Failing the California real estate exam can feel confusing and discouraging—especially if you studied hard and thought you were prepared. After teaching thousands of students at ADHI Schools, I can tell Read more...

Failing the California real estate exam can feel confusing and discouraging—especially if you studied hard and thought you were prepared. After teaching thousands of students at ADHI Schools, I can tell you this: good people fail this exam for predictable, fixable reasons.

Most students who fail aren’t lacking intelligence. They’re dealing with:

Studying the wrong material

Misreading the way the DRE writes questions

Mismanaging time and anxiety

Not truly understanding the concepts

This 2026 update breaks down why people fail—and how to avoid doing it again. If you need the full roadmap, revisit our California Real Estate Exam Guide for big-picture context.

1. Studying the Wrong Material

This is the most common failure point for people that don’t pass the real estate exam on the first attempt.

Most students think they know what’s important, but the DRE’s actual blueprint tells a different story. People over-study math, obscure facts, or random topics—and under-study the heavy hitters like Practice of Real Estate and Mandated Disclosures, Agency, and Contracts.

If the exam felt “nothing like what I studied,” it’s usually a blueprint mismatch not because the California real estate exam is inherently hard.

Fix: Study according to weighting, not feeling. Your score follows the blueprint—your study plan should too.

2. Memorizing Instead of Understanding Concepts

The DRE exam is not a vocabulary quiz. It’s a psychometric, scenario-based exam.

Even when two answers look right, only one reflects the best professional judgment.

Examples:

Knowing the definition of “fiduciary” isn’t enough—you must know how it applies in real situations.

Memorizing loan definitions won’t help if you can’t apply financing concepts to a buyer scenario.

Students who memorize instead of understanding get crushed by paragraph-style questions.

Fix:

Study concepts, not sentences.

Ask: “How would this play out in practice?”

Practice explaining rules out loud as if teaching a new agent.

Understanding beats memorization every time.

3. Weak Test-Taking Strategy

Even with strong knowledge, poor strategy sinks scores.

The CA exam is designed with:

Four options per question

Distractors that look reasonable

Trap words like always, never, must, only

Questions that hide the real ask behind long paragraphs

Weak strategy leads to:

Rushing

Misreading

Overthinking

Getting tricked by distractors

Fix:

Slow your brain, not your pace.

Your process should be:

Identify what the question is actually asking.

Eliminate two bad choices.

Choose the best remaining answer—not the first one that feels right.

4. Not Completing the 135 Hours Effectively

Yes, you “completed” the hours. But did you learn the material?

Common problems:

Clicking through content while multitasking

Rushing to unlock final exams

Treating quizzes as speed bumps instead of diagnostics

Finishing the course fast but retaining very little

The DRE requires structured pacing for a reason: cramming destroys comprehension.

Fix:

Go back into your course with intentionality:

Redo chapter quizzes

Slow down on mandated disclosures, agency, and practice

Take notes instead of scanning

Your 135 hours are the foundation. If the foundation is weak, the exam will expose it.

5. Mismanaging Exam-Day Timing and Anxiety

The pacing is strict:

150 questions in 180 minutes

≈ 1.2 minutes per question

Two patterns cause failure:

A. Poor timing

Spending too long on early questions → panic later → rushed guesses at the end.

B. Snowball anxiety

When tension rises, accuracy drops. Even easy questions start to feel hard.

You can know the material and still fail simply from mismanaging the clock or stress.

Fix:

If a question hits 90 seconds, mark it and move on

Answer all “easy confidence” questions first.

Use structured breathing to reset between sections.

The exam rewards calm, not perfection.

6. Overconfidence After Practice Exams

Practice tests help—but they can also mislead.

Students score 80–85% on practice questions and assume the real test will feel similar. But:

Practice questions are often easier

Some aren’t written in true DRE style

Students memorize patterns instead of concepts

Most don’t simulate full, timed testing conditions

Overconfidence destroys focus on test day.

Fix:

Treat practice scores as data, not predictions.

Switch question banks to avoid memorization.

Take at least one full-length timed exam to feel real pacing.

If you “crushed the practice tests” but failed the DRE exam, this is likely the reason.

7. Not Reviewing Weak Areas Using Data

Most people study based on what feels comfortable, not what the data shows.

Real patterns:

Students love reviewing topics they already understand

They avoid areas where they miss questions

They never measure category-level performance

But the DRE doesn’t care about your feelings—it cares whether you get the heavy-weighted categories right.

Fix:

Track your misses by category:

Agency

Practice & Disclosures

Contracts

Financing

Property Ownership

Land Use & Regulation

Then study ONLY your weakest two or three areas until they improve.

This is how repeat test-takers turn scores around fast.

8. Misunderstanding How the DRE Scores the Exam

There is so much myth around how the exam is scored.

Here’s the truth:

Raw scoring only

No curve

70% required for salesperson, 75% for broker

Different exam forms exist but are statistically balanced

Missing “easy questions” hurts exactly as much as missing hard ones

When students misunderstand scoring, they:

Over-focus on hard questions

Ignore high-weighted fundamentals

Think the curve will “save” them

If scoring confuses you, read How the CA Real Estate Exam Is Scored for a full breakdown.

Fix:

Aim for consistent accuracy—not perfection or “beating the curve.”

You can miss many questions and still pass. You just can’t miss the wrong ones.

If You’ve Already Failed Once (or More): What To Do Next

Failing once is common. Failing repeatedly happens only when students don’t change their approach.

Here’s your reset plan.

1. Shift mindset

Give yourself a day to be upset. Then move into diagnosis-mode:

“Where exactly did things break down?”

2. Rebuild using the blueprint

Anchor everything to the California Real Estate Exam Guide and the Content Breakdown.

3. Identify your three weakest categories

Use chapter quizzes, practice tests, and memory from the exam.

4. Fix your strategy

If timing or distractors tripped you up, revisit our Multiple-Choice Strategy article.

5. Re-engage the 135 hours

Slow down. Relearn. Retest.

6. Plan your retake intentionally

If you need reassurance about retake limits, see How Many Times Can You Take the CA Real Estate Exam?

You have time—and unlimited attempts within your application window.

7. Treat your next attempt like a professional dry run

Your goal isn’t to “beat the test.”

Your goal is to perform like the licensee the DRE is willing to approve.

Ready to Finally Pass?

At ADHI Schools, everything we teach—including exam prep, crash courses, and strategy coaching—is built around California-specific DRE standards, psychometrics, and student performance data.

If you’re tired of guessing, overwhelmed with conflicting advice, or don’t want another exam fee on your credit card, we can help you approach the next attempt correctly, confidently, and strategically.

You don’t have to be the person who almost became an agent.

With the right structure, the right content, and the right test strategy, you will pass this exam.

Ready when you are.

1. What is the number one reason people fail the California real estate exam?

Most students fail because they study the wrong material. The DRE blueprint emphasizes topics like Practice of Real Estate and Mandated Disclosures, Agency, and Contracts, not the random facts or formula-heavy topics many students focus on. Aligning your study plan with the actual DRE weighting dramatically improves pass rates.

2. Is the California real estate exam harder than people expect?

Yes—mainly because the exam is a psychometric, scenario-based test, not a memorization test. Students who rely on flashcards or definitions often struggle with paragraph-style questions that require judgment, application, and analysis.

3. What score do I need to pass the California real estate exam?

You must score at least:

70% on the Salesperson Exam → 105 correct out of 150 questions

75% on the Broker Exam → 113 correct out of 150 questions

The DRE uses raw scoring, not a curve. A miss is a miss—whether the question was “easy” or difficult.

4. Why do I pass practice tests but fail the real exam?

This is extremely common. Practice tests often:

Use easier or differently phrased questions

Encourage memorization instead of true understanding

Don’t simulate real timing or pressure

Lack scenario depth compared to DRE questions

Students should treat practice test scores as data, not predictions. Using an Error Log to categorize missed questions is one of the most effective ways to improve.

5. Does anxiety really cause people to fail the California real estate exam?

Absolutely. The exam is a timed endurance test, and anxiety causes students to:

Overspend time on early questions

Second-guess correct answers

Rush the last 20–30 questions

Misread wording or fall for distractors

Using a simple reset phrase like “One question at a time” or “Slow is smooth” helps regain focus.

6. Can you fail the CA real estate exam even if you know the material?

Yes. Many students understand the concepts but still fail due to:

Poor pacing

Weak test-taking strategy

Missing fundamentals instead of difficult questions

Misinterpreting what the question is really asking

Knowledge without a strategy leads to preventable mistakes.

7. How many times can I take the California real estate exam if I fail?

California allows unlimited retakes within your two-year application window. There is no penalty for failing besides paying the exam fee again. See our guide: How Many Times Can You Take the CA Real Estate Exam?

8. What should I do after failing the California real estate exam?

You should follow a structured reset plan:

Diagnose your weakest categories

Re-align with the DRE content outline

Re-engage your 135 hours with intention

Practice full-length timed exams

Strengthen test-taking strategy

Track mistakes using an Error Log

Repeat test-takers improve fastest when they take a data-driven approach, not a “study everything again” approach.

9. Is the California real estate exam curved?

No. The DRE does not curve, scale, or adjust scores. Each question carries equal weight. Different exam forms are equated psychometrically to ensure fairness, meaning the difficulty level is balanced statistically—not curved.

10. What topics should I focus on to avoid failing the exam again?

Focus on the highest-weighted categories, which often include:

Practice of Real Estate & Mandated Disclosures

Agency & Fiduciary Duties

Contracts

Property Ownership & Regulations

These areas make up a significant portion of the exam and must be mastered to pass. See our California Real Estate Exam Content Breakdown for details.

|

When most students enroll in real estate classes and receive their textbooks, a frequent reaction is overwhelm.

You are staring at thousands of pages covering everything from freehold estates Read more...

When most students enroll in real estate classes and receive their textbooks, a frequent reaction is overwhelm.

You are staring at thousands of pages covering everything from freehold estates to trust fund accounting, and the pressure to memorize it all can be paralyzing. But here is the truth: You do not need to memorize every single word to pass. You need a specific strategy.

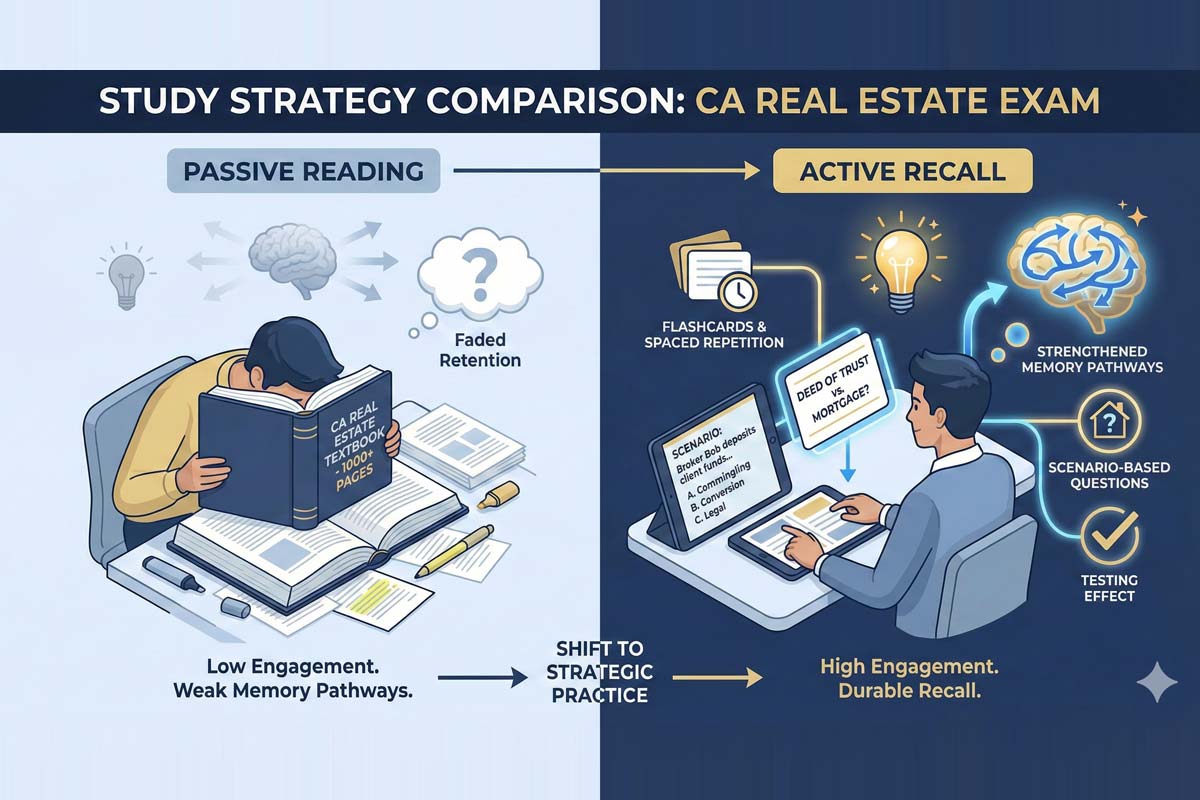

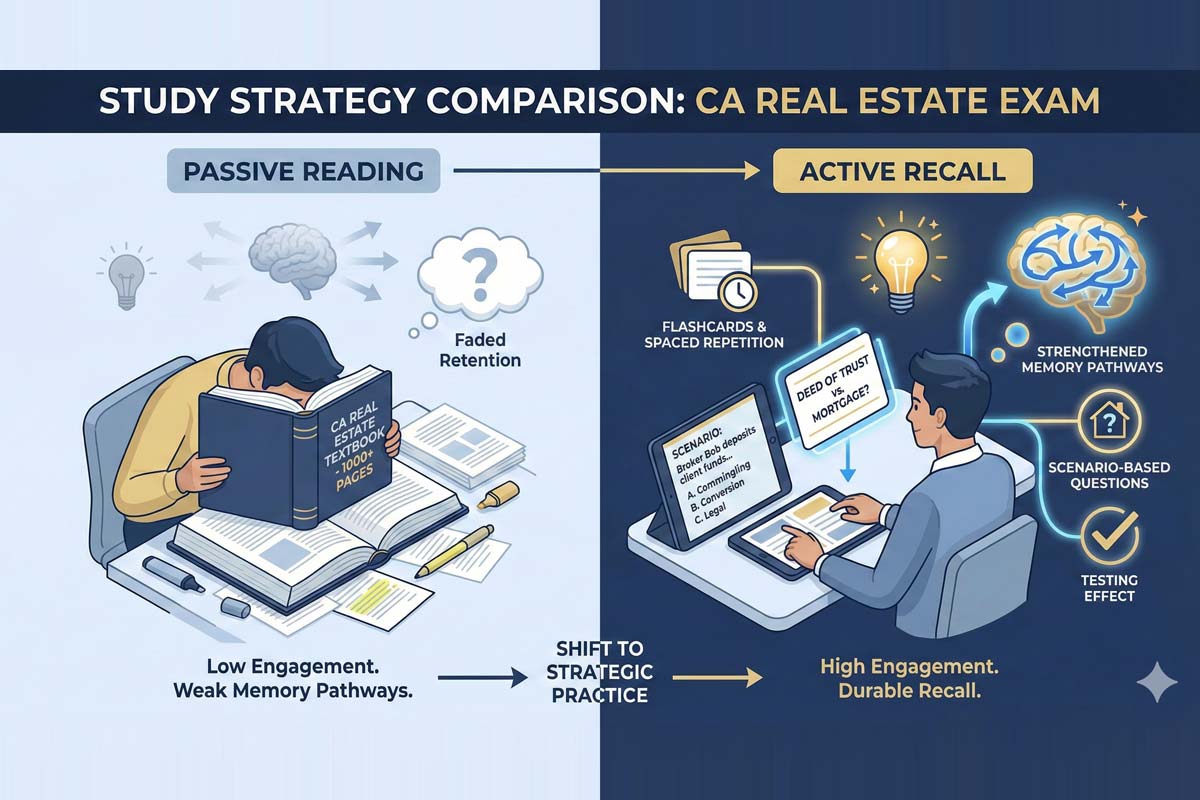

The best way to study for the California real estate exam is to shift from passive reading to active, strategic practice aligned with the DRE blueprint.

While our comprehensive California Real Estate Exam Guide covers the broader scope of eligibility and the application process, this article focuses entirely on the tactical side of preparation—the specific study methods that transform confusion into passing scores.

What Is the Best Way to Study for the California Real Estate Exam?

The most effective study method is a targeted approach that prioritizes high-weight content areas and learns them through application rather than mere memorization. Think of it this way: The student who reads the textbook three times often fails, while the student who reads it once but spends their time analyzing practice scenarios usually passes.

To study effectively, you must first stop studying "everything" and start studying what matters. Your study time gains the biggest return on investment when you prioritize the sections that appear most frequently.

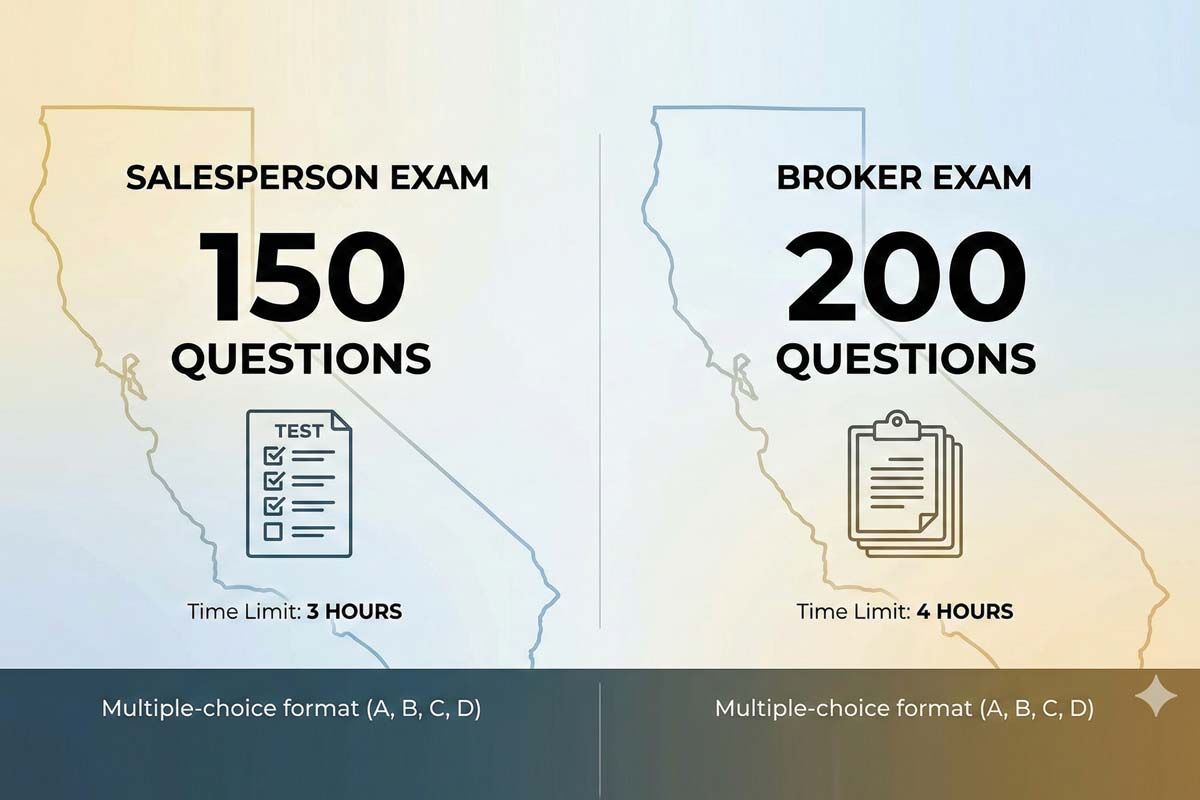

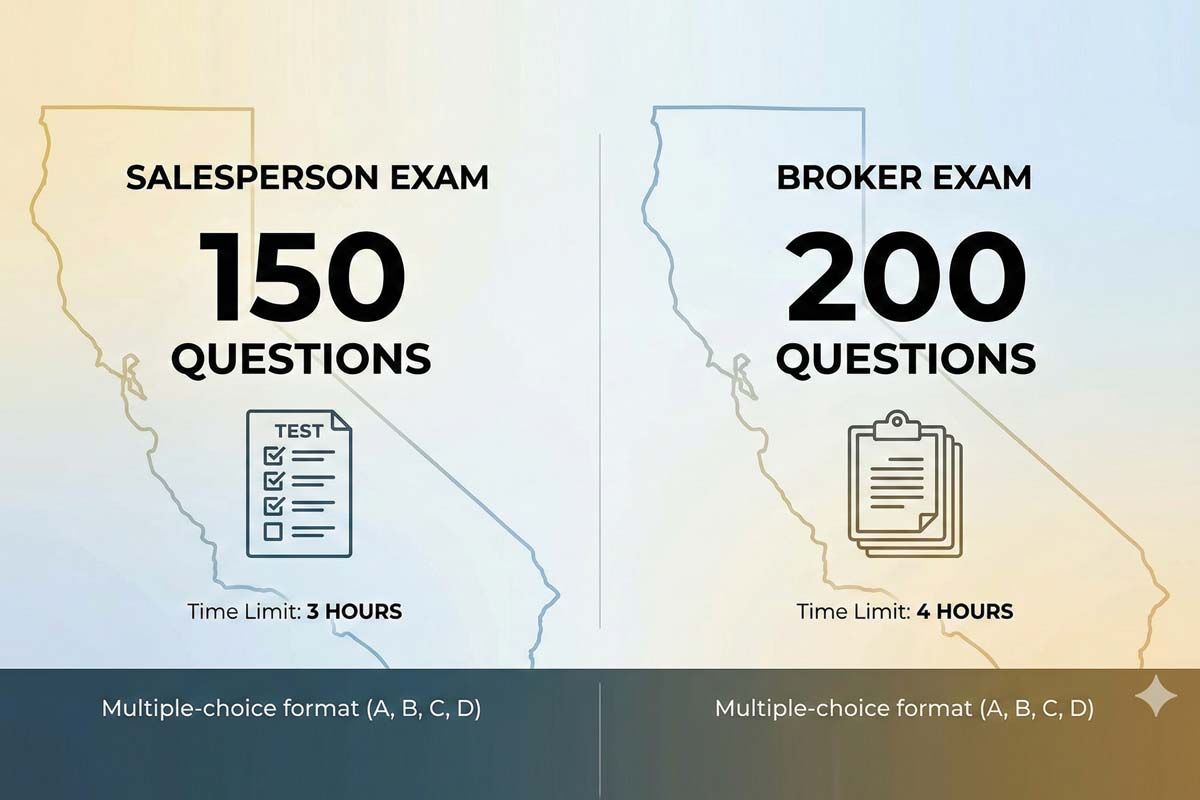

The California salesperson exam consists of 150 multiple-choice questions to be completed in 3 hours. The broker exam is 200 multiple-choice questions and you are given up to 4 hours to complete it. To pass, you need a score of 70% or 75% respectively. However, remember that the questions are weighted toward specific areas. While the DRE may update specific questions, these category weights remain consistent year after year.

Practice of Real Estate and Mandated Disclosures (approx. 25%)

Laws of Agency and Fiduciary Duties (approx. 17%)

Property Ownership and Land Use Controls (approx. 15%)

If you master Practice and Agency, you have already covered nearly half the exam. Your study time should reflect this distribution.

Decode the Question Style: Scenarios Over Definitions

One of the biggest shocks for students on exam day is the format of the questions. They rarely ask for simple definitions. Instead, the DRE uses scenarios to test if you understand the spirit of the law, not just the letter of it.

The "Story Problem" Pattern

Most questions are disguised as simple stories. These scenarios reflect how nearly every DRE question is structured—they present a situation and ask you to identify the legal implication. Success here comes down to pattern recognition.

Scenario A (Trust Funds): A broker named Bob deposits a client’s rent check into his personal account because he was in a rush. The test won’t ask “Define Commingling.” It asks what violation Bob committed.

Scenario B (Agency Disclosure): An agent representing a buyer writes an offer on a property listed by her own firm. She waits until the offer is accepted to tell the buyer she also represents the seller. The test won’t ask “What is Dual Agency?” It asks if the agent’s timing was legal (it wasn’t).

If you study isolated terms without applying them to these “story problems,” you may struggle to recognize the answer when it is wrapped in a real-world situation especially if you haven’t memorized and internalized the vocabulary.

Active Recall and Spaced Repetition

The “Forgetting Curve” is real. If you study contracts on Monday and don’t look at them again until Friday, you will have forgotten a significant portion of what you learned.

Why Active Recall Works

Simply re-reading a chapter feels comfortable, but it is passive. Remember: Comfort ≠ Learning. If it feels easy, you probably aren’t retaining it.

Active recall—testing yourself before looking at the answer—forces your brain to work harder to retrieve the information. For example, instead of reading a definition, cover the page and ask yourself: “What is the definition of constructive eviction?” This mental exertion strengthens neural pathways, making the memory more durable.

Build a Study Routine You Can Stick To

One of the biggest mistakes students make is waiting for "free time" to study. In our busy lives, free time rarely exists; it has to be created. You need a schedule that treats studying like a non-negotiable appointment.

Sample Weekly Plan for a Busy Adult

This schedule focuses on consistency over intensity.

Day

Focus

Activity

Monday

Learning (1 hr)

Read 1 chapter + Take notes.

Tuesday

Reinforcement (30 min)

Review Monday's notes. Do 20 practice questions on that topic.

Wednesday

Learning (1 hr)

Read the next chapter + Take notes.

Thursday

Review (30 min)

Review Mon/Wed notes. Explain concepts out loud.

Friday

Rest

No studying. Let your brain recover.

Saturday

Testing (2 hrs)

Full practice exam or comprehensive quiz. Review missed answers.

Sunday

Analysis (1 hr)

Review weak areas identified on Saturday.

The 4-Week Roadmap

To maintain momentum, visualize your month like this:

Weeks 1–2: Build foundational knowledge (Read, Note-take, Quiz).

Week 3: Transition to comprehensive practice exams and error correction. Note: Only move to this stage when you can consistently score ~70% on section quizzes.

Week 4: High-yield review of weak spots and vocabulary drills.

Note: If you work full-time or have a busy family life, don’t force a 4-week timeline. Extend this roadmap to 6–8 weeks to ensure you retain what you learn.

Establishing a routine is crucial, but determining your total timeline is personal; understanding How Long Should You Study for the CA Real Estate Exam depends heavily on your background knowledge and how many hours per week you can honestly commit. A student with a legal background might need four weeks, while someone completely new to the industry might need three months of steady preparation.

Use Practice Exams Intentionally

Taking practice exams is not about seeing what score you get; it is about diagnosing why you are getting questions wrong.

When to Start Full Mock Exams

Avoid taking full 150-question mock exams until you can consistently score 70–75% on topic-based quizzes. Taking them too early leads to discouragement. Once you hit that threshold, aim to take one full mock exam per week in a quiet environment to build stamina.

Track your errors by type to see which patterns repeat. Taking mock tests is essential, but simply churning through questions won't improve your score unless you know how to use Practice Exams for the CA Real Estate License Test to diagnose your weak spots effectively. The goal is to condition your brain to recognize how the state asks questions, which is often tricky and filled with double negatives.

When a Crash Course Can Supercharge Your Prep

Self-study requires immense discipline. Sometimes, despite your best efforts, certain concepts—like the difference between a trust deed and a mortgage—just don’t click when reading a book.

Signs You Might Need Help

The Plateau: You have been stuck at scoring 60% for two weeks.

The "Why": You know the answer is B, but you don’t understand why it isn’t C.

The Application Gap: You understand definitions but consistently miss scenario questions.

If you reach this point, deciding whether You Should Take a Crash Course for the CA Real Estate Exam often comes down to whether you need structured, instructor-led guidance—not just more reading or random YouTube videos. A well-designed crash course like crashcourseonline.com acts as a final filter, stripping away irrelevant information and focusing purely on what is likely to appear on the state exam. The right course clarifies confusing topics, shows you how questions are actually phrased, and reinforces the high-yield concepts that move your score the fastest.

Common Mistakes That Sabotage Students

Even smart students fail because they study inefficiently or panic on the big day. Avoid these common traps:

Study Pitfalls

The Highlighter Fallacy: Highlighting everything in your book makes you feel productive, but it doesn’t help you learn. It is better to write notes in the margins.

Binge Studying: Studying for eight hours straight on a Sunday is far less effective than studying for one hour a day for eight days. Your brain needs sleep to consolidate memory.

Exam-Day Trap

The Second-Guessing Trap: On exam day, avoid changing your answers unless you have found clear evidence you were wrong. Your gut instinct is usually based on your study prep; second-guessing is usually based on anxiety.

Why ADHI's System Works

At ADHI Schools, we have spent nearly two years refining our curriculum not just to meet DRE standards, but to match how students actually learn. We don’t believe in drowning you in data. Our approach focuses on the “why” behind the laws. These methods mirror the principles we teach in our courses because they consistently produce results.

FAQs

1. What is the most effective way to study for the California real estate exam?

The most effective study method is a targeted approach that focuses on the highest-weighted exam topics and uses active recall and scenario-based practice. Students who move beyond passive reading and spend more time analyzing question patterns consistently score higher than those who simply reread the textbook.

2. How many hours a day should I study for the California real estate exam?

Most students do well with 1–2 hours per day, 4–6 days a week. What matters more than total hours is consistency. Short, focused sessions with spaced repetition outperform long cram sessions. Your timeline also depends on your background—some students need four weeks; others need two to three months.

3. When should I start taking practice exams?

Start full-length practice exams only after you can consistently score 70–75% on topic-based quizzes. Taking them too early leads to discouragement and doesn’t improve retention. Once ready, take one mock exam per week and spend equal time reviewing your mistakes to identify patterns.

4. Do I need a crash course to pass the California real estate exam?

A crash course isn’t mandatory, but many students see their biggest score jumps after following a structured review program. When you’re stuck or unsure why answers are wrong, guided review—such as the approach used at crashcourseonline.com—can help you quickly identify weak areas and understand how the exam actually phrases its scenarios.

|

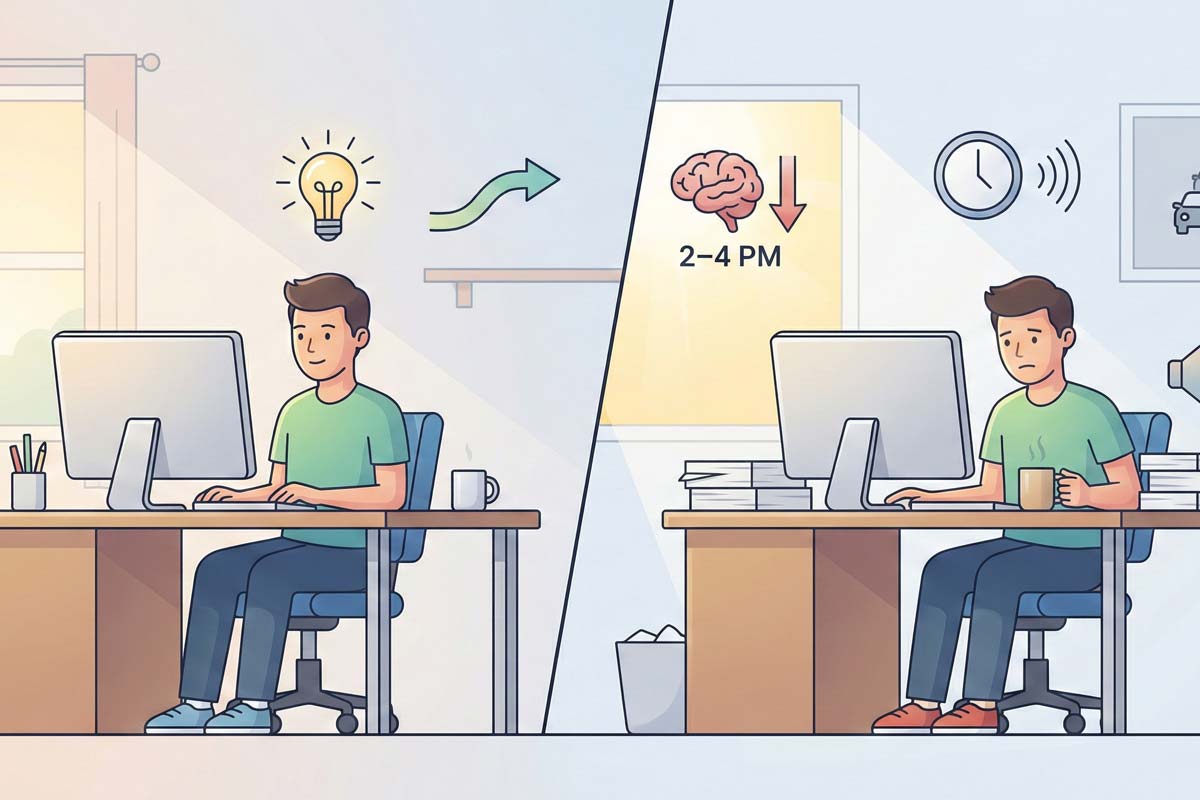

Selecting a date for your state licensing exam is a milestone, but selecting the right time of day is a strategy.

Most students treat the time slot as a matter of convenience—scheduling around Read more...

Selecting a date for your state licensing exam is a milestone, but selecting the right time of day is a strategy.

Most students treat the time slot as a matter of convenience—scheduling around work shifts or childcare. However, when you are preparing to sit for an exam that could determine your career future, convenience should be secondary to cognitive performance.

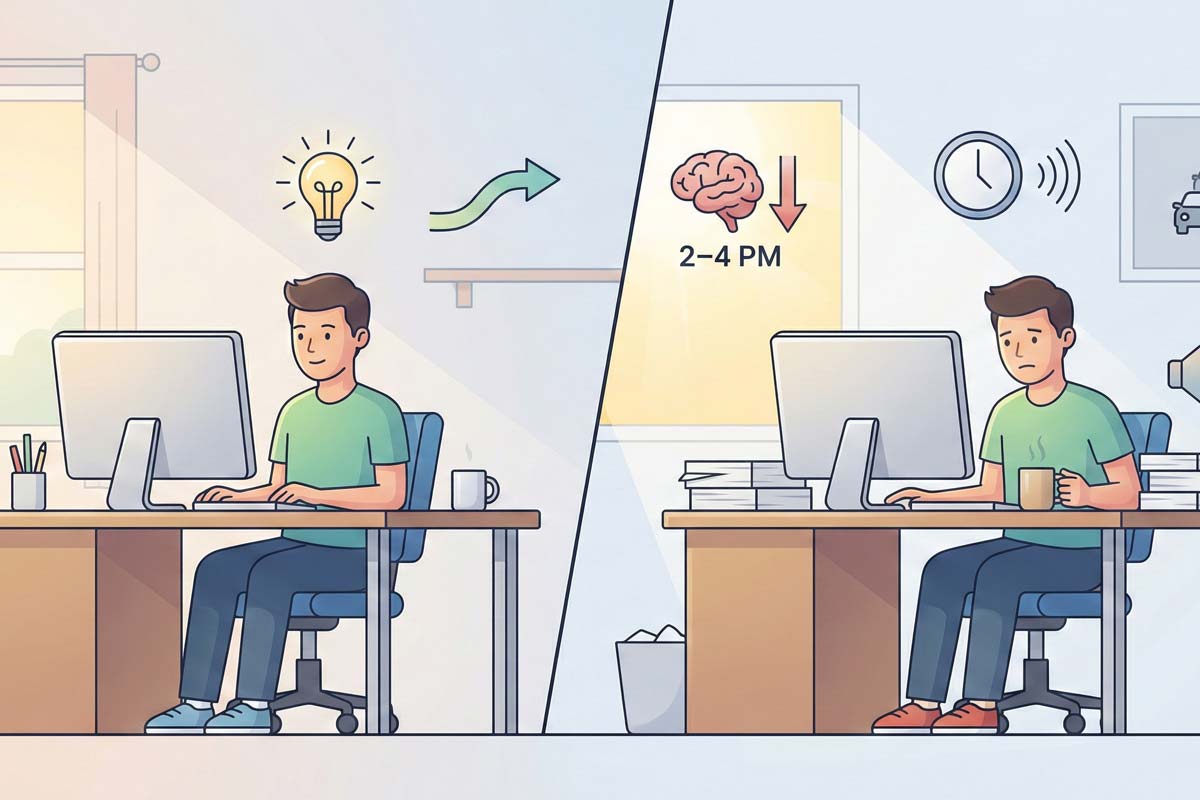

The Department of Real Estate (DRE) typically offers morning and afternoon sessions. The content of the exam does not change based on the time, nor does the scoring criteria. However, your ability to focus, recall information, and manage anxiety absolutely fluctuates. By aligning your exam slot with the two biggest variables—your biological chronotype and local logistics—you give yourself a statistical edge.

Quick Decision Matrix

Choose Morning (AM) If: You are an "Early Bird" who wakes up alert, you have high anticipatory anxiety (need to "get it over with"), or your route involves driving against rush hour traffic.

Choose Afternoon (PM) If: You are a "Night Owl" who feels groggy before 10:00 AM, you are traveling a long distance that risks morning gridlock, or you rely on a slow warm-up routine to manage stress.

Is There a Best Time of Day to Take the Exam?

There is no officially mandated "correct" time that guarantees a passing grade. However, research suggests there is a best time for your specific physiology.

Cognitive science indicates that for approximately 75% of adults, analytical thinking and focus peak in the late morning. Conversely, the "post-lunch dip"—a documented circadian trough occurring between 2:00 PM and 4:00 PM—can significantly impact mental endurance. However, biology is adaptable; if you are forced into a time slot that doesn't match your rhythm, you can shift your circadian peak by taking practice exams at that specific time for a couple of weeks prior to the test.

But biology isn't the only factor. Your choice must also account for:

Traffic density at the specific arrival time.

Parking availability at the test site.

Commute stress and its effect on your adrenaline levels.

Because the 2026 California real estate exam contains no math questions and allows no calculators, the test consists entirely of conceptual questions, vocabulary, and scenario-based reading comprehension. You do not need calculation power; you need sustained mental endurance. You must choose a time slot that aligns with your peak mental alertness.

How Time of Day Affects Your Performance

Your brain’s performance on a standardized test is influenced by three main biological factors: cortisol levels, body temperature, and decision fatigue.

Cortisol and Alertness

Cortisol is the "waking hormone." For most people, it peaks around 30 to 45 minutes after waking up. This natural spike helps clear morning grogginess. If you schedule an 8:00 AM exam but usually wake up at 7:30 AM, you may be sitting in the testing chair before your brain has fully engaged.

Decision Fatigue vs. Scenario Questions

Decision fatigue is real. As the day progresses, the brain becomes tired of making choices. By the afternoon, after navigating traffic, scrolling through emails, or handling domestic tasks, your "willpower battery" is depleted. Because the California exam is heavily weighted toward scenario-based questions ("What should the agent do next?"), decision fatigue is particularly dangerous here. It can lead to careless errors on nuance questions you actually know the answers to.

The "No-Math" Factor

Since the DRE removed math from the exam, the test is less about formulas and more about linguistic nuance. Reading 150 or more scenario-based questions requires high-level executive function. If you are prone to afternoon slumps, the sheer volume of reading in a PM session can feel overwhelming compared to an AM session.

Morning Exam Slots — Pros and Cons

Morning slots (typically starting between 8:00 AM and 9:00 AM) are the most popular choice for first-time test takers, but they come with specific trade-offs.

The Pros:

Peak Cognitive Freshness: You capture the natural late-morning cognitive peak.

Reduced Anticipatory Anxiety: You wake up, get ready, and go. You have less time to sit around stressing about the outcome.

Operational Smoothness: Testing centers are generally cleaner and quieter in the morning. Additionally, morning sessions rarely face delays caused by technical bottlenecks or check-in backlogs from previous groups.

The Cons:

Rush Hour Traffic: If your testing center is in a metro area like Los Angeles or Oakland, getting there by 7:45 AM means battling peak traffic.

Sleep Deprivation: If you are too nervous to sleep the night before, an early alarm can leave you exhausted before you start.

Do NOT Choose Morning If:

You are a "night owl" who feels groggy until 10:00 AM.

Your commute is unpredictable (e.g., crossing major bridges or freeways prone to accidents).

You know that anxiety keeps you awake past midnight.

Afternoon Exam Slots — Pros and Cons

Afternoon slots (typically starting between 1:00 PM and 1:30 PM) offer a buffer for those who need a slower start to their day.

The Pros:

Traffic Avoidance: You can usually travel to the testing center after the morning rush has subsided.

Warm-Up Time: You have time to eat a decent meal and review the material one last time (though cramming is not recommended).

Ideal for Night Owls: If your brain doesn't fully "turn on" until 11:00 AM, this is your only viable option.

The Cons:

The Post-Lunch Slump: The body’s natural circadian dip occurs between 2:00 PM and 4:00 PM. If your exam starts at 1:30 PM, this fatigue hits you exactly around question #60 or #70—right in the middle of the test.

Ambient Noise: Afternoon sessions often contend with higher ambient noise from hallway traffic, deliveries, and street sounds as the city fully wakes up.

Accumulated Stress: You spend the whole morning waiting for the event, which can spike adrenaline levels prematurely and lead to a crash during the test.

Logistics That Influence Your Time Choice

Biology is important, but geography often dictates your schedule. California is vast, and the location of your test center should heavily influence whether you choose an AM or PM slot.

For example, if you are testing in San Diego or Oakland, an 8:00 AM exam requires arriving by 7:30 AM at the latest. This places you on the freeway during the absolute worst congestion of the day.

Remember: Traffic conditions are determined by your arrival time, not your appointment time. The stress of being late can spike your heart rate and scramble your focus before you even see the first question.

When evaluating specific California real estate exam testing centers, consider the local traffic patterns surrounding the facility. If the center is located in a high-density office park, parking might be scarce in the mid-morning but open in the early morning. Conversely, some centers have dedicated lots that fill up by 8:30 AM.

How Scheduling Works

The DRE uses a "first come, first served" model through the eLicensing system.

Morning slots tend to fill up faster than afternoon slots because many professionals prefer to take the exam and then head to work. This is especially true during the busy spring season (Q1 and Q2), where morning availability can become scarce. Once you've chosen the testing time that aligns with your chronotype, make sure you know how to schedule the California real estate exam properly—popular morning slots often fill quickly. Delaying your scheduling may force you into a less ideal time block.

What Your Exam Time Means for Exam-Day Prep

Your strategy for the day changes based on your clock.

For Morning Exams: Focus on a high-protein breakfast. Avoid heavy carbohydrates that induce sleepiness. Your goal is immediate, sustained energy. Arrive early enough to use the restroom and acclimate to the room temperature.

For Afternoon Exams: Eat a moderate lunch. A heavy meal right before a 1:00 PM test precipitates cognitive decline and drowsiness. Use the morning to relax, not to panic-study. Your arrival protocol changes slightly based on the time of day, understand what to expect on exam day regarding check-in lines and lobby congestion. Afternoon lobbies are often crowded with morning test-takers leaving as afternoon candidates arrive.

Why You Can’t Take a “Flexible Online Exam”

In the modern era, students often assume they can take the test at midnight from their home computer. This is a dangerous misconception.

Because it is currently impossible to take the California real estate exam online, you are bound to the physical constraints and operating hours of a brick-and-mortar test center. While rigid, this standardized schedule offers predictability. You cannot choose a random start time like 10:45 AM, and you cannot control the environment. This makes your choice of the standard AM or PM block even more critical. You must perform on their schedule, in person, under proctored conditions.

Final Thoughts

There is no magical time slot that makes the questions easier. The DRE creates a standardized difficulty level regardless of when you sit for the test. However, you can control the variables surrounding the test.

Choose Morning if: You wake up early, you want to avoid anticipation anxiety, and you have a clear commute.

Choose Afternoon if: You are a night owl, you have a long commute through heavy traffic, or you need the morning to settle your nerves.

Aligning your biological clock with your testing schedule is just one component of a broader strategy found in our comprehensive California Real Estate Exam Guide. Success is about preparation—both of your mind and your logistics.

Frequently Asked Questions

Is the morning or afternoon real estate exam easier? Statistically, neither exam is "easier." The difficulty level is identical, and time of day does not impact scoring. However, some students find morning exams subjectively easier because their brains are fresher and less fatigued by the day's events.

Do testing centers ever run behind schedule? Yes. While morning sessions almost always start on time, afternoon sessions can occasionally face delays if the morning check-out process runs long or if there are technical glitches at the facility.

Should I try a practice exam at the same time of day I plan to test? Yes. This is highly recommended. Taking a full-length simulated exam at the exact time of your scheduled test helps train your brain to be alert during that specific window, effectively shifting your circadian rhythm.

Should I drink coffee before the exam? If you normally drink coffee, yes. Do not change your caffeine routine on exam day. However, avoid drinking too much liquid immediately before the test, as unscheduled restroom breaks eat into your exam time.

Are morning exam slots quieter? Generally, yes. Morning sessions often have fewer distractions because the office building or testing complex hasn't fully "woken up" yet. Afternoon sessions may have more ambient noise from hallway traffic or street noise.

How early should I arrive for a morning exam? You should aim to arrive at the testing center at least 30 minutes before your scheduled start time. For an 8:00 AM exam, this means arriving by 7:30 AM to handle parking and check-in procedures.

|

If you're gearing up for your California licensing test, one of the most practical details to lock down is the exam's length. How many questions are on the California real estate exam? Knowing the exact Read more...

If you're gearing up for your California licensing test, one of the most practical details to lock down is the exam's length. How many questions are on the California real estate exam? Knowing the exact number is the cornerstone of an effective study plan and confident test-day pacing. Here’s the straightforward answer:

The California Real Estate Salesperson Exam contains 150 multiple-choice questions.

The California Real Estate Broker Exam contains 200 multiple-choice questions.

This structure directly influences your time-management strategy. For a full picture of the entire testing process, from scheduling to scoring, our California real estate exam guide walks you through every step. To see how these questions are distributed by topic, review our guide to what’s on the California real estate exam — it outlines all testable areas.

The Salesperson Exam Breakdown (150 Questions)

The salesperson licensing exam is a 150-question test, with every item presented in a multiple-choice format with four options (A, B, C, D). The questions are pulled from specific content areas with predetermined weighting. For example, roughly a quarter of the exam focuses on the Practice of Real Estate and Duties to Clients, while Financing makes up a smaller percentage. Understanding this weighting is critical for efficient study.

The Broker Exam Breakdown (200 Questions)

The broker exam increases in both scope and depth, featuring 200 multiple-choice questions, also in A, B, C and D format. While the core subject categories align with the salesperson test, the broker version delves slightly deeper into areas like real estate law, brokerage management, and trust fund handling. The additional questions reflect the content around supervisory knowledge required for a broker's license.

Time Management: The “Minute-Per-Question” Rule

With standardized time limits, a simple calculation gives you a powerful pacing tool:

Salesperson Exam: 150 questions / 180 minutes = 1.2 minutes per question.

Broker Exam: 200 questions / 240 minutes = 1.2 minutes per question.

This consistent pace is very manageable if you avoid getting stalled. The best approach is to answer known questions quickly, mark uncertain ones for review, and maintain forward momentum. Returning to challenging items at the end ensures you capture all the points available from questions you find easier.

Passing Scores: How Many You Can Get Wrong

It’s a relief to many students that perfection is not required. The passing percentages are clear:

Salesperson Exam: A 70% score means you need 105 correct answers. You can miss 45 questions and still pass.

Broker Exam: A 75% score requires 150 correct answers, allowing you to get 50 questions wrong.

This margin for error is built into the exam design. For a deeper look into the scoring process, including how "equating" questions work, our article on how the California real estate exam is scored provides clarity.

Format Consistency: Every Question Is Multiple Choice

Since the exam sticks to a simple four-option multiple-choice format, you don’t have to adjust your thinking from question to question. Learn one solid strategy and you can use it throughout the test—whether you know the answer or you’re narrowing it down to the best option. Honing this skill is a major part of effective preparation, and a dedicated multiple-choice strategy for the CA real estate exam can significantly boost your confidence and accuracy.

So, to recap: the sales license exam has 150 questions, and the broker test has 200 questions. When you understand the question count, timing, and pass thresholds, the exam stops feeling mysterious and becomes a numbers game you can win. With focused study and smart test-taking tactics, you’re well-positioned for success. For a complete step-by-step journey to your license, your central reference should always be our main California real estate exam guide.

Frequently Asked Questions

Q: Is there math on the California real estate exam? A: No. Since calculators are strictly prohibited, the DRE has removed math calculation questions from the test. You may need to recall specific numbers (like knowing there are 43,560 square feet in an acre), but you will not be asked to perform arithmetic.

Q: Do all 150 questions count toward my score? A: Treat every question as if it counts. While the DRE may include a few unscored "experimental" questions to test them for future exams, they are not labeled.

Q: Is the Broker exam harder than the Salesperson exam? A: Yes, primarily due to endurance. Answering 200 questions over 4 hours is a mental marathon. It also tests supervisory topics that aren't on the salesperson exam.

Q: What happens if I don't finish in time? A: Any blank answer is marked wrong. There is no penalty for guessing, so if you are running out of time, pick a letter and fill in every remaining bubble before the clock stops.

|

Deep knowledge of real estate principles is non-negotiable. However, even the most dedicated students can stumble if they rely on memorization alone.

That’s because the Department of Real Estate (DRE) Read more...

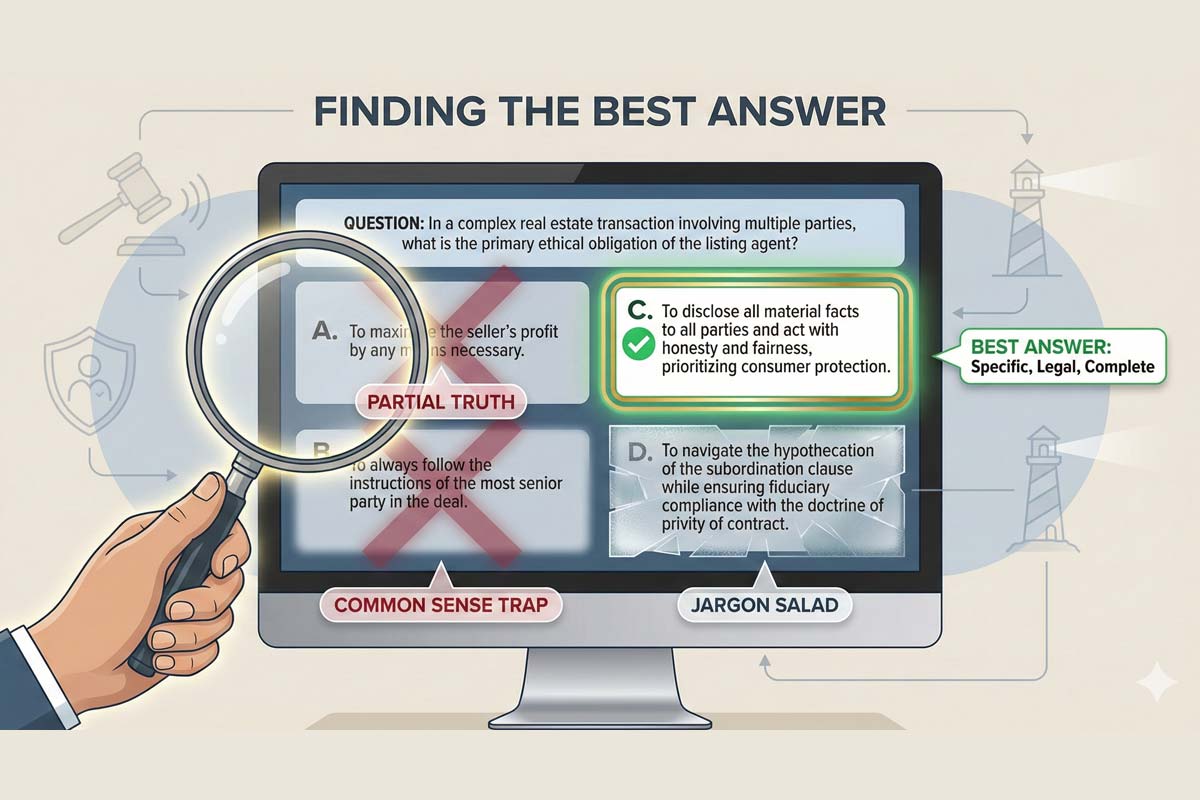

Deep knowledge of real estate principles is non-negotiable. However, even the most dedicated students can stumble if they rely on memorization alone.

That’s because the Department of Real Estate (DRE) isn’t simply checking your memory; the exam tests your professional judgment. They want to ensure you can protect a client in a complex scenario. To pass, you need to combine your command of the facts with a clear understanding of how the exam measures critical thinking.

This article teaches you how to think like the DRE—because passing is as much about mental process as it is about content.

What You Will Learn

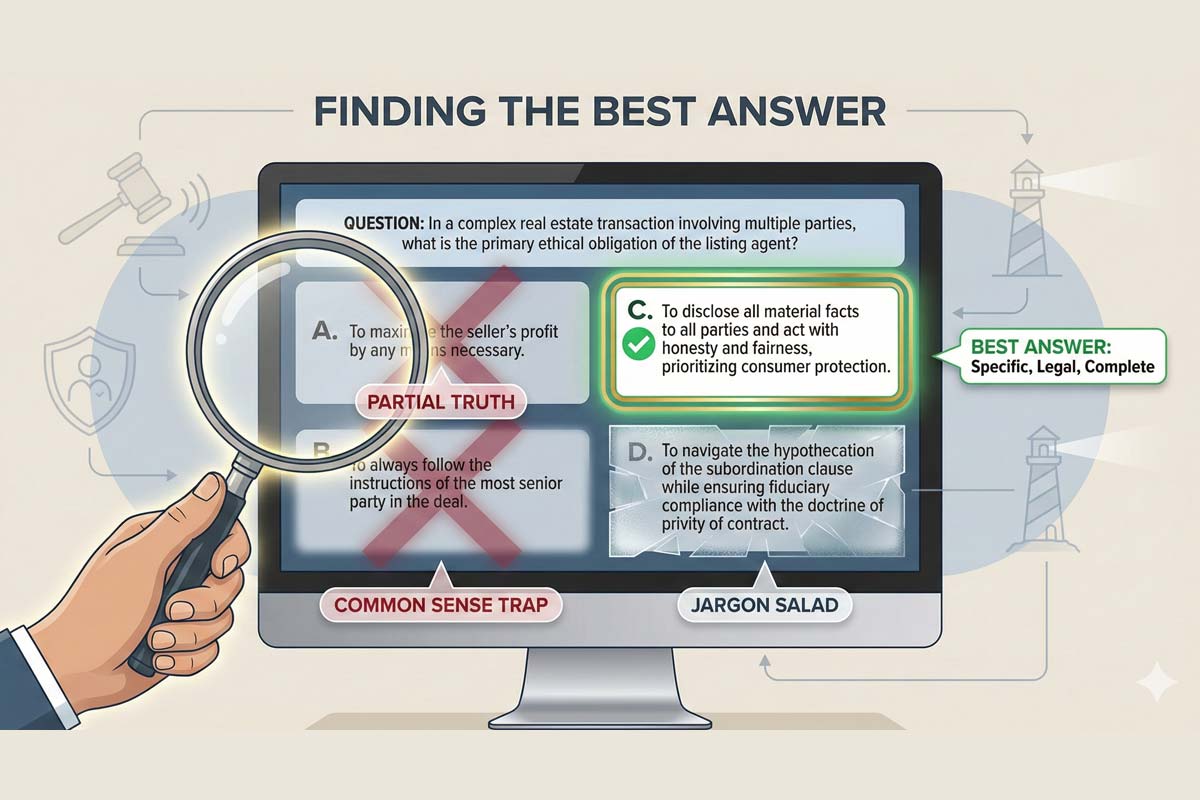

The "Best Answer" Logic: Why two answers can be right, but only one aligns with DRE scoring.

The Keyword Radar: How to spot trap words like "Always" and "Must" that signal incorrect answers.

Scenario Mastery: How to filter out the irrelevant "noise" in complex story problems.

Psychometric Hacks: How to mathematically increase your guessing odds from 25% to 50%.

This article is the strategic companion to our California Real Estate Exam (2026 Complete Guide). If that guide is your roadmap, this article is your instruction manual for driving the car.

How to Outsmart DRE Multiple-Choice Logic

To beat the exam, you have to deconstruct the weapon formed against you. The DRE does not write random questions; they write questions that follow a specific hierarchy of correctness.

The “Best Answer” Theory

If you take nothing else from this article, take this: In the DRE world, correct is not enough.

This is where smart people fail. They read option (A), see that it is technically a true statement, mark it, and move on. They never read option (C), which was more specific or more applicable to the exact scenario described.

Insider Insight: The DRE almost never rewards the answer that is merely technically accurate—they reward the one that aligns with legal intent and consumer protection.

Insider Tip: Never mark an answer until you have read all four choices. Often, option (A) is a "Partial Truth"—a statement that is true in a vacuum but doesn't solve the specific problem in the question stem.

When Two Answers Look the Same

This is the #1 anxiety point for students. You will see two answers that both look "right." Usually, the difference comes down to scope.

Broad vs. Specific: If the question asks about a specific violation (e.g., commingling), the answer that cites the specific code or action is better than the answer that just says "unethical behavior."

The Scope Mismatch:

Question: "What is the primary duty of a property manager?"

Choice A: To keep the building fully occupied.

Choice B: To generate the highest net income consistent with the owner's objectives.

Analysis: Choice A is good. Choice B is better because it encompasses the owner's goals, not just occupancy. The DRE rewards precision.

Anatomy of a DRE Question

Let’s break down the components of the items you’ll face.

1. The Stem

This is the setup. It might be a direct question (“What is an easement?”) or a scenario (“Broker Bob lists a property…”).

Insider Tip: Read the last sentence of the stem first. This tells you exactly what they are looking for before you get bogged down in the story details.

Clarification: This is a preview technique. Once you know the goal, you must still read the full scenario. Do not skip the middle, or you will miss the twist.

2. The Distractors (The Traps)

These are the wrong answers. They aren’t random; they are designed to trap you.

The "Common Sense" Trap: An answer that sounds logical to a layperson but violates real estate law.

Example: "The broker should return the deposit because the buyer is sad." (Kind, but legally wrong).

The "Jargon Salad": An answer that throws in impressive words just to intimidate you.

Example: "The hypothecation of the subordination clause." (If it sounds like nonsense, it usually is).

Scenario-Based Question Mastery

Now that you understand distractors, let’s look at the DRE’s favorite testing style: long scenario questions.

The DRE loves to test whether you can separate signal from noise. They will give you a paragraph full of details, but often only one fact matters. This is why it’s important to not only understand the content of the real estate exam but also how to cut through the fluff to get to what the state is actually asking.

The "Red Herring" Technique:The exam writers will include facts that have nothing to do with the legal issue.

Example: "A buyer looks at a Victorian home built in 1977. It is painted blue, has a large swimming pool, and the seller is going through a messy divorce..."

The Trap: You focus on the pool, the color, or the seller's emotional state.

The Reality: The year "1977" is the only thing that matters (Lead-Based Paint Disclosure).

Beware of Details That Seem Important but Aren't :

Exact square footage.

Emotional descriptions ("distressed seller," "anxious buyer").

"Curb appeal" descriptions.

Rule: If the detail doesn't change the legal outcome, ignore it.

The Keyword Radar System

The English language is flexible. The law is not. The DRE uses specific qualifiers to signal whether an answer is likely right or wrong.

The "Always" and "Never" Trap (Absolutes)

Real estate is rarely black and white. There are exceptions to almost every rule. If you see these words, the answer is highly likely to be incorrect:

Always

Never

Must

Everyone

Example: "A broker must disclose a death on the property." (False. You only must disclose it if it occurred within 3 years or if the buyer asks. The absolute "must" makes this answer incorrect).

The Exception: When the law deals with Fair Housing, "Never" is often correct. You never discriminate based on race.

The "Generally" and "Most" Safety Net (Conditionals)

The DRE prefers answers that leave room for nuance. If you are forced to guess, these words often signal the correct answer:

Generally

Typically

Most likely

May

Example: "The agent must generally obey the client." (Safe, accurate, allows for exceptions).

The Skip-and-Return Strategy

Based on the number of questions on the real estate exam, it’s evident that time management is crucial. You have roughly 1.2 minutes per question on both the sales and broker exams.

Do not let your ego lose you points.

If you encounter a scenario question that is a paragraph long: Mark it for review and skip it.

Momentum: Answering 10 easy questions in a row builds confidence.

Subconscious Processing: Your brain will continue to work on the hard question in the background.

Process of Elimination (POE)

If you don’t know the answer, you can still manufacture a higher probability of passing.

Psychometricians intentionally design four-option items with two distractors that are easy to eliminate—because this increases reliability and makes POE mathematically powerful.

Blind Guess: 25% chance of success.

Eliminating 2 Distractors: 50% chance.

The Math of Passing: As detailed in our guide on How the California Real Estate Exam Is Scored, you need a 70% to pass. That means you can miss 45 questions. If you can use POE to get your guessing success rate up to 50% on the hard questions, you are mathematically on the path to passing.

Full-Question Reading Discipline

Speed is your enemy. The DRE writes questions that pivot in the middle.

The "Except" and "Not" Twist

The DRE loves negative stems:

"All of the following are necessary for a valid contract, EXCEPT..."

If you read too fast, your brain skips "EXCEPT." You mark option (A) because it is necessary, and you fail the question.

Technique: When you see "EXCEPT," mentally rephrase the question: "I am looking for the WRONG statement."

Stop Overthinking (The Anxiety Check)

Most test-takers sabotage themselves by letting adrenaline override logic—strategy is how you stay in control.

The Exam is Not Evil: It is designed to assess competence, not to prank you.

Trust Your First Instinct: Once you have used the Process of Elimination, your first instinct is statistically more likely to be correct. Second-guessing without new information usually leads to changing a right answer to a wrong one.

Default to Safety: If you are stuck, ask yourself: "Which answer best protects the consumer?" That is usually the direction the DRE wants you to go.

The 2026 Angle: What Has Changed?

While the core mechanics of multiple-choice psychometrics remain consistent, the DRE updates its exam with some regularity to ensure that the content of the real estate exam reflects the reality of the real estate landscape.

In 2026, we are seeing a continued emphasis on ethics and transparency.

What to Expect:

Scenario Questions: Testing whether you recognize when a disclosure is required or when a duty to a non-client arises.

Fair Housing Granularity: Expect questions that drill down into subtle discrimination, not just obvious bias.

Agency Duties: A shift away from "closing the deal" toward "fiduciary transparency."

Key Exam-Day Takeaways

Read the last sentence first to identify the goal of the question.

Eliminate absolutes (Always/Never) unless it's a Fair Housing question.

Identify the scope: If the question is specific, the answer must be specific.

Don't over-read: If the fact isn't in the paragraph, it doesn't exist.

Apply these four rules, and the exam becomes a formality rather than a hurdle.

Strategy is vital, but it cannot replace content mastery. You need to combine these test-taking tactics with a comprehensive study plan.

Start with the full roadmap here: California Real Estate Exam (2026 Complete Guide).

Inside, you'll find the complete content breakdown, registration steps, preparation timelines, and scoring explanations you need to pass on the first try.

FAQ: Cracking the DRE Code

Q: What is the "Best Answer" strategy for the CA Real Estate Exam?

A: "Best Answer" logic means ignoring options that are merely true and selecting the one that is most specific to the scenario. Based on how the DRE scores the exams, while two answers could “look” correct, choose the one that aligns with consumer protection and specific legal intent rather than a broad generalization.

Q: Are there specific "trap words" that signal a wrong answer?

A: Yes. Be suspicious of absolute words like "Always," "Never," "Must," and "Everyone." Since real estate law almost always has exceptions, these are usually incorrect. Exception: In Fair Housing questions, "Never" discriminate is often the right answer.

Q: How do I handle long, confusing scenario questions?

A: Use the "Last Sentence First" technique. Read the very end of the question prompt before reading the story. This tells you exactly what legal issue to look for so you can filter out "noise" like emotional descriptions or irrelevant house details.

Q: How can I improve my odds if I have to guess?

A: Use Process of Elimination (POE). The DRE includes two "distractors" (obvious wrong answers) in almost every question. By crossing these out, you mathematically double your chance of guessing correctly from 25% to 50%.

Q: What is the "Red Herring" technique on the exam?

A: A Red Herring is an irrelevant fact designed to distract you. For example, a question about Lead-Based Paint might mention a "messy divorce." The divorce is the Red Herring; the year the house was built is the only fact that matters.

Q: How should I handle "EXCEPT" or "NOT" questions?

A: These negative stems cause high failure rates due to speed reading. When you see "EXCEPT," mentally rephrase the question to: "I am looking for the FALSE statement." This prevents you from accidentally marking the first true statement you see.

|

The California Department of Real Estate (DRE) salesperson exam is notorious for its 50% fail rate, but that number is misleading. It’s not an impossible test; it’s just a specific one. Most students Read more...

The California Department of Real Estate (DRE) salesperson exam is notorious for its 50% fail rate, but that number is misleading. It’s not an impossible test; it’s just a specific one. Most students fail because they study the wrong things. Here is the good news: the DRE tells us exactly what matters. Master these core areas, and you remove the mystery—and the risk—from exam day.

If you haven’t already reviewed our comprehensive California real estate exam guide, start there for an overview of the full licensing journey.

The 7 Major Content Areas (DRE Syllabus)

The DRE structures the real estate license syllabus into seven competency areas. Each represents a skill set you must demonstrate to pass the DRE salesperson exam. Below is a clear breakdown of what you’re expected to know in each and this is true regardless of the sales or broker exams. Sure, the number of questions on each exam is different, but the topics are the same across both tests.

Practice of Real Estate and Mandated Disclosures

This is the heart of the DRE exam and the section where students commonly underestimate the depth of material. Expect scenario-based questions that test whether you can apply real estate principles, ethical rules, and disclosure laws correctly.

Key concepts include:

Trust Fund Handling: Proper receipt, deposit, reconciliation, recordkeeping, and the consequences of commingling or conversion.

Fair Housing Laws: Federal and California anti-discrimination statutes, protected classes, blockbusting, steering, and reasonable accommodation requirements.

Transfer Disclosure Statements: What must be disclosed, who must sign, defects that trigger disclosure, and exemptions.

Ethics & Prohibited Conduct: Unlawful misrepresentation, duties of honesty and fair dealing, advertising rules, and handling offers.

Laws of Agency and Fiduciary Duties

You’ll be tested on how agency relationships are created, how they are terminated, and what fiduciary duties a licensee owes.

Key concepts include:

Agency Disclosure Timing: When and how the Agency Disclosure form must be delivered, acknowledged, and confirmed in a transaction.

Creation of agency: express, implied, ostensible, ratification.

Disclosure obligations in agency relationships.

Fiduciary duties — loyalty vs. honesty and fairness to all parties.

Dual agency rules and the unique risks and requirements involved.

Consequences of breaching fiduciary duties and permitted vs. prohibited conduct.

Property Ownership and Land Use Controls

This section examines the legal framework that governs how property is held, controlled, and regulated in California.

Key concepts include:

Types of ownership: joint tenancy, tenancy in common, community property.

Land use controls: zoning, variances, conditional use permits.

Government powers: police power, eminent domain, taxation, escheat.

Public and private restrictions (CC&Rs, HOA rules).

Legal property descriptions and boundaries.

Property Valuation and Financial Analysis

You don’t need to be an appraiser, but you do need a solid grasp of how value is estimated and how income-producing properties are analyzed.

Key concepts include:

Three approaches to value: market, cost, and income.

Appraisal fundamentals: substitution, conformity, contribution, and regression.

Income concepts: gross rent multiplier (GRM), net operating income (NOI), and capitalization basics.

What affects property value: supply and demand, neighborhood cycles, economic forces.

Understanding when each valuation approach is appropriate.

Contracts

Contracts appear all over the exam because they appear all over real estate practice.

Key concepts include:

Essential elements of a valid contract (capacity, mutual consent, lawful object, consideration).

Listing agreements: exclusive right to sell, exclusive agency, open listings.

Residential purchase agreements and common contingencies.

Offer and acceptance rules, counteroffers, termination.

Enforceability and consequences of breach.

Financing

Expect questions that test your understanding of lending systems and consumer protection laws.

Key concepts include:

Primary vs. secondary mortgage markets.

Loan products: conventional, FHA, VA, adjustable-rate, and seller financing.

TILA/RESPA integration (TRID) requirements and timing.

Points, loan origination, and discount points.

Mortgage defaults, foreclosure basics, and rights of reinstatement or redemption.

Transfer of Property

This section deals with how real estate actually changes hands — legally and procedurally.

Key concepts include:

Deeds: grant, quitclaim, warranty, essential elements, delivery.

Title insurance: CLTA vs. ALTA, exclusions, and protections.

Escrow process: prorations, instructions, trustworthiness requirements.

Recording and priority rules.

Property taxes, assessments, and transfer fees.

Is the Exam Content the Same Every Year?

The core real estate principles remain remarkably stable year to year, but the DRE updates exam questions periodically to reflect changes in law, disclosures, lending rules, and fair housing standards. For a deeper breakdown of how topics evolve, review our current California Real Estate Exam content breakdown.

How Deeply Do You Need to Know These Topics?

Whether you are taking the sales license or broker exam, passing is not about memorizing isolated facts — it tests whether you can apply concepts to realistic scenarios. The better you understand the underlying real estate principles, the easier it becomes to eliminate wrong answers. To fully prepare, you should also understand how the real estate exam is scored and exactly how many questions are on the exam so you can manage your time effectively.

Strategy for Mastering the Material

Focus on understanding, not cramming. Most students waste time over-studying math (there isn’t any math on the exam) or memorizing obscure details. Instead:

Study in short, focused bursts.

Use process-of-elimination on questions with similar answer choices.

Prioritize practice questions that mirror DRE logic.

Review mistakes deliberately — they reveal pattern gaps.

To sharpen your testing approach, study our multiple-choice strategies, which are specifically designed for the DRE salesperson exam.

Mastering the seven core areas of the real estate license syllabus is the most reliable path to passing the California Department of Real Estate exam. With the right preparation, consistent practice, and a clear understanding of what the DRE is looking for, you’ll walk into the testing center confident and ready.

Begin your focused review today — the exam is challenging, but absolutely conquerable with the right strategy and guidance.

FAQ: What’s on the California Real Estate Exam?

Is the California real estate exam hard?

It’s challenging, but not because the material is impossible. The exam is hard for people who study the wrong things. If you understand the seven DRE content areas and practice scenario-based questions, it becomes very manageable.

How many questions are on the California real estate exam?

The salesperson exam has 150 questions and the broker exam has 200 questions. Both are multiple-choice and both are timed.

How long do you get to finish the exam?

Salesperson: 3 hours and 15 minutes

Broker: 4 hours

There are no scheduled breaks, so pacing matters.

Does the exam include math?

No. The DRE removed math years ago. You may see questions about valuation concepts (like cap rates or GRM), but you won’t be asked to calculate formulas.

What score do you need to pass?

Salesperson: 70%

Broker: 75%

The DRE does not curve scores and does not release which questions you missed.

Is every exam the same?

No. There are multiple versions in circulation, and the DRE updates questions periodically. However, the content areas and competency weights stay consistent year to year.

Does the DRE test more scenarios or definitions?

Scenarios dominate. Many questions test whether you can apply a rule—not just recognize a definition. This is especially true in agency, disclosures, ethics, and trust fund handling.

Which section of the exam is the hardest?

Most students struggle with:

Practice of Real Estate & Disclosures

Agency & Fiduciary DutiesThese are heavily scenario-based and require understanding, not memorization.

Can you bring notes, calculators, or reference materials?

No. The exam is closed-book, and the testing center provides everything you’re allowed to use.

Are the salesperson and broker exams based on the same topics?

Yes. The subject areas are the same, but the broker exam goes deeper and includes more questions per topic.

How often can you retake the exam?

As many times as needed. There is no waiting period. The only requirement is paying the re-exam fee and scheduling a new appointment.

What’s the best way to prepare for the content areas?

Use practice questions that mirror DRE logic, focus on the most heavily weighted topics, and study in short, consistent sessions. Understanding beats cramming.

Are exam questions pulled from a public question bank?

No. The DRE does not publish exam questions. Any company claiming to have “real exam questions” is misleading you.

What topics should I NOT waste time studying?

Detailed math

Obscure federal laws that rarely appear

Commercial-only concepts not tied to the syllabus

Hyper-technical appraisal jargon

The DRE sticks closely to the seven official content areas.

Does the exam focus on California-specific laws?

Yes. Proper disclosures, agency rules, trust fund handling, and fair housing compliance are all tested from a California perspective, not a national one.

|

Key Takeaways (Read This First):

Match your name exactly across every certificate and application.

Verify your provider’s DRE sponsor number is valid and active.

Make sure your course titles and Read more...

Key Takeaways (Read This First):

Match your name exactly across every certificate and application.

Verify your provider’s DRE sponsor number is valid and active.

Make sure your course titles and completion dates are correct and align with DRE expectations.

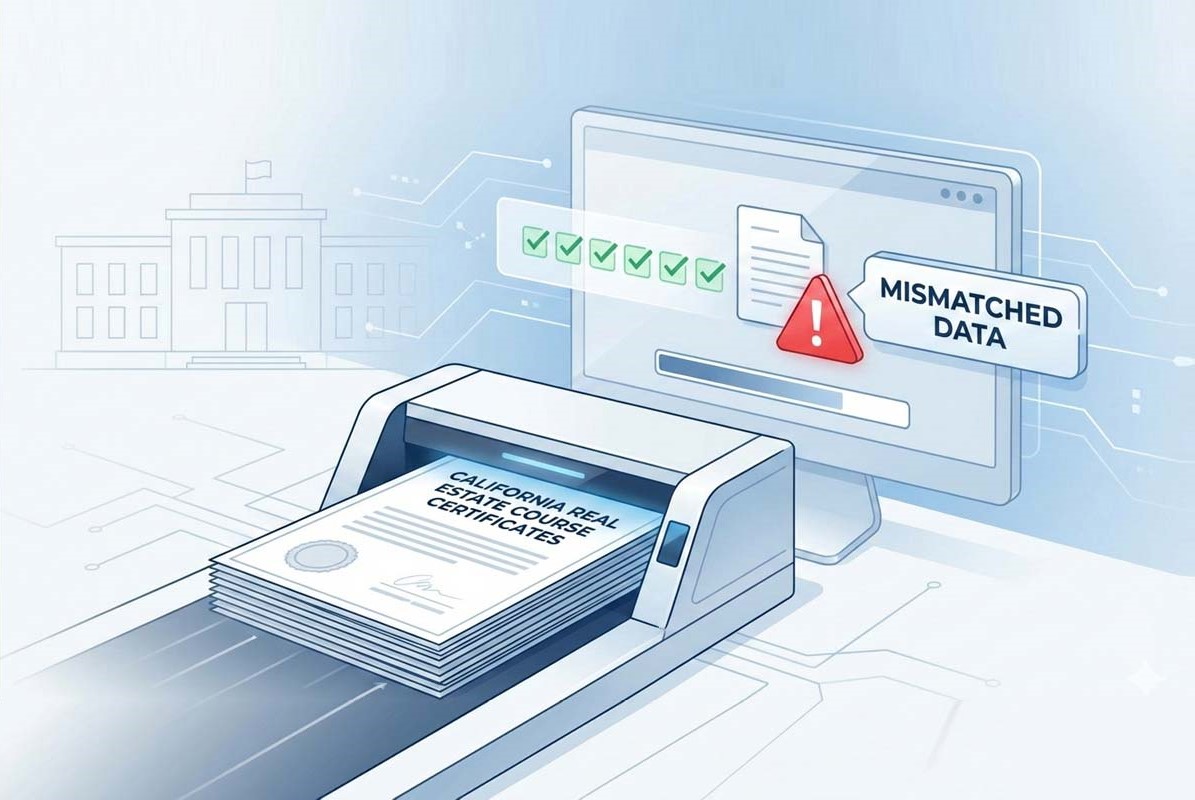

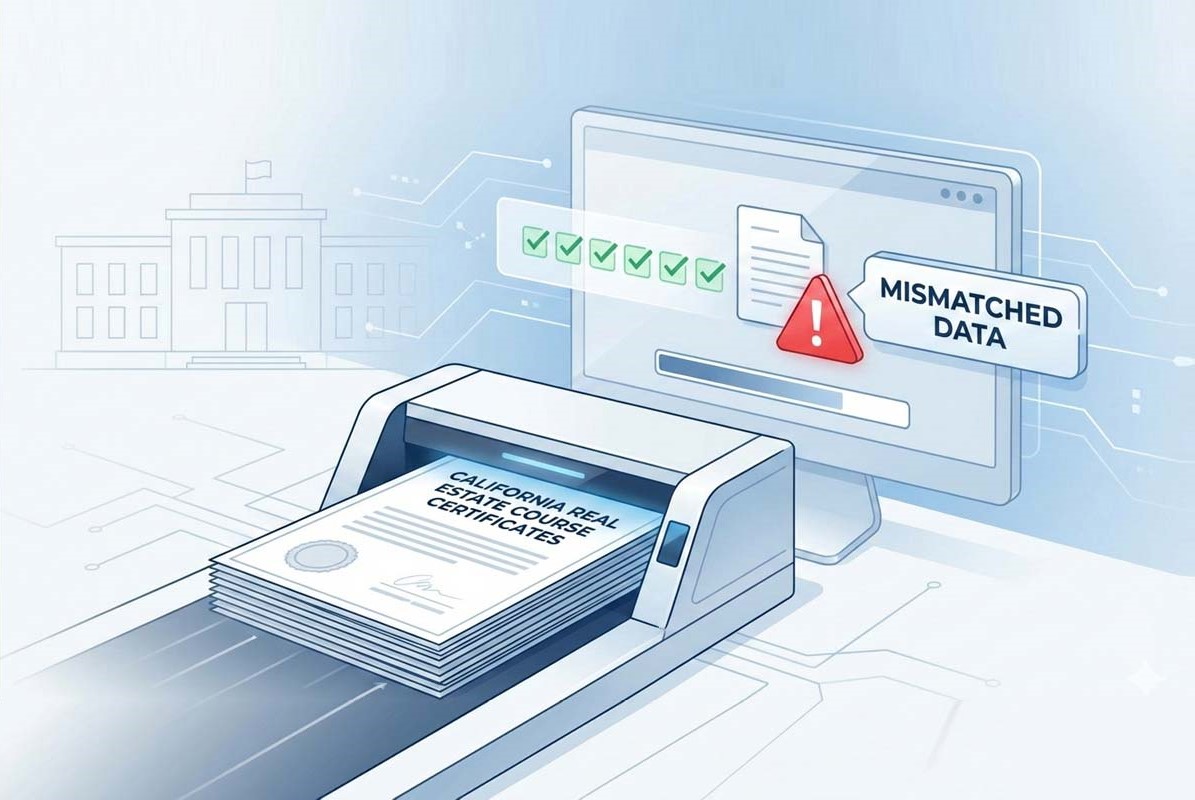

You’ve completed your real estate courses, downloaded your certificates, and submitted your application — but your real estate exam application still hasn’t been approved. For most applicants, the delay begins with one easily overlooked issue: Education Verification.

The DRE’s system is designed to move efficiently when everything aligns, but it slows down immediately when it encounters inconsistencies. Understanding how the DRE evaluates education documents is key to avoiding weeks of unnecessary waiting.

How the DRE Automated Verification Works

The DRE processes thousands of applications every month (crazy right?), and most of that work happens through automated checks. The system verifies whether your certificates match what their database expects: your name, your provider, your course titles, and the timing of your completions.

If anything looks unusual — mismatched names, unexpected dates, incorrect titles, inactive provider numbers — the automated flow stops. Your file leaves the fast lane and drops into manual review, which is where delays begin.

Most applicants assume that as long as the courses are completed, the DRE will read the certificates and approve them. But the DRE’s process is literal and exact. Even small formatting errors or inconsistencies can trigger a complete review.

Top 4 Reasons for Education Verification Failure

1. The Name Match Requirement

The biggest cause of delays comes from name inconsistencies.

Your certificates must reflect your legal name exactly as it appears on your DRE application.

If your application says one thing, your ID says another, and your certificate uses a shortened version or a hyphen that appears nowhere else, the system assumes there’s a potential identity mismatch.

You may see a harmless variation. The DRE sees a documentation discrepancy that must be reviewed manually.

Example of a Name Mismatch That Triggers a DRE Delay

Name on DRE Application: Maria Laura Hernandez

Name on Driver’s License: Maria L. Hernandez-Wilson

Name on Course Certificates: Maria Hernandez

To the applicant, these all feel like harmless variations — a middle initial here, an abbreviated last name there, a maiden name.

But to the DRE’s automated system, these are three different names.

The system cannot confidently verify that the education belongs to the same person who submitted the application, so your file is pulled out of the automated queue and into manual review.

A small inconsistency that seems meaningless to you is treated by the DRE as a potential identity mismatch, and that’s enough to slow the entire licensing process down.

2. Incorrect or “Marketing” Course Titles

Course titles create another major slowdown.

The DRE expects titles to match their official naming conventions. Providers often rename courses for branding, but the DRE doesn’t process branding — they process compliance.

If the DRE expects “Legal Aspects of Real Estate” and your certificate says ““Intro to RealEstate Fundamentals,” the system may not recognize it, pushing your file into manual review.

This is not the DRE being picky. It’s the DRE preventing misclassification.

3. Invalid or Inactive Provider Numbers

Provider issues are more common than people realize.

Not every website selling real estate courses is a DRE-approved school (be careful!). Some operate as resellers.

If the DRE cannot verify the provider number printed on your certificate, the application pauses immediately because the system cannot confirm your education source.

This is one of the quickest ways for an applicant to fall into a long delay without understanding why.

4. Timestamp and Study Period Errors

Completion dates also matter. California requires minimum study periods.

If your coursework appears to be completed too quickly… you fall into manual review.

The DRE checks whether your completion timeline aligns with legally required pacing. If your provider uses a faulty timestamping system, or if your certificates don’t reflect legal timing, your application will be held until an analyst can review it manually.

Even when the student did everything correctly, tech errors on the provider side can stall an otherwise clean application.

Remember, no one course can be finished faster than 18 days and no two courses can be finished faster than 36 days, etc. Also, no course can take longer than one year to complete.

The Danger of Fragmented Submissions

Fragmented submissions are another overlooked cause of delays. Applicants sometimes send things piecemeal into the DRE.

When your education record appears split across multiple submissions, your application leaves the automated lane and waits for an analyst to reorganize the documents.

This is especially critical for broker applicants. The DRE requires all eight college-level courses submitted together. Anything less creates complications.

The DRE Submission Checklist (Use This Before You Hit “Submit”)

My name matches exactly across all certificates, application forms, and ID

Course titles match official DRE titles

Completion dates comply with minimum study periods

My provider’s DRE sponsor number was active and valid at the time of completion

All certificates are submitted together in one complete upload

PDFs are clean, readable, and fully visible

No duplicate or outdated certificate versions are included

@media(max-width:1200px){

.example{

display: inline;

}

}

Checking every box eliminates nearly all common verification delays.

When you submit clean, consistent, DRE-verified certificates, your licensing process runs exactly the way it should. And the easiest way to make that happen is to start with a provider that understands the DRE’s requirements and formats everything correctly from day one. If you want to avoid delays, start your coursework with a DRE-approved school that guarantees compliant certificates — and keeps your licensing timeline on track.

|

If you’re a California real estate salesperson ready to take the next step and become a broker, you’ll need more than coursework and an exam — you’ll need to prove your experience.

That’s Read more...

If you’re a California real estate salesperson ready to take the next step and become a broker, you’ll need more than coursework and an exam — you’ll need to prove your experience.

That’s where the RE 226 — Licensed Experience Verification — comes in. It’s one of the most important documents in your broker license application, and completing it correctly can mean the difference between a smooth approval and a DRE delay.

Let’s break it down.

What Is Form RE 226?

Form RE 226 is the California Department of Real Estate’s official method for confirming that you’ve been licensed — and actually working — long enough to qualify for the broker’s exam.

In plain English, it answers the question:

“Has this person truly gained enough real estate experience to become a broker?”

The form must be completed and signed by your supervising or responsible broker — not by you alone — and submitted with either your Broker Exam Application (RE 400B) or your Combined Exam/License Application (RE 436).

The Experience Requirement

To qualify for the broker exam, you must demonstrate at least two years of full-time licensed salesperson experience within the five years immediately preceding your application.

Here’s what that means:

Full-time = roughly 40 hours per week (part-time experience is prorated).

Experience must be earned under an active California real estate license.

Out-of-state licensees can use equivalent experience but must still verify it via RE 227.

Older experience (more than five years before applying) won’t be counted.

What Your Broker Must Complete

Your supervising broker certifies your experience by completing several key sections of RE 226, including:

Employment period: The dates you worked under their supervision.

Average weekly hours: Full-time or part-time.

Types of activities handled: Listings, sales, leases, loans, etc.

Approximate earnings or income: Or a signed explanation if income was minimal.

Nature of duties: A brief description of what you did — e.g., residential listings, commercial leasing, property management.

Your broker must sign, date, and include their license number and contact details.

If you’ve worked under multiple brokers, you’ll need a separate RE 226 for each one.

Common Mistakes That Delay Applications

Small errors on RE 226 often cause major delays. Avoid these pitfalls:

Missing broker signatures or dates

Leaving blank fields (use “N/A” or “none” where applicable)

Overlapping or incorrect employment dates

Reporting low transaction volume without a written explanation

Submitting an outdated form version

What If You Don’t Have Enough Experience?

If you don’t meet the full two-year salesperson requirement, you may still qualify through equivalent experience in related fields, such as:

Real estate escrow or title work

Mortgage or loan processing

Property management or development

In that case, you’ll use Form RE 227 (Equivalent Experience Verification) instead — a similar form tailored for non-salesperson roles.

Pro Tip from ADHI Schools

Start thinking about your RE 226 early. Don’t wait until you’re ready to submit your broker application.

Track down past brokers ahead of time and confirm they’re willing to sign.

Provide them with a partially pre-filled version to save time.

Double-check that their license number, business address, and phone are current — the DRE may contact them for verification.

How ADHI Schools Can Help

At ADHI Schools, we’ve helped thousands of California agents move from their first real estate class to earning their broker license. We know exactly how to make the paperwork simple.

If you’re ready to make the jump:

Enroll in our Broker Course Package (Real Estate Appraisal, Finance, Legal Aspects, and more).

Schedule a one-on-one advisor session to review your experience documentation before submission.

Final Thoughts

Form RE 226 isn’t as intimidating as it looks — it’s simply the DRE’s way of confirming that you’ve put in the work and earned your experience in the field.

Fill it out carefully, coordinate with your broker, and you’ll be one step closer to joining California’s broker ranks.

For more tips and step-by-step licensing guidance, visit ADHISchools.com — your trusted partner from first class to broker license.

|

Choosing the right California real estate exam prep course is crucial for passing the state licensing exam on your first try. With the statewide first-time pass rate hovering around 50 percent, Read more...

Choosing the right California real estate exam prep course is crucial for passing the state licensing exam on your first try. With the statewide first-time pass rate hovering around 50 percent, inadequate prep can mean retakes, extra fees, and months of delayed income. This guide walks you through the decision process so you can select a program you trust—and start your career sooner.

table, th, td{

border:1px solid gray !important;

border-style: dashed !important;

border-collapse: collapse !important;

}

@media (max-width: 768px) {

.table-over-flow {

width: 100%;

overflow-x: scroll;

}

}

Online vs. Live: Which Prep Style Fits You Best?

Format

Key Advantages

Possible Drawbacks

Ideal For

Online Courses

24/7 access on any device

Self-paced—great for “weekend warriors”

Often lower cost

Requires discipline & tech comfort

Less face-to-face accountability

Busy professionals, parents, or anyone far from a major city

Live Classes

Live instructor Q&A

Fixed schedule builds routine

Networking with peers

Commute & parking costs if in person

Higher cost on average

Learners who thrive in a classroom or need real-time coaching

Pro tip: Love flexibility but crave structure? Our real estate exam prep course offers an instructor-led option through Zoom offering the best of both worlds. You eliminate the need to park and commute but still have the option of asking questions and getting live feedback.

Five Questions to Think About Before Enrolling

Why Is a California-Specific Real Estate Exam Curriculum Important?

Generic national courses skip crucial California real estate exam state specific topics like agency relationships as defined under California law, community property laws, probate and trust sales specific to California, California Landlord-Tenant laws, the California Real Estate Recovery Fund, and natural hazard disclosure requirements mandated by the state to name a few. A curriculum written by Californians for Californians keeps you laser-focused on what appears on the DRE exam—saving study hours and frustration.

What Makes Experienced Instructors Crucial for Real Estate Exam Prep?

Our seasons trainers:

Translate dense statutes into real-life stories.

Flag “trick” questions we have seen candidates be confused by.

Score reports let you refine study plans—critical for those who need guided feedback.

Why Are Realistic Practice Exams Vital for California Real Estate?

A simulated DRE exam interface reduces exam-day anxiety.

Adaptive scoring pinpoints weak areas early.

Score reports let you refine study plans—critical for those who need guided feedback.

What Study Materials Should a Good Real Estate Prep Course Offer?

Beyond PDFs: expect concise video walkthroughs, audio lectures for your commute, and a mobile app. Mixing formats boosts recall and keeps burnout at bay.

What is the Course's Track Record and Student Success Rate in California?

Look for evidence of the course's effectiveness specifically for California test-takers. Testimonials from past students who successfully passed the California exam, along with any reported pass rates, can provide valuable insight into the course's quality and how well it prepares individuals for the specific nuances of the California DRE exam.

Why ADHI Schools Is the Smart Choice for California Real Estate License Success

ADHI Advantage

How It Benefits You

California-Focused Since 2003

No time wasted on irrelevant national laws—every minute of study targets the DRE outline, maximizing efficiency.

Instructors Who Still Close Deals

Real-world examples make tough concepts stick and show exactly how laws apply in practice.

Adaptive Mock Exams & Analytics

An algorithm adjusts question difficulty, then displays color-coded score reports so you know when you’re ready.

Multimedia Mastery Suite

Video, audio, and printable guides fit any learning style—perfect for on-the-go real estate exam takers.

Thousands of students credit ADHI with accelerating their path to licensure—and the industry knows it.

Ready to Pass on Your First Attempt?