving you a clear picture of the market conditions.

Low Inventory (Under 4 Months): Seller’s market.

4-6 Months: Balanced market.

Over 6 Months: Buyer’s market.

Interest Rates

Interest rates affect how much it costs to borrow money to buy a home.

Low Interest Rates: More people can afford homes, so demand usually goes up.

High Interest Rates: Fewer people can afford homes, so demand usually slows down.

The Federal Reserve’s policies can influence these rates, so it’s smart to keep an eye on their announcements.

Foreclosure Rates

Foreclosure rates tell us how many homes are being taken back by lenders because their owners cannot pay their loans.

If foreclosures are high, it can mean that the economy is struggling, and home prices might drop because many distressed properties hit the market.

Foreclosure data can be found on local government websites, local MLS systems, or online real estate data providers.

Absorption Rate

The absorption rate shows how fast homes are selling in a certain area.

How to Calculate: Absorption Rate (%) = (Number of Homes Sold in a Given Period ÷ Number of Homes Available) × 100

For example, if 100 homes are for sale and 20 sell in one month, the absorption rate is (20 ÷ 100) × 100 = 20%.

A higher absorption rate means homes sell quickly (seller’s market), while a lower rate means they sell slowly (buyer’s market).

Seasonality: How the Time of Year Affects Indicators

Real estate activity often changes with the seasons.

Spring and Summer:

These seasons are a hotbed for real estate activity. Many buyers are on the lookout for homes when the weather is pleasant and before the new school year begins. This surge in demand often results in shorter DOM and escalating prices.

Fall and Winter: These seasons bring a shift in real estate dynamics. With fewer buyers in the market due to colder weather and holiday distractions, homes may take longer to sell. Prices, in turn, tend to remain stable or experience a slight dip.Understanding how seasonality affects your local market is not just a skill, it's a responsibility. It can help you advise clients on the best time to list or buy a home, ensuring they make the most informed decisions.

Looking at Indicators Together: Two Scenarios

Relying on one number can be misleading. By using multiple indicators, you get a clearer picture.